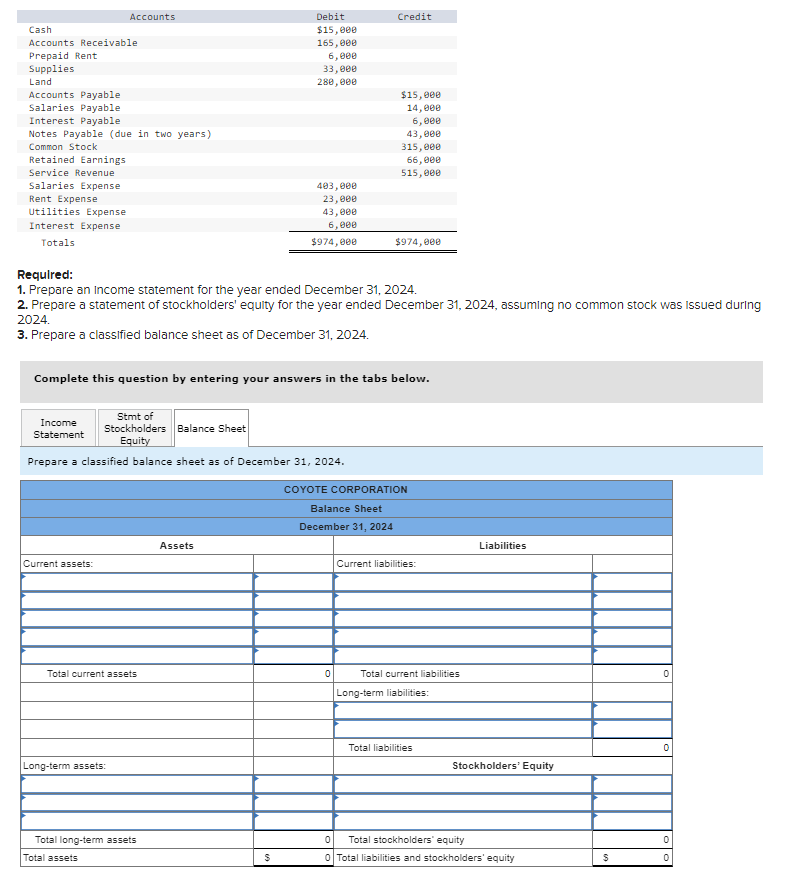

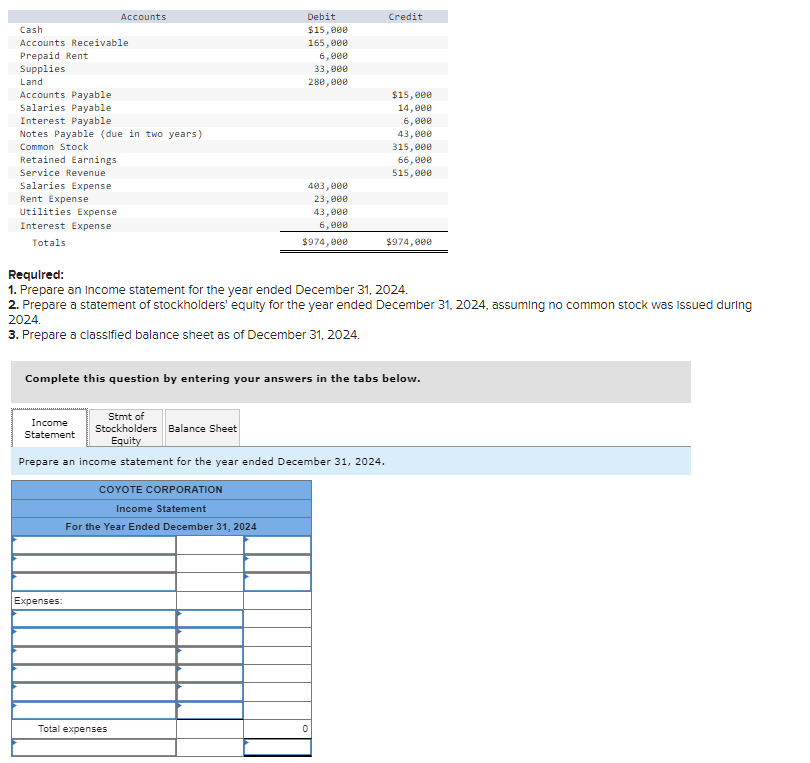

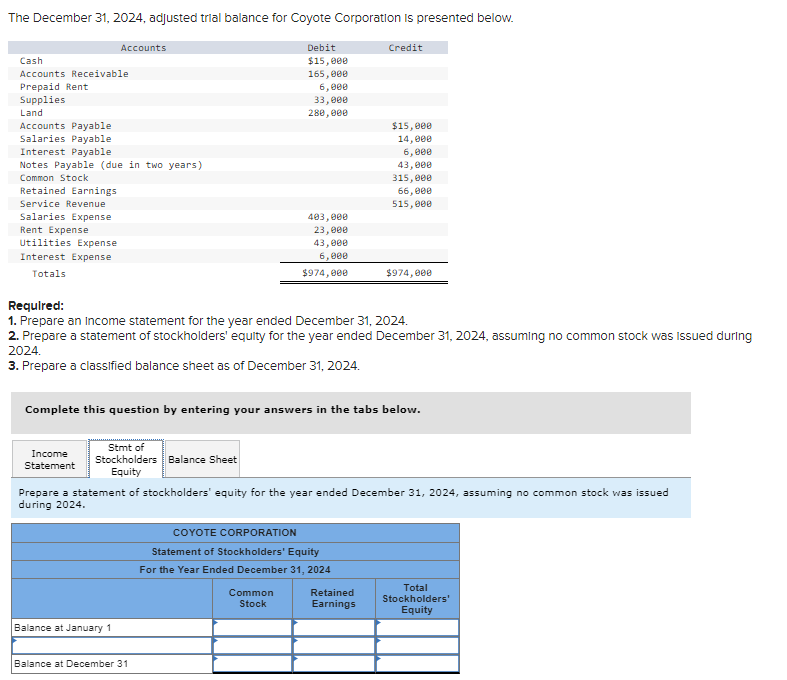

Question: Requlred: 1. Prepare an Income statement for the year ended December 31, 2024. 2. Prepare a statement of stockholders' equity for the year ended December

Requlred: 1. Prepare an Income statement for the year ended December 31, 2024. 2. Prepare a statement of stockholders' equity for the year ended December 31, 2024, assuming no common stock was Issued during 2024. 3. Prepare a classlfied balance sheet as of December 31, 2024. Complete this question by entering your answers in the tabs below. Prepare a classified balance sheet as of December 31, 2024. Required: 1. Prepare an Income statement for the year ended December 31, 2024. 2. Prepare a statement of stockholders' equity for the year ended December 31,2024 , assumlng no common stock was Issued durlng 2024. 3. Prepare a classified balance sheet as of December 31, 2024. Complete this question by entering your answers in the tabs below. Prepare an income statement for the year ended December 31, 2024. The December 31, 2024, adjusted trlal balance for Coyote Corporation is presented below. Requlred: 1. Prepare an Income statement for the year ended December 31, 2024. 2. Prepare a statement of stockholders' equity for the year ended December 31,2024 , assumling no common stock was Issued during 2024. 3. Prepare a classlfied balance sheet as of December 31, 2024. Complete this question by entering your answers in the tabs below. Prepare a statement of stockholders' equity for the year ended December 31, 2024, assuming no common stock was issued during 2024

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts