Question: Requlred: Compute the net pay for Eve Khan and Marn Hart. Assume that they are paid a $3,100 salary biweekly, subject to federal income tax

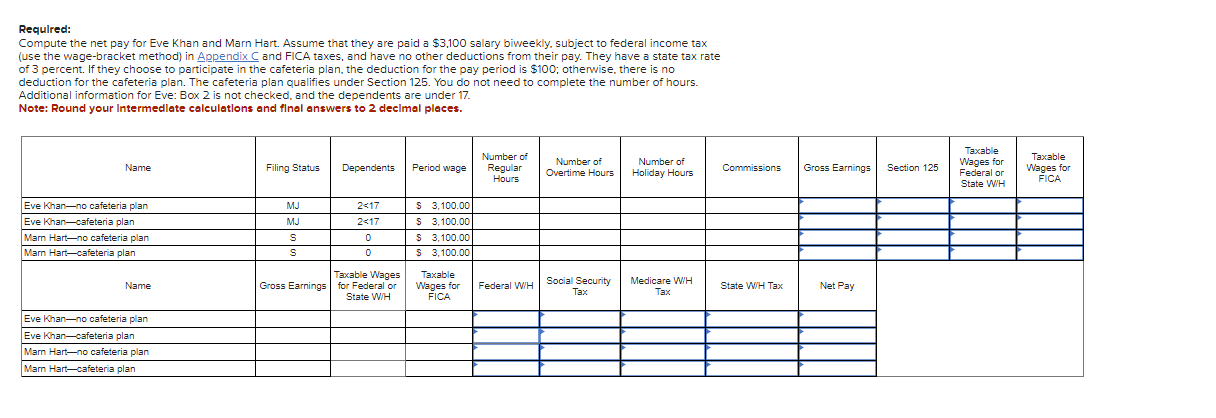

Requlred: Compute the net pay for Eve Khan and Marn Hart. Assume that they are paid a \$3,100 salary biweekly, subject to federal income tax (use the wage-bracket method) in Appendix C and FICA taxes, and have no other deductions from their pay. They have a state tax rate of 3 percent. If they choose to participate in the cafeteria plan, the deduction for the pay period is $100; otherwise, there is no deduction for the cafeteria plan. The cafeteria plan qualifies under Section 125 . You do not need to complete the number of hours. Additional information for Eve: Box 2 is not checked, and the dependents are under 17. Note: Round your Intermedlete colculetlons and flnal answers to 2 declmal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts