Question: Requlred Information Use the following information for the Exercises below. (Algo) [The following information applies to the questions displayed below] Tory Enterprises pays $251,400 for

![[The following information applies to the questions displayed below] Tory Enterprises pays](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e98ffc9c977_78066e98ffc21ad1.jpg)

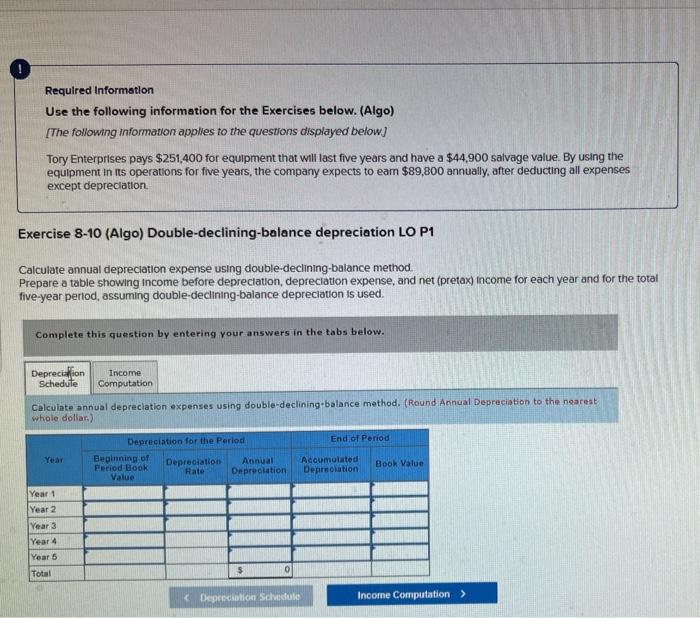

Requlred Information Use the following information for the Exercises below. (Algo) [The following information applies to the questions displayed below] Tory Enterprises pays $251,400 for equipment that will last five years and have a $44,900 salvage value. By using the equipment in its operations for five years, the company expects to eam $89,800 annually, after deducting all expenses except depreclation. Exercise 8-10 (Algo) Double-declining-balance depreciation LO P1 Calculate annual depreciation expense using double-declining-balance method. Prepare a table showing income before depreciation, depreciation expense, and net (pretax) income for each year and for the total five-year period, assuming double-decining-balance depreciation is used. Complete this question by entering your answers in the tabs below. Calculate annual depreciation expenses using double-declining-balance method. (Round Annual Depreciation to the nearest whole dollar.? Requlred Information Use the following information for the Exercises below. (Algo) [The following information applies to the questions displayed below] Tory Enterprises pays $251,400 for equipment that will last five years and have a $44,900 salvage value. By using the equipment in its operations for five years, the company expects to eam $89,800 annually, after deducting all expenses except depreclation. Exercise 8-10 (Algo) Double-declining-balance depreciation LO P1 Calculate annual depreciation expense using double-declining-balance method. Prepare a table showing income before depreciation, depreclation expense, and net (pretax) income for each year and for the tot five-year period, assuming double-declining-balance depreciation is used. Complete this question by entering your answers in the tabs below. Prepare a table showing income before depreciation, depreciation expense, and net (pretax) income for each year and for the total five-year period, assuming double-declining-balance depreciation is used. (Net loss should be entered with a minus signif)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts