Question: Research Problem 3 . Randall owns an office building ( adjusted basis of ( $ 2 5 0 , 0 0 0

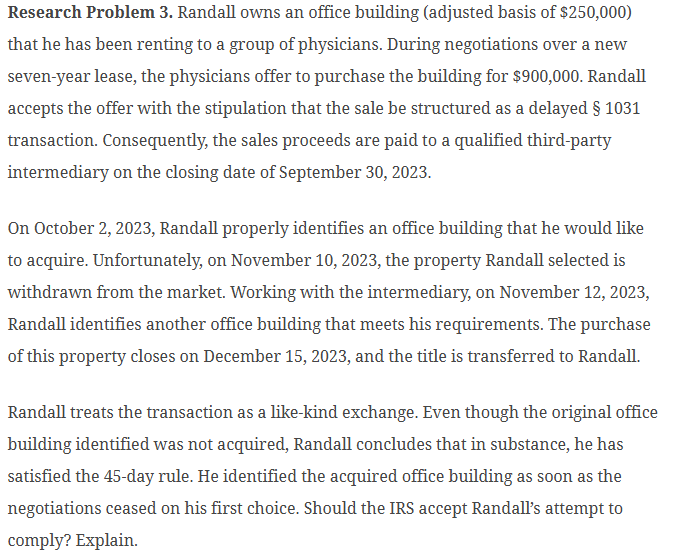

Research Problem Randall owns an office building adjusted basis of $ that he has been renting to a group of physicians. During negotiations over a new sevenyear lease, the physicians offer to purchase the building for $ Randall accepts the offer with the stipulation that the sale be structured as a delayed transaction. Consequently, the sales proceeds are paid to a qualified thirdparty intermediary on the closing date of September

On October Randall properly identifies an office building that he would like to acquire. Unfortunately, on November the property Randall selected is withdrawn from the market. Working with the intermediary, on November Randall identifies another office building that meets his requirements. The purchase of this property closes on December and the title is transferred to Randall.

Randall treats the transaction as a likekind exchange. Even though the original office building identified was not acquired, Randall concludes that in substance, he has satisfied the day rule. He identified the acquired office building as soon as the negotiations ceased on his first choice. Should the IRS accept Randall's attempt to comply? Explain.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock