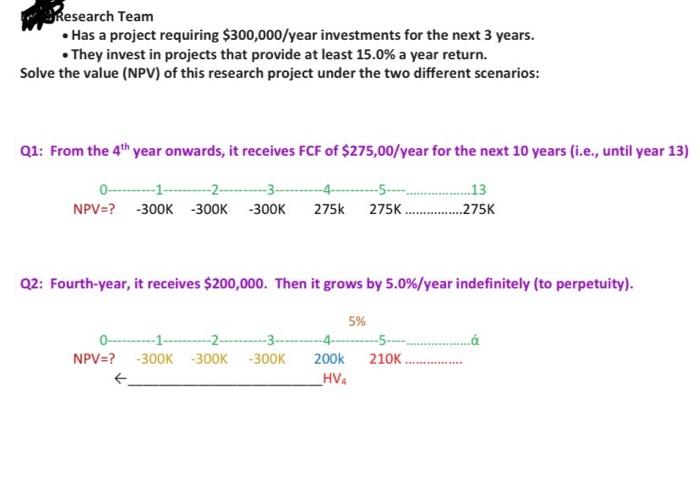

Question: Research Team Has a project requiring $300,000/year investments for the next 3 years. They invest in projects that provide at least 15.0% a year return.

Research Team Has a project requiring $300,000/year investments for the next 3 years. They invest in projects that provide at least 15.0% a year return. Solve the value (NPV) of this research project under the two different scenarios: Q1: From the 4th year onwards, it receives FCF of $275,00/year for the next 10 years (i.e., until year 13) NPV=? -300K -300K -300K ..13 ..275K 275k 275K. Q2: Fourth-year, it receives $200,000. Then it grows by 5.0%/year indefinitely (to perpetuity). 5% . 0----14 --2-------- NPV=? -300K -300K -300K 200k 210K HVA

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts