Question: Resolve Please- Excel Part 1 Part 2 Part 3 Part 4 Here is a trial balance for you to apply the knowledge acquired during the

Resolve Please- Excel

Part 1

Part 2

Part 3

Part 4

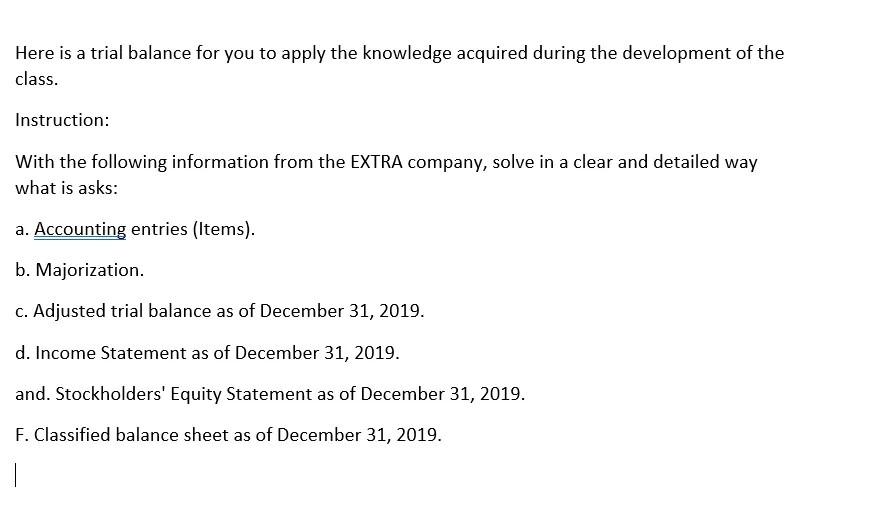

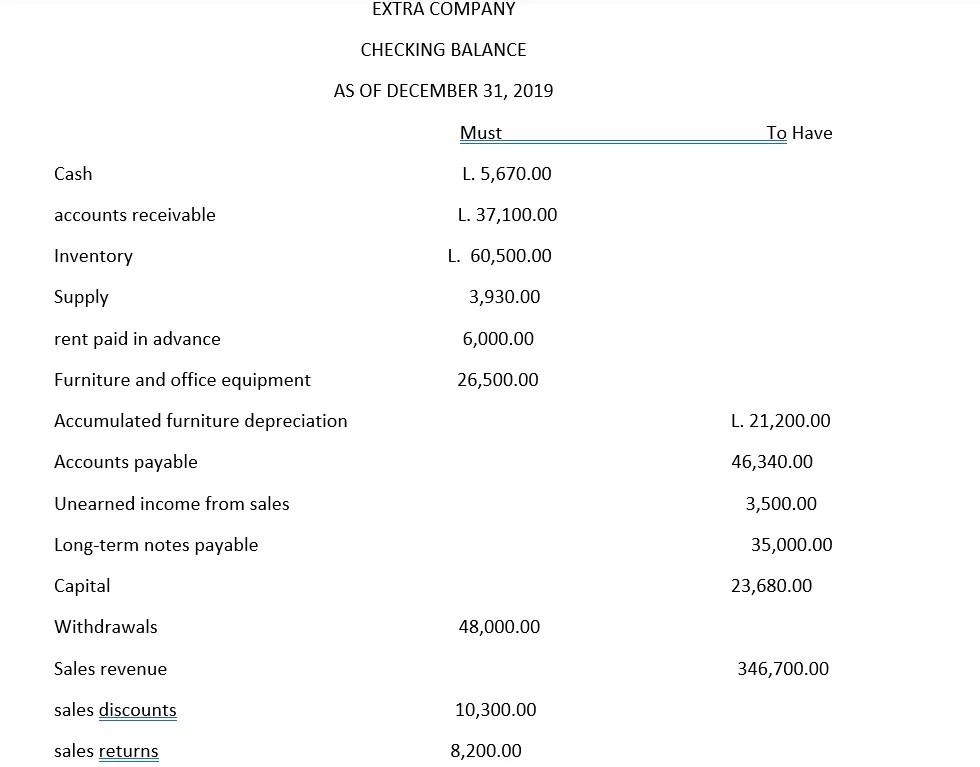

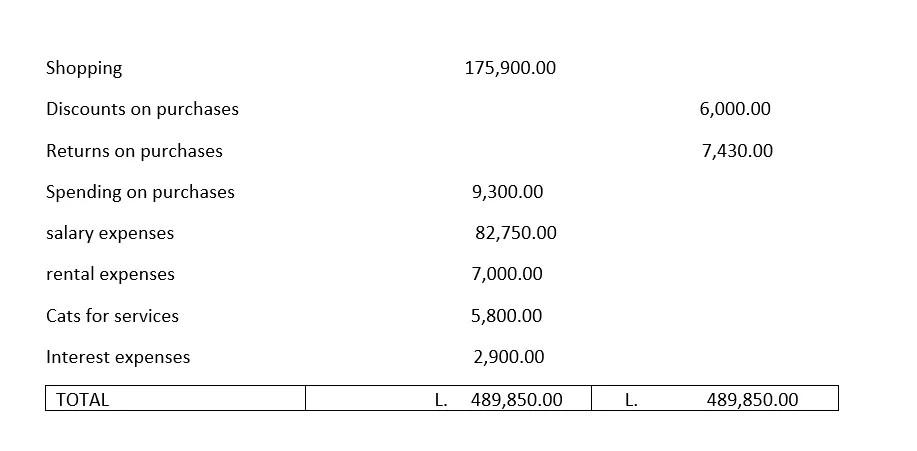

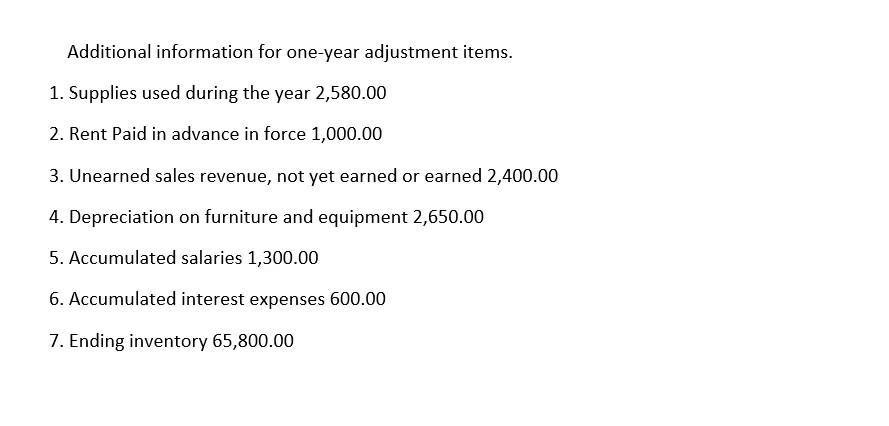

Here is a trial balance for you to apply the knowledge acquired during the development of the class. Instruction: With the following information from the EXTRA company, solve in a clear and detailed way what is asks: a. Accounting entries (Items). b. Majorization. c. Adjusted trial balance as of December 31, 2019. d. Income Statement as of December 31, 2019. and. Stockholders' Equity Statement as of December 31, 2019. F. Classified balance sheet as of December 31, 2019. EXTRA COMPANY CHECKING BALANCE AS OF DECEMBER 31, 2019 Shopping 175,900.00 Discounts on purchases 6,000.00 Returns on purchases Spending on purchases 9,300.00 salary expenses 82,750.00 rental expenses 7,000.00 Cats for services 5,800.00 Interest expenses 2,900.00 \begin{tabular}{|l|llll|} \hline TOTAL & L. 489,850.00 & L. & 489,850.00 \\ \hline \end{tabular} Additional information for one-year adjustment items. 1. Supplies used during the year 2,580.00 2. Rent Paid in advance in force 1,000.00 3. Unearned sales revenue, not yet earned or earned 2,400.00 4. Depreciation on furniture and equipment 2,650.00 5. Accumulated salaries 1,300.00 6. Accumulated interest expenses 600.00 7. Ending inventory 65,800.00 Here is a trial balance for you to apply the knowledge acquired during the development of the class. Instruction: With the following information from the EXTRA company, solve in a clear and detailed way what is asks: a. Accounting entries (Items). b. Majorization. c. Adjusted trial balance as of December 31, 2019. d. Income Statement as of December 31, 2019. and. Stockholders' Equity Statement as of December 31, 2019. F. Classified balance sheet as of December 31, 2019. EXTRA COMPANY CHECKING BALANCE AS OF DECEMBER 31, 2019 Shopping 175,900.00 Discounts on purchases 6,000.00 Returns on purchases Spending on purchases 9,300.00 salary expenses 82,750.00 rental expenses 7,000.00 Cats for services 5,800.00 Interest expenses 2,900.00 \begin{tabular}{|l|llll|} \hline TOTAL & L. 489,850.00 & L. & 489,850.00 \\ \hline \end{tabular} Additional information for one-year adjustment items. 1. Supplies used during the year 2,580.00 2. Rent Paid in advance in force 1,000.00 3. Unearned sales revenue, not yet earned or earned 2,400.00 4. Depreciation on furniture and equipment 2,650.00 5. Accumulated salaries 1,300.00 6. Accumulated interest expenses 600.00 7. Ending inventory 65,800.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts