Question: Respecfully--Please answer all if you are willing to help. This is over MM propositions anf optimal capital structure theories QUESTION 1 With perfect capital markets,

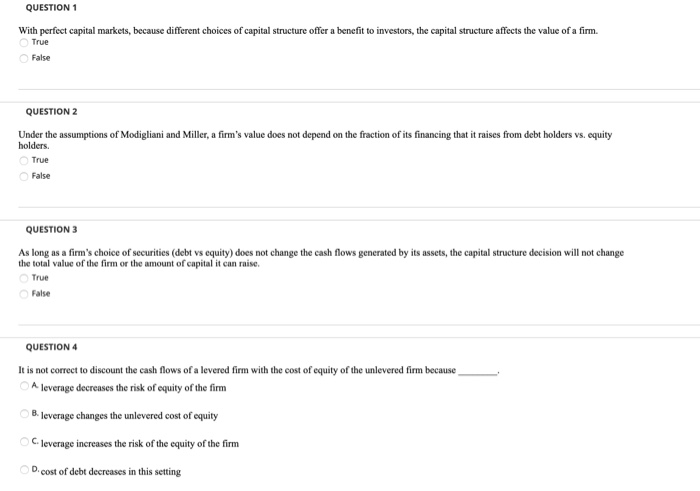

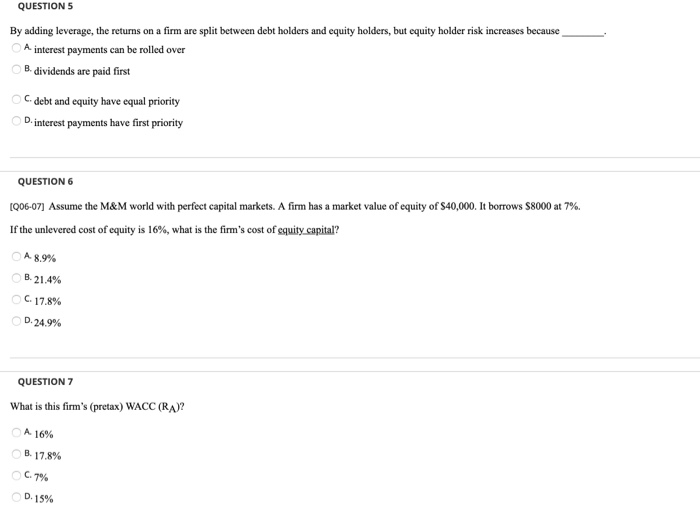

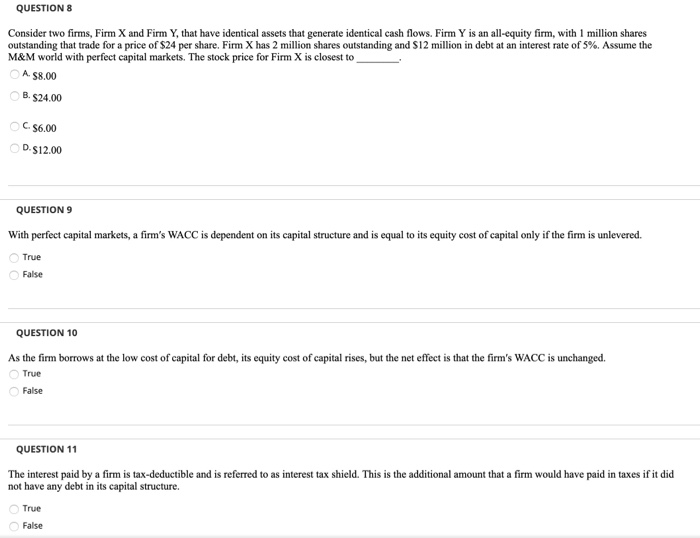

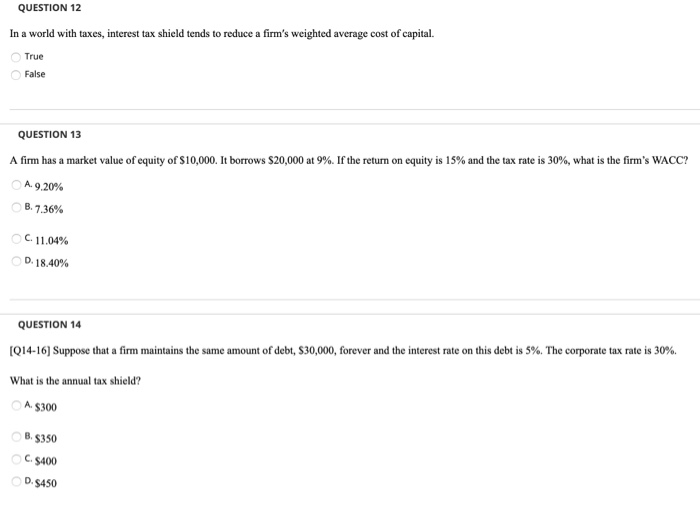

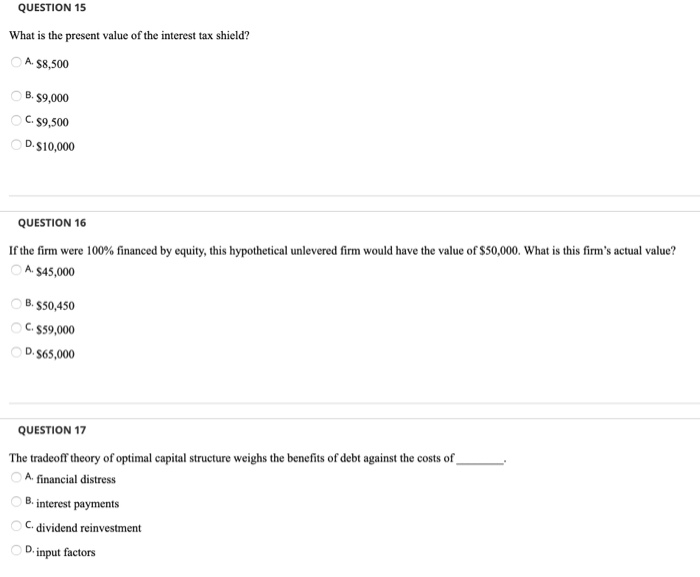

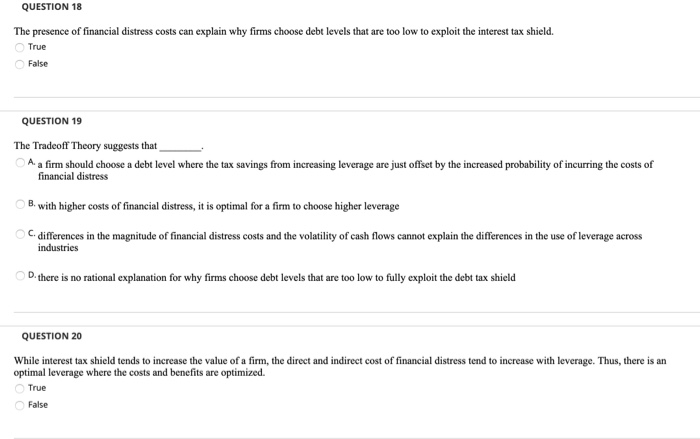

QUESTION 1 With perfect capital markets, because different choices of capital structure offer a benefit to investors, the capital structure affects the value of a firm. True False QUESTION 2 Under the assumptions of Modigliani and Miller, a firm's value does not depend on the fraction of its financing that it raises from debt holders vs. equity holders. True False QUESTION 3 As long as a firm's choice of securities (debt vs equity) does not change the cash flows generated by its assets, the capital structure decision will not change the total value of the firm or the amount of capital it can raise. True False QUESTION 4 It is not correct to discount the cash flows of a levered firm with the cost of equity of the unlevered firm because A leverage decreases the risk of equity of the firm B. leverage changes the unlevered cost of equity Cleverage increases the risk of the equity of the firm D.cost of debt decreases in this setting QUESTION 5 By adding leverage, the returns on a firm are split between debt holders and equity holders, but equity holder risk increases because A interest payments can be rolled over B. dividends are paid first debt and equity have equal priority D. interest payments have first priority QUESTION 6 [Q06-07) Assume the M&M world with perfect capital markets. A firm has a market value of equity of S40,000. It borrows $8000 at 7%. If the unlevered cost of equity is 16%, what is the firm's cost of cquity capital? A 8.9% B.21.4% 17.8% D. 24.9% QUESTION 7 What is this firm's (pretax) WACC (RA)? A 16% B. 17.8% C.7% D.15% QUESTIONS Consider two firms, Firm X and Firm Y, that have identical assets that generate identical cash flows. Firm Y is an all-equity firm, with 1 million shares outstanding that trade for a price of $24 per share. Firm X has 2 million shares outstanding and S12 million in debt at an interest rate of 5%. Assume the M&M world with perfect capital markets. The stock price for Firm X is closest to A. 58.00 B. $24.00 C 56.00 D. $12.00 QUESTION 9 With perfect capital markets, a firm's WACC is dependent on its capital structure and is equal to its equity cost of capital only if the firm is unlevered. True False QUESTION 10 As the firm borrows at the low cost of capital for debt, its equity cost of capital rises, but the net effect is that the firm's WACC is unchanged. True False QUESTION 11 The interest paid by a firm is tax-deductible and is referred to as interest tax shield. This is the additional amount that a firm would have paid in taxes if it did not have any debt in its capital structure. True False QUESTION 12 In a world with taxes, interest tax shield tends to reduce a firm's weighted average cost of capital. True False QUESTION 13 A firm has a market value of equity of $10,000. It borrows $20,000 at 9%. If the return on equity is 15% and the tax rate is 30%, what is the firm's WACC? A.9.20% B. 7.36% C. 11.04% D. 18.40% QUESTION 14 1014-16) Suppose that a firm maintains the same amount of debt, $30,000, forever and the interest rate on this debt is 5%. The corporate tax rate is 30%. What is the annual tax shield? A $300 B. $350 C. $400 D. $450 QUESTION 15 What is the present value of the interest tax shield? A $8,500 B.$9,000 C. $9,500 D. $10,000 QUESTION 16 If the firm were 100% financed by equity, this hypothetical unlevered firm would have the value of $50,000. What is this firm's actual value? A $45,000 B. $50,450 C$59,000 D. 965,000 QUESTION 17 The tradeoff theory of optimal capital structure weighs the benefits of debt against the costs of A financial distress B. interest payments C. dividend reinvestment D. input factors QUESTION 18 The presence of financial distress costs can explain why firms choose debt levels that are too low to exploit the interest tax shield. True False QUESTION 19 The Tradeoff Theory suggests that A a firm should choose a debt level where the tax savings from increasing leverage are just offset by the increased probability of incurring the costs of financial distress B. with higher costs of financial distress, it is optimal for a firm to choose higher leverage C. differences in the magnitude of financial distress costs and the volatility of cash flows cannot explain the differences in the use of leverage across industries D. there is no rational explanation for why firms choose debt levels that are too low to fully exploit the debt tax shield QUESTION 20 While interest tax shield tends to increase the value of a firm, the direct and indirect cost of financial distress tend to increase with leverage. Thus, there is an optimal leverage where the costs and benefits are optimized. True False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts