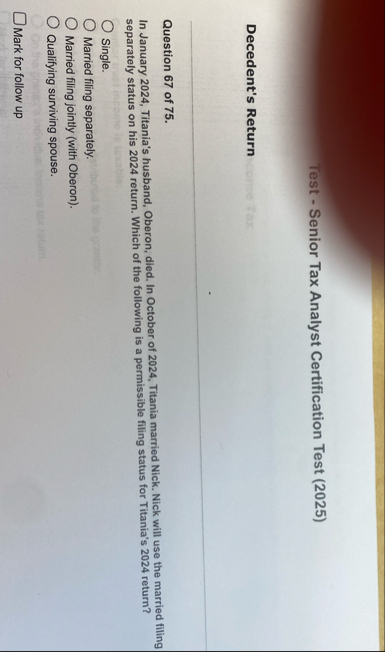

Question: rest - Senior Tax Analyst Certification Test ( 2 0 2 5 ) Decedent's Return Question 6 7 of 7 5 . In January 2

rest Senior Tax Analyst Certification Test

Decedent's Return

Question of

In January Titania's husband, Oberon, died. In October of Titania married Nick. Nick will use the married filing separately status on his return. Which of the following is a permissible filing status for Titania's return?

Single.

Married filing separately.

Married filing jointly with Oberon

Qualifying surviving spouse.

Mark for follow up

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock