Question: Restating Inventory Values Using the LIFO Inventory Reserve. Chemical Boost, Inc. is a manufacturer of chemical and derivative products. Presented below is selected information from

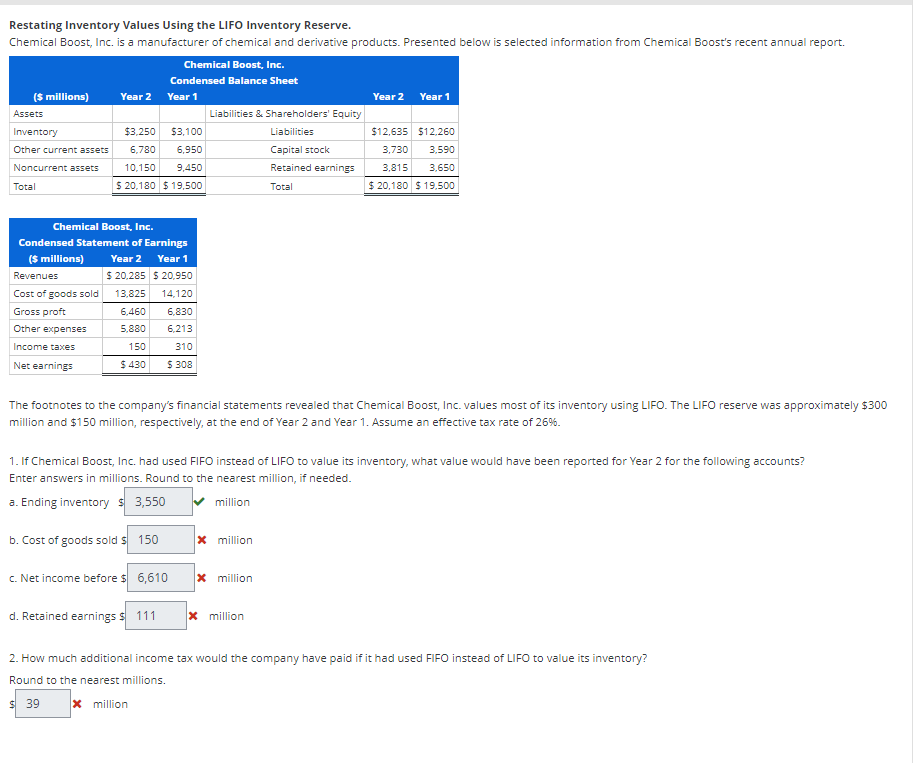

Restating Inventory Values Using the LIFO Inventory Reserve.

Chemical Boost, Inc. is a manufacturer of chemical and derivative products. Presented below is selected information from Chemical Boost's recent annual report.

The footnotes to the company's financial statements revealed that Chemical Boost, Inc. values most of its inventory using LIFO. The LIFO reserve was approximately $

million and $ million, respectively, at the end of Year and Year Assume an effective tax rate of

If Chemical Boost, Inc. had used FIFO instead of LIFO to value its inventory, what value would have been reported for Year for the following accounts?

Enter answers in millions. Round to the nearest million, if needed.

a Ending inventory

million

b Cost of goods sold $

million

c Net income before

million

d Retained earnings $

million

How much additional income tax would the company have paid if it had used FIFO instead of LIFO to value its inventory?

Round to the nearest millions.

million

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock