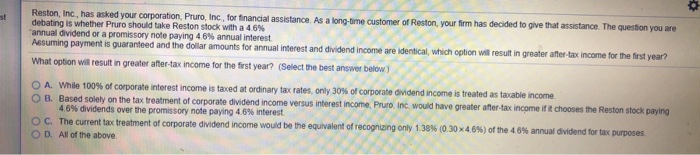

Question: Reston, Inc., has asked your corporation, Pruro, debating is whether Pruro should take Reston stock with a 4 6% annual dividend or a promissory note

Reston, Inc., has asked your corporation, Pruro, debating is whether Pruro should take Reston stock with a 4 6% annual dividend or a promissory note paying 4 6% annual interest. Assuming payment is guaranteed and the dollar amounts for annual interest and dividend Inc., for ftinancal assistance. As a long-time customer of Reston, your firm has decided to give that assistance. The question you are s for annual interest and dividend income are identical, which option will esult in greater afer- tax income for the first year? are What option will esult in greater after tax income for the first year? (Select the best answer below) 0 A. While 100% of corporate interest income is taxed at ordinary tax rates, O B. Based solely on the tax treatment of corporate dividend income versus interest onty 30% or corporate avidend ncome is treated as taabe name income. Pruro inc. would have greater after-tax income if it chooses the Reston stock paying 4 6% dividends over the promissory note paying 46% interest C. The current tax treatment of corporate dividend income would be the equivalent of recognizing only 138% (030x46 O D. All of the above %) of the 4 6% annual dvidend for tax purposes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts