Question: RET Inc. currently has two products, low and high priced stoves. RET Inc. has decided to sell a new line of medium-priced stoves. Sales revenues

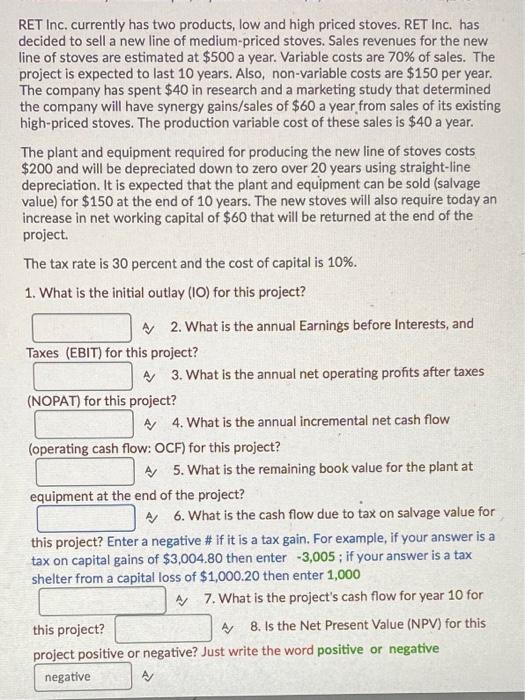

RET Inc. currently has two products, low and high priced stoves. RET Inc. has decided to sell a new line of medium-priced stoves. Sales revenues for the new line of stoves are estimated at $500 a year. Variable costs are 70% of sales. The project is expected to last 10 years. Also, non-variable costs are $150 per year. The company has spent $40 in research and a marketing study that determined the company will have synergy gains/sales of $60 a year from sales of its existing high-priced stoves. The production variable cost of these sales is $40 a year. The plant and equipment required for producing the new line of stoves costs $200 and will be depreciated down to zero over 20 years using straight-line depreciation. It is expected that the plant and equipment can be sold (salvage value) for $150 at the end of 10 years. The new stoves will also require today an increase in net working capital of $60 that will be returned at the end of the project. The tax rate is 30 percent and the cost of capital is 10%. 1. What is the initial outlay (10) for this project? A 2. What is the annual Earnings before Interests, and Taxes (EBIT) for this project? A 3. What is the annual net operating profits after taxes (NOPAT) for this project? A 4. What is the annual incremental net cash flow (operating cash flow: OCF) for this project? A 5. What is the remaining book value for the plant at equipment at the end of the project? A 6. What is the cash flow due to tax on salvage value for this project? Enter a negative # if it is a tax gain. For example, if your answer is a tax on capital gains of $3,004.80 then enter -3,005; if your answer is a tax shelter from a capital loss of $1,000.20 then enter 1,000 A 7. What is the project's cash flow for year 10 for this project? A 8. Is the Net Present Value (NPV) for this project positive or negative? Just write the word positive or negative negative

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts