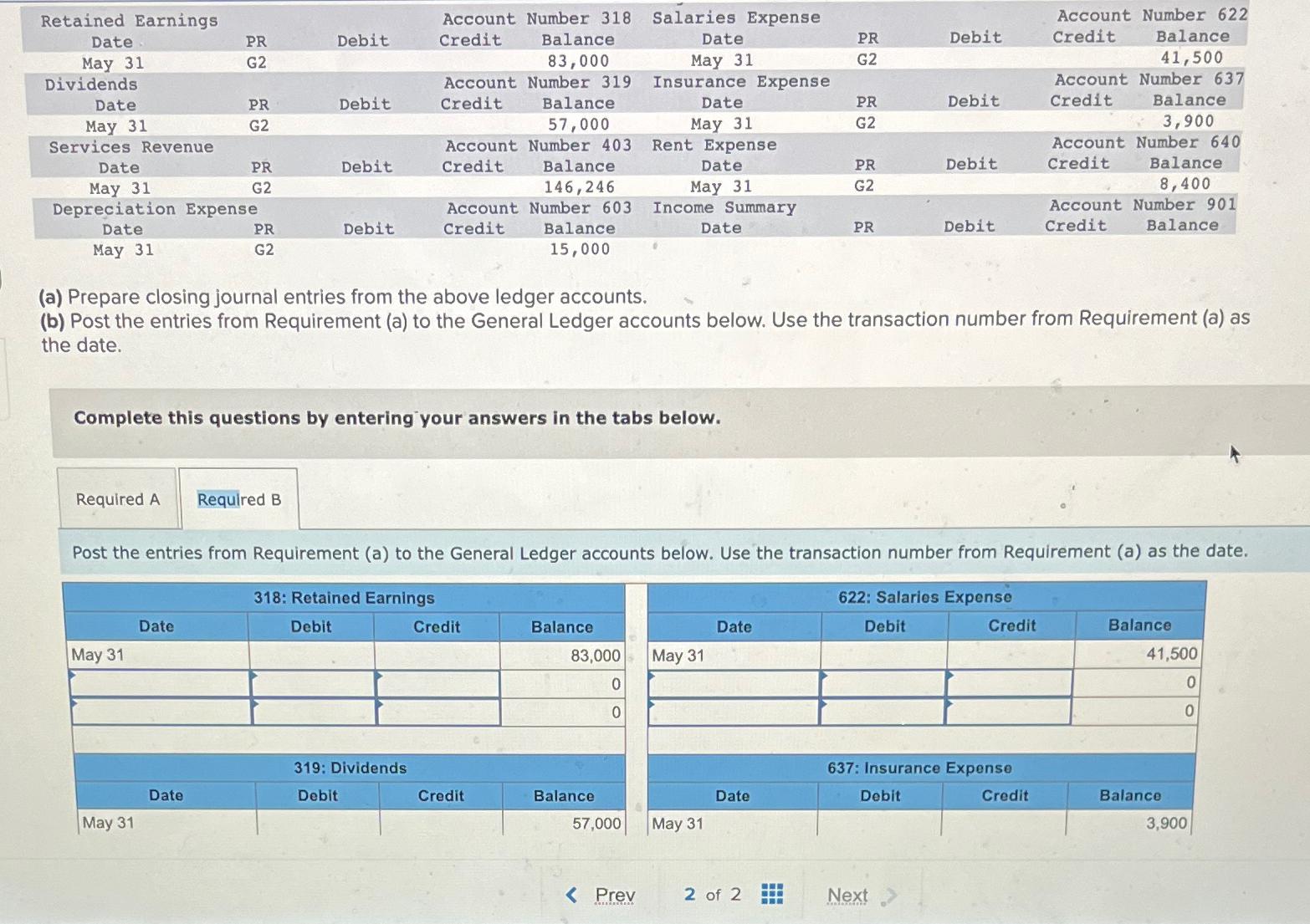

Question: Retained Earnings Date May 31 Dividends Date PR Debit Account Number 318 Credit Salaries Expense Account Number 622 Balance Date PR Debit Credit Balance

Retained Earnings Date May 31 Dividends Date PR Debit Account Number 318 Credit Salaries Expense Account Number 622 Balance Date PR Debit Credit Balance G2 83,000 May 31 G2 41,500 PR Debit Account Number 319 Credit Insurance Expense Account Number 637 Balance Date PR Debit Credit Balance May 31 G2 57,000 May 31 G2 3,900 Services Revenue Date PR Debit Account Number 403 Credit Rent Expense Account Number 640 Balance Date PR Debit Credit May 31 G2 146,246 Depreciation Expense Date PR Debit Account Number 603. Credit May 31 Income Summary G2 Balance 8,400 Balance Date PR Debit Account Number 901 Credit Balance May 31 G2 15,000 (a) Prepare closing journal entries from the above ledger accounts. (b) Post the entries from Requirement (a) to the General Ledger accounts below. Use the transaction number from Requirement (a) as the date. Complete this questions by entering your answers in the tabs below. Required A Required B Post the entries from Requirement (a) to the General Ledger accounts below. Use the transaction number from Requirement (a) as the date. 318: Retained Earnings Date May 31 Debit May 31 Date 319: Dividends Debit Credit Balance Date 622: Salaries Expense Debit Credit Balance 83,000 May 31 41,500 0 0 0 0 637: Insurance Expense Credit Balance Date Debit Credit Balance 57,000 May 31 3,900 < Prev 2 of 2 Next www

Step by Step Solution

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Here are the closing journal entries a Closing journal entries 1 Debit Income Summary Credit Service... View full answer

Get step-by-step solutions from verified subject matter experts