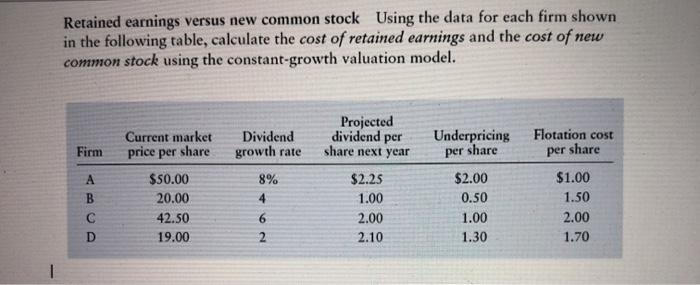

Question: Retained earnings versus new common stock Using the data for each firm shown in the following table, calculate the cost of retained earnings and the

Retained earnings versus new common stock Using the data for each firm shown in the following table, calculate the cost of retained earnings and the cost of new common stock using the constant-growth valuation model. Projected dividend per share next year Current market price per share Underpricing Flotation cost Firm Dividend growth rate per share per share B $50.00 20.00 42.50 19.00 8% 4 6 $2.25 1.00 2.00 2.10 $2.00 0.50 1.00 1.30 $1.00 1.50 2.00 1.70 D

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts