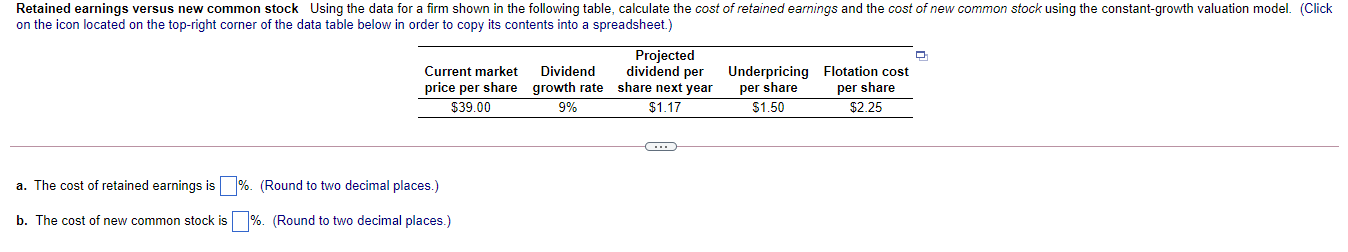

Question: Retained earnings versus new common stock Using the data for a firm shown in the following table, calculate the cost of retained earnings and the

Retained earnings versus new common stock Using the data for a firm shown in the following table, calculate the cost of retained earnings and the cost of new common stock using the constant-growth valuation model. (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Projected Current market Dividend dividend per Underpricing Flotation cost price per share growth rate share next year per share per share $39.00 9% $1.17 $1.50 $2.25 a. The cost of retained earnings is % (Round to two decimal places.) b. The cost of new common stock is %. (Round to two decimal places.) Ruta canings were now.common stock fotom shown in the following the che con lored camou and the cost of rew.com in contul orthodontic on the icon located on the light of the date toile below in order to contento pradsheet) Projecte Current Dividend dividend per nderping to price share growth rate share your Pershane share 300 3117 31.54 225 a. The cost of retained damingt E Roond to two decinul place) b. The cost of new common shock Round to two decin place

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts