Question: Retirement Planning Application Project Create an object - oriented retirement calculator using a programming language of your choice. The calculator will take the following inputs

Retirement Planning Application Project

Create an objectoriented retirement calculator using a programming language of your choice.

The calculator will take the following inputs from the user:

Retirement age: The retirement age is any age the individual wants to retire. Note that the earliest age to

receive social security pension is and the latest age is Create an estimate until age

Retirement account balance: This refers to the amount the employee saved in a retirement account.

Typically, employers help their employees save into this account. If money is taken from this account

before age an early withdrawal penalty of will apply. Withdrawal from this account is subject to

taxation at the ordinary rate. For this calculator assume the tax rate is or you can ask the user to enter

the estimated tax rate. The retirement account will go down by the amount withdrawn each year to cover

the deficit in living expenses which is not covered by social security income. The retirement account

balance will also grow by each year as it will be invested in the market. Assume investment balance

of at age

Social Security Income SSI The SSI amount will depend on length of working history and income. A

full work history is years. If SSI is taken at it will be of the full amount which will be given at

Every year after SSI increases by SSI is also subject to costofliving adjustment COLA of

annually. For this purpose, assume SSI at is $ per month and at full retirement age of is

$ Taking SSI can be delayed until age at which time SSI will be higher by compared to the

amount at age

Cost of Living Adjustment COLA SSI will be increased by an average of each year.

Monthly Living Cost Assume that average monthly cost is $ and it will increase by each year

to factor in inflation.

Retirement account balance ROI The retirement account balance will grow by each year after any

withdrawals are deducted as it will be invested in the market.

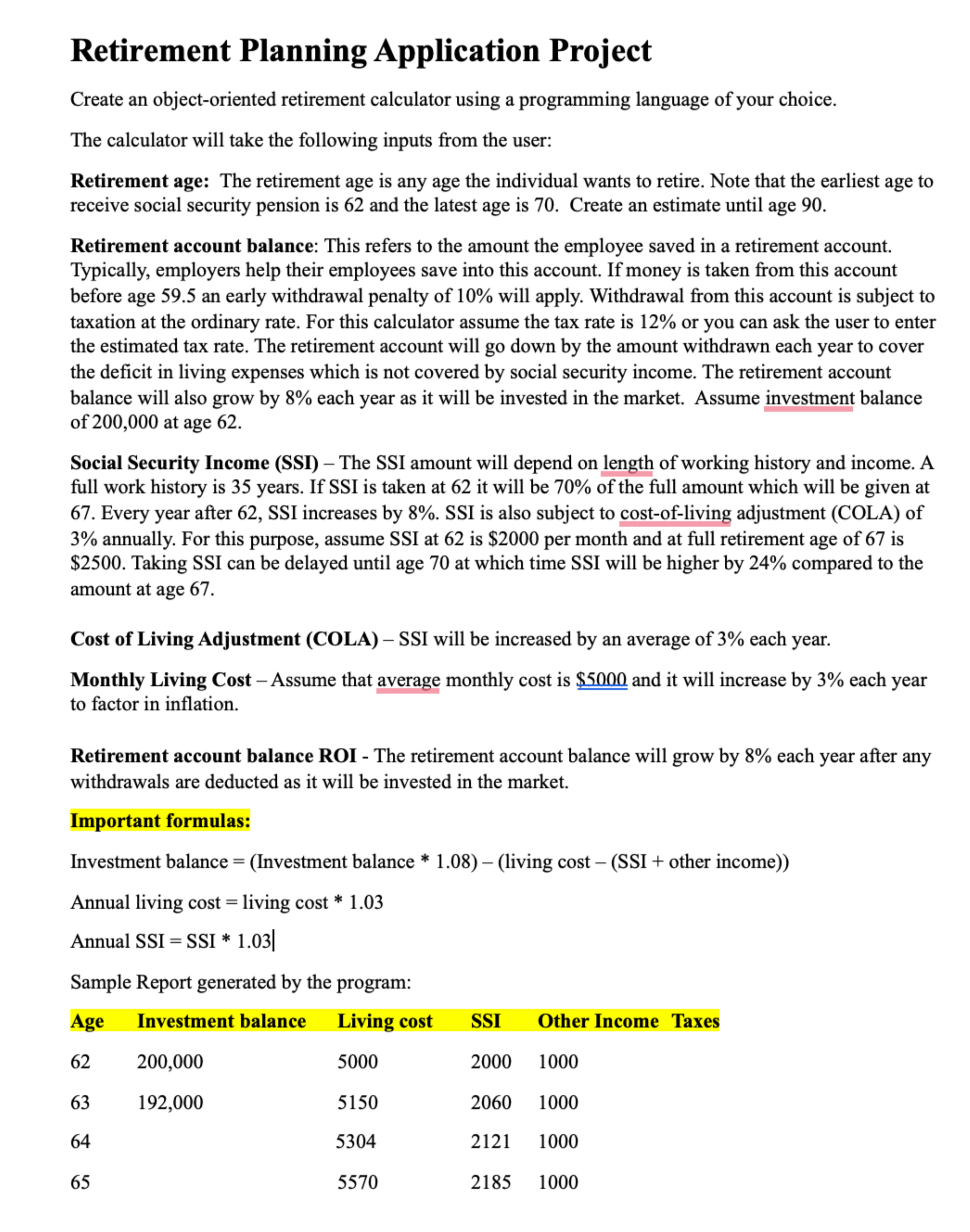

Important formulas:

Investment balance Investment balance living cost other income

Annual living cost living cost

Annual SSI SSI

Sample Report generated by the program:

in java code please

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock