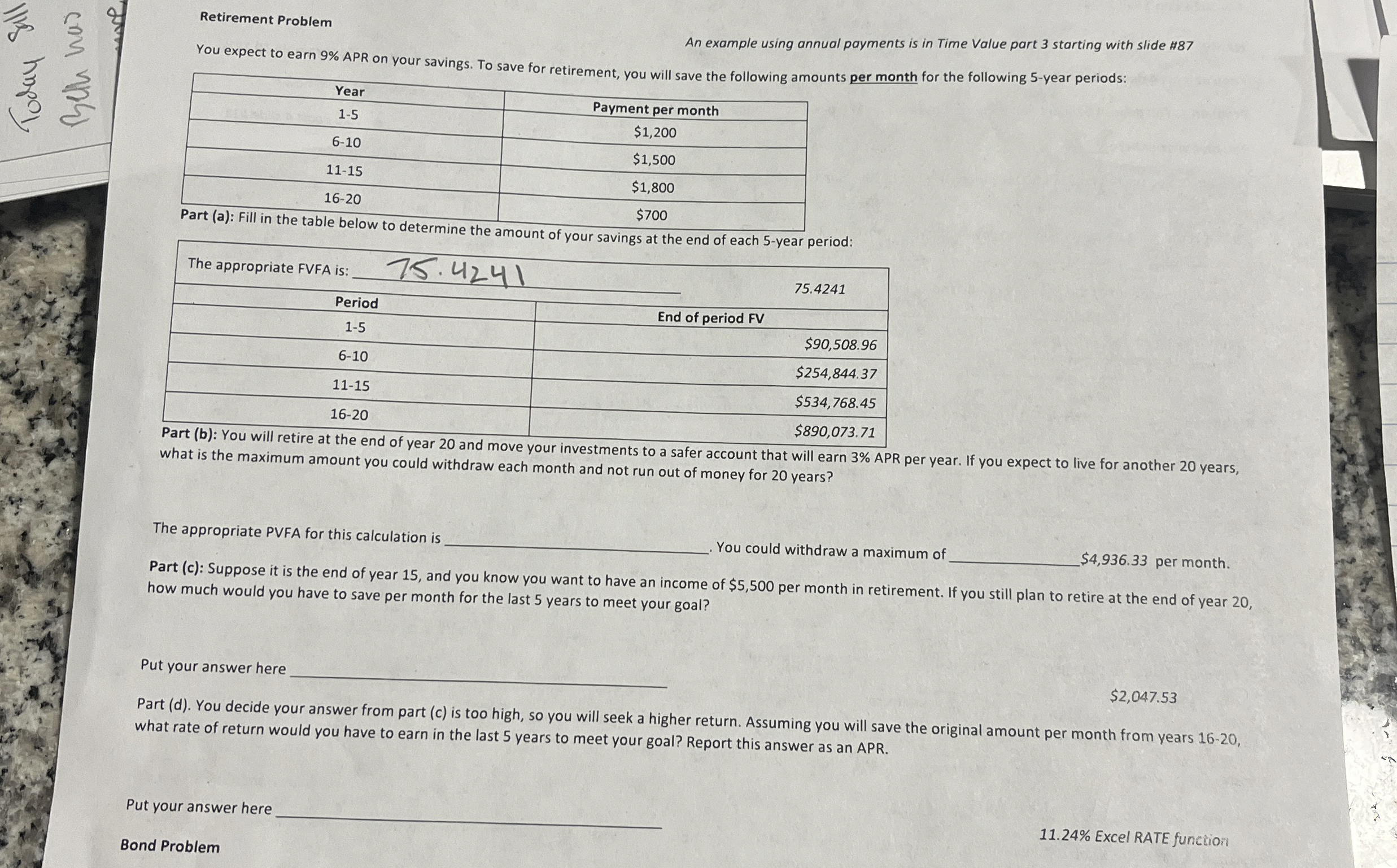

Question: Retirement Problem An example using annual payments is in Time Value part 3 starting with slide # 8 7 Part ( a ) : Fill

Retirement Problem

An example using annual payments is in Time Value part starting with slide #

Part a: Fill in the table below to determine the amount of your savings at the end of each year period:

Part b: You will retire at the end of year and move your investments to a safer account that will earn APR per year. If you expect to live for another years,

what is the maximum amount you could withdraw each month and not run out of money for years?

The appropriate PVFA for this calculation

You could withdraw a maximum of

$ per month.

Part c: Suppose it is the end of year and you know you want to have an income of $ per month in retirement. If you still plan to retire at the end of year

how much would you have to save per month for the last years to meet your goal?

Put your answer her

$

Part d You decide your answer from part c is too high, so you will seek a higher return. Assuming you will save the original amount per month from years

what rate of return would you have to earn in the last years to meet your goal? Report this answer as an APR.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock