Question: Retirement Retirement (5 points) In Section 3C we considered the problem of a planned retirement income under the assumption that this needs to be financed

Retirement

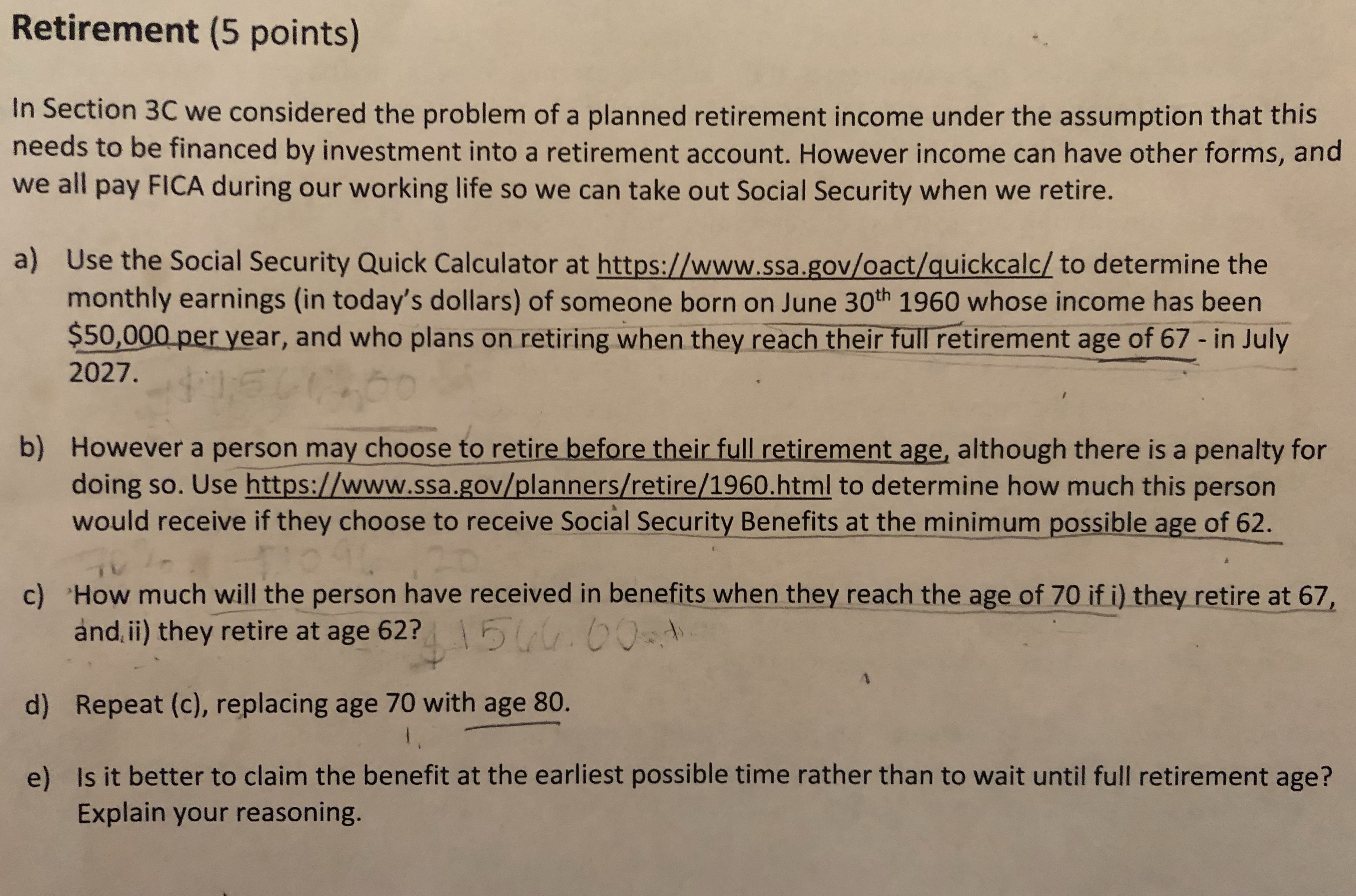

Retirement (5 points) In Section 3C we considered the problem of a planned retirement income under the assumption that this needs to be financed by investment into a retirement account. However income can have other forms, and we all pay FICA during our working life so we can take out Social Security when we retire. a) Use the Social Security Quick Calculator at https://www.ssa.gov/oact/quickcalc/ to determine the monthly earnings (in today's dollars) of someone born on June 30th 1960 whose income has been $50,000 per year, and who plans on retiring when they reach their full retirement age of 67 - in July 2027. 4:1:561600 b) However a person may choose to retire before their full retirement age, although there is a penalty for doing so. Use https://www.ssa.gov/planners/retire/1960.html to determine how much this person would receive if they choose to receive Social Security Benefits at the minimum possible age of 62. c) 'How much will the person have received in benefits when they reach the age of 70 if i) they retire at 67, and ii) they retire at age 62? 15 (4 0Ow. d) Repeat (c), replacing age 70 with age 80. e) Is it better to claim the benefit at the earliest possible time rather than to wait until full retirement age? Explain your reasoning

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts