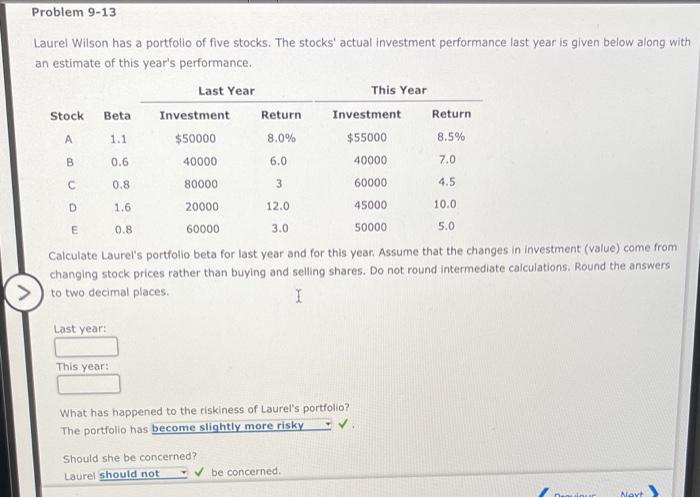

Question: Return A 1.1 Problem 9-13 Laurel Wilson has a portfolio of five stocks. The stocks' actual investment performance last year is given below along with

Return A 1.1 Problem 9-13 Laurel Wilson has a portfolio of five stocks. The stocks' actual investment performance last year is given below along with an estimate of this year's performance. Last Year This Year Stock Beta Investment Return Investment $50000 8.0% $55000 8.5% 40000 40000 0.8 80000 20000 45000 10.0 50000 Calculate Laurel's portfolio beta for last year and for this year. Assume that the changes in investment (value) come from changing stock prices rather than buying and selling shares. Do not round Intermediate calculations. Round the answers to two decimal places. 1 0.6 6.0 7.0 3 60000 4.5 D 1.6 12.0 E 0.8 60000 3.0 5.0 Last year: This year: What has happened to the riskiness of Laurel's portfolio? The portfolio has become slightly more risky Should she be concerned? Laurel should not be concerned. . A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts