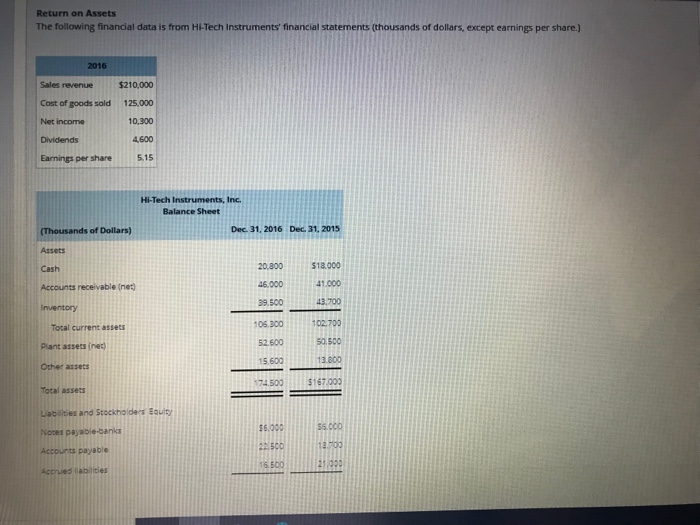

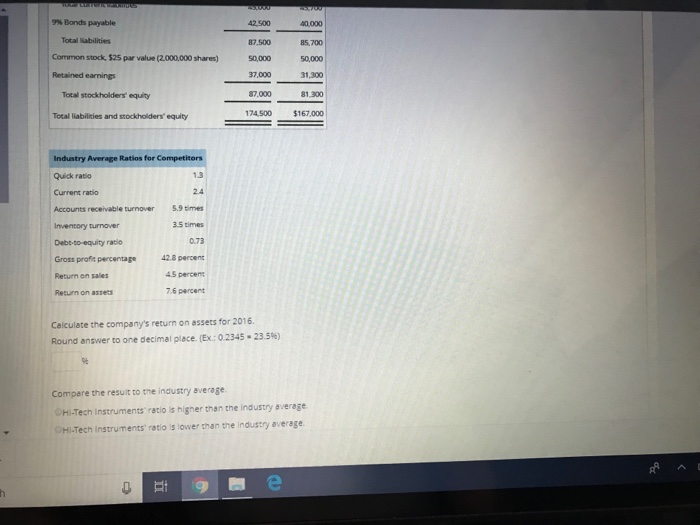

Question: Return on Assets The following financial data is from Hi-Tech Instruments' financial statenents (thousands of dollars, except earnings per share.) 2016 Sales revenue $210,000 Cost

Return on Assets The following financial data is from Hi-Tech Instruments' financial statenents (thousands of dollars, except earnings per share.) 2016 Sales revenue $210,000 Cost of goods sold 125,000 Net income Dividends Earnings per share 10,300 4,600 5.15 Hi-Tech Instruments, Inc Balance Sheet Dec. 31. 2016 Dec 31, 201:5 (Thousands of Dollars) Assets Cash Accounts receivable (net) Inventony 20,800$18,000 46.000 39.500 06.300 52.600 15.600 74.500$167.003 3.700 102 700 Total current assets Plant assets (net) Other azsecs Total assets Lablities and Stockholde Eauity 13.800 6.000ss.cC0 50013.50 15 500 Accounta payable

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock