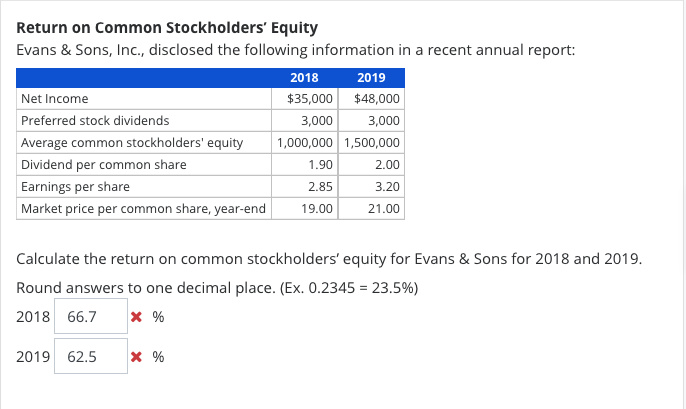

Question: Return on Common Stockholders' Equity Evans & Sons, Inc., disclosed the following information in a recent annual report: 2018 2019 Net Income $35,000 $48,000 Preferred

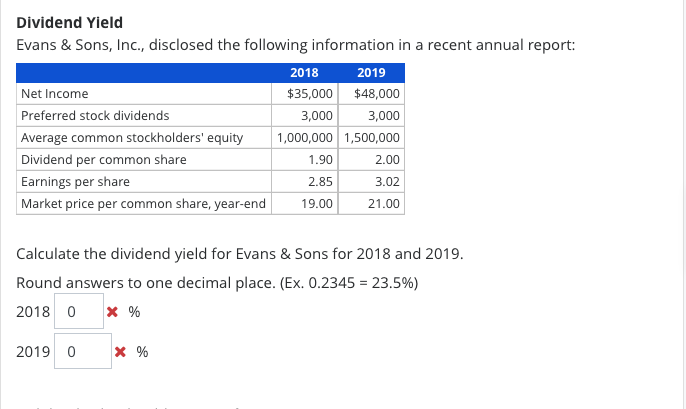

Return on Common Stockholders' Equity Evans & Sons, Inc., disclosed the following information in a recent annual report: 2018 2019 Net Income $35,000 $48,000 Preferred stock dividends 3,000 3,000 Average common stockholders' equity 1,000,000 1,500,000 Dividend per common share 1.90 2.00 Earnings per share 2.85 3.20 Market price per common share, year-end 19.00 21.00 Calculate the return on common stockholders' equity for Evans & Sons for 2018 and 2019. Round answers to one decimal place. (Ex. 0.2345 = 23.5%) 2018 66.7 X % 2019 62.5 X % Dividend Yield Evans & Sons, Inc., disclosed the following information in a recent annual report: 2018 2019 Net Income $35,000 $48,000 Preferred stock dividends 3,000 3,000 Average common stockholders' equity 1,000,000 1,500,000 Dividend per common share 1.90 2.00 Earnings per share 2.85 3.02 Market price per common share, year-end 19.00 21.00 Calculate the dividend yield for Evans & Sons for 2018 and 2019. Round answers to one decimal place. (Ex. 0.2345 = 23.5%) 2018 0 X % 2019 0 X %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts