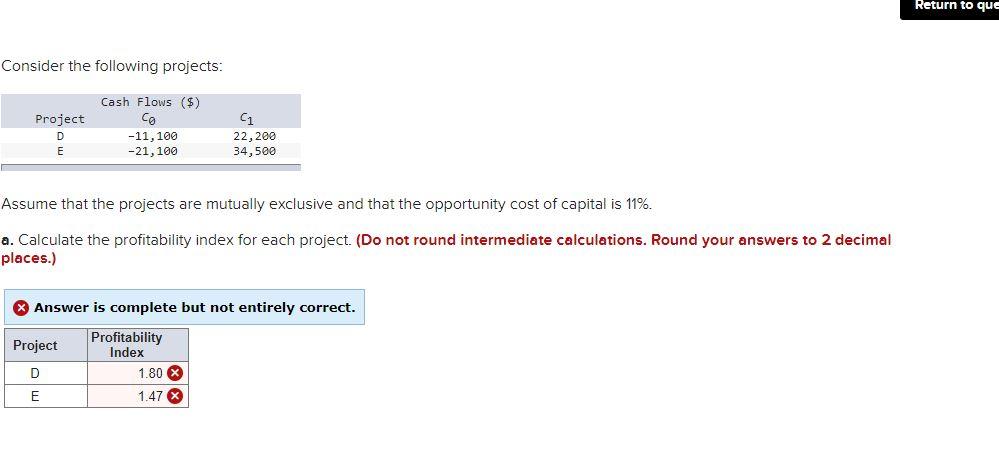

Question: Return to que Consider the following projects: Project D E Cash Flows ($) co -11, 100 -21,100 C1 22,200 34,500 Assume that the projects are

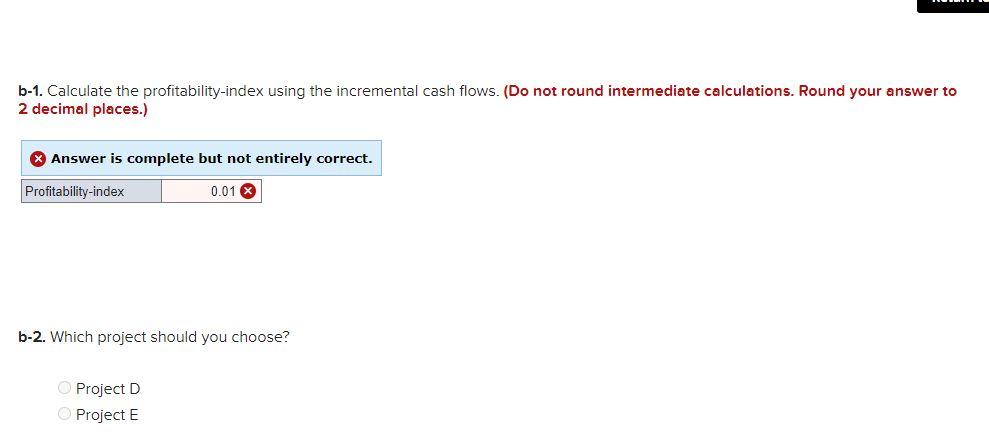

Return to que Consider the following projects: Project D E Cash Flows ($) co -11, 100 -21,100 C1 22,200 34,500 Assume that the projects are mutually exclusive and that the opportunity cost of capital is 11%. a. Calculate the profitability index for each project. (Do not round intermediate calculations. Round your answers to 2 decimal places.) Answer is complete but not entirely correct. Profitability Project Index D 1.80 X E 1.47 X b-1. Calculate the profitability-index using the incremental cash flows. (Do not round intermediate calculations. Round your answer to 2 decimal places.) Answer is complete but not entirely correct. Profitability-index 0.01 b-2. Which project should you choose? Project D Project E

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts