Question: Return to questi 00 Problem 17-15 Dividends Set Annually (LG17-4) Suppose that a firm always announces a yearly dividend at the end of the first

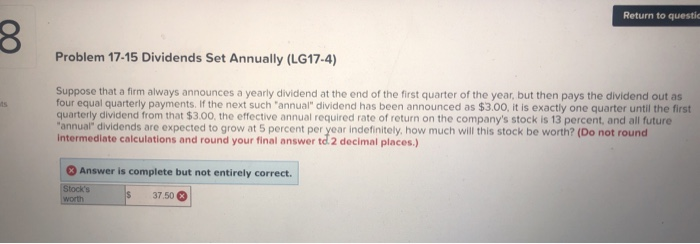

Return to questi 00 Problem 17-15 Dividends Set Annually (LG17-4) Suppose that a firm always announces a yearly dividend at the end of the first quarter of the year, but then pays the dividend out as four equal quarterly payments. If the next such 'annual" dividend has been announced as $3.00, it is exactly one quarter until the first quarterly dividend from that $3.00, the effective annual required rate of return on the company's stock is 13 percent, and all future "annual" dividends are expected to grow at 5 percent per year indefinitely, how much will this stock be worth? (Do not round Intermediate calculations and round your final answer td 2 decimal places.) Answer is complete but not entirely correct. Stock's worth S 37.50

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts