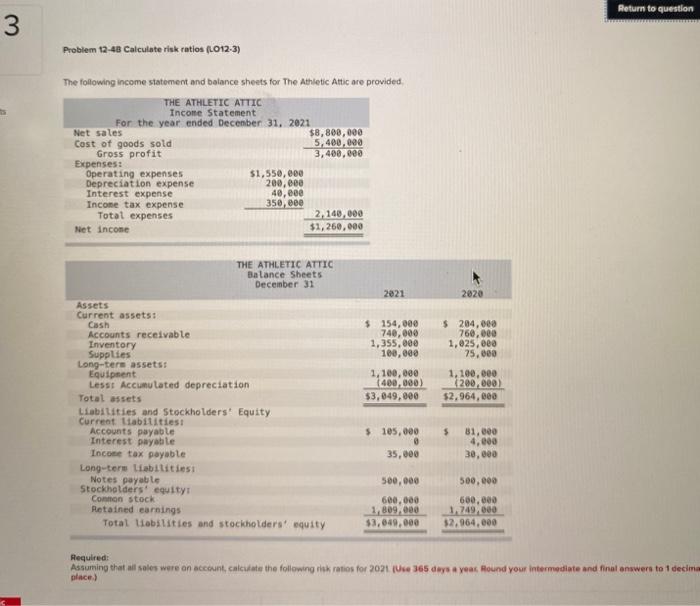

Question: Return to question 3 Problem 12-48 Calculate risk ratios (L012-3) The following income statement and balance sheets for The Athletic Attic are provided THE ATHLETIC

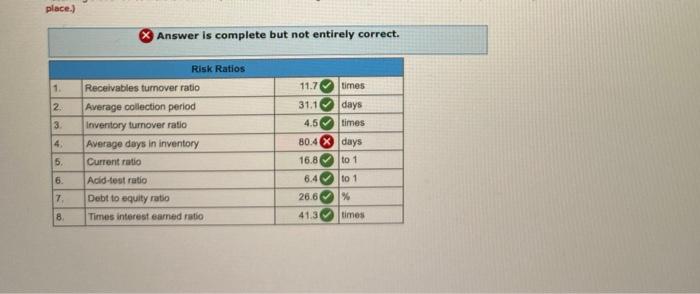

Return to question 3 Problem 12-48 Calculate risk ratios (L012-3) The following income statement and balance sheets for The Athletic Attic are provided THE ATHLETIC ATTIC Income Statement For the year ended December 31, 2021 Net sales $8,800,000 Cost of goods sold 5,400,000 Gross profit 3,400,000 Expenses: Operating expenses $1,550,000 Depreciation expense 200,000 Interest expense 40, eee Income tax expense 350,000 Total expenses 2,140,000 Net income $1,260,000 THE ATHLETIC ATTIC Balance Sheets December 31 2021 2020 $ 154,000 740,000 1,355,000 100,000 $ 204,000 760,000 1,025,000 75,000 1,100,000 X200,000) $2,964,000 1,100,000 (480,000) $3,049,000 Assets Current assets: Cash Accounts receivable Inventory Supplies Long-term assets Equipment Lesst Accumulated depreciation Total assets Liabilities and Stockholders' Equity Current liabilities Accounts payable Interest payable Incoce tax payable Long-terw liabilities Notes payable Stockholders' equity! Connon stock Retained earnings Total liabilities and stockholders' equity $ 105,000 $ 31,600 4.000 30,000 35,000 500,000 600,000 1.809,000 $3,649.000 500,000 600,000 1,249,000 $2.964,000 Required: Assuming that all sales were an account, calculate the following risk ratios for 2021 (Use 365 days a year Round your intermediate and final answers to 1 decima place) place.) Answer is complete but not entirely correct. Risk Ratios 1 11.7 times 2 3 Receivables turnover ratio Average collection period Inventory turnover ratio Average days in inventory Current ratio Acid-test ratio Debt to equity ratio Times interest earned ratio 31.1 days 4.5 times 80.4 X days 16.8 to 1 4. 5. 6. 7 8 > 6.4 to 1 26.6 % 41.3 times

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts