Question: Return to question 5 Problem 7-62 (LO 7-4) Molly Grey (single) acquired a 30 percent limited partnership interest in Beau Geste LLP several years ago

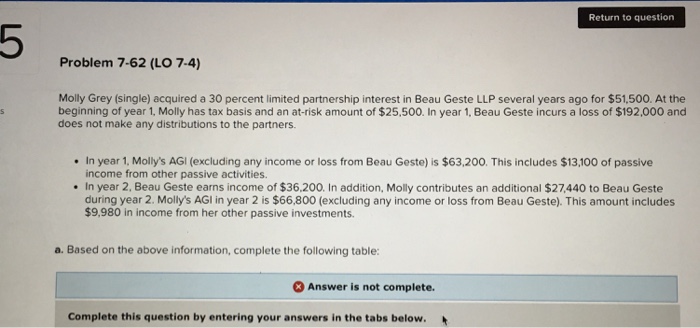

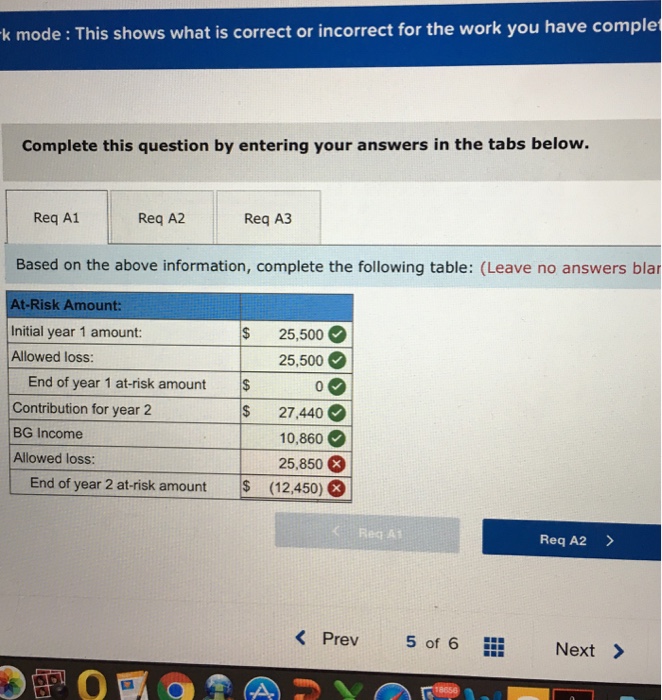

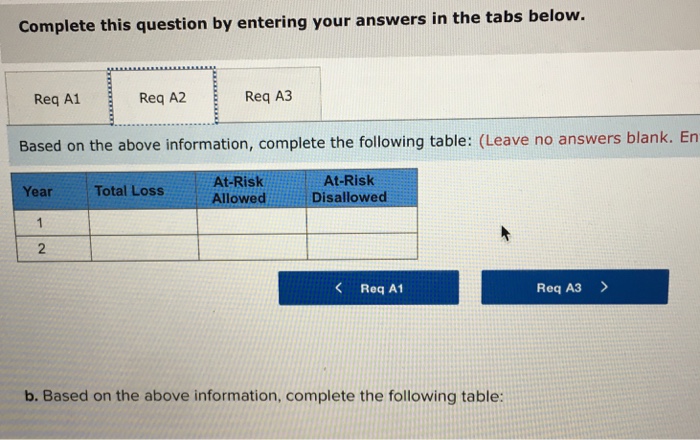

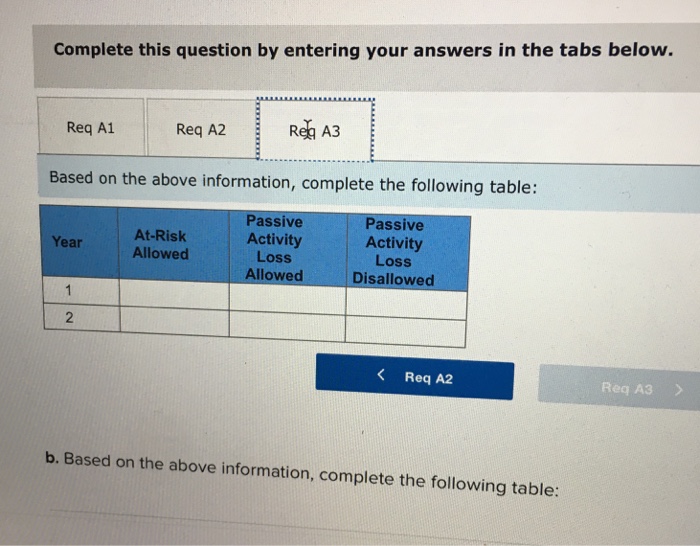

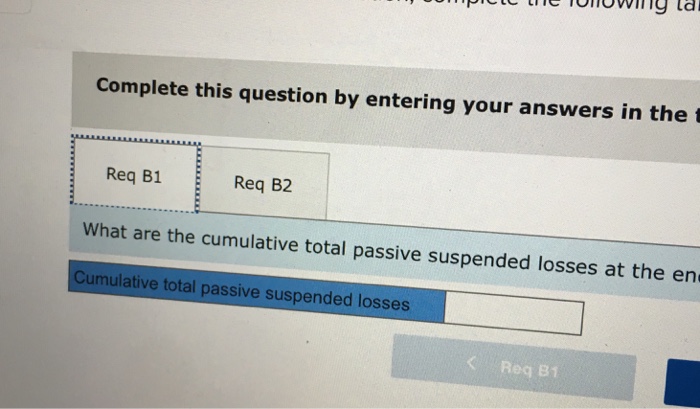

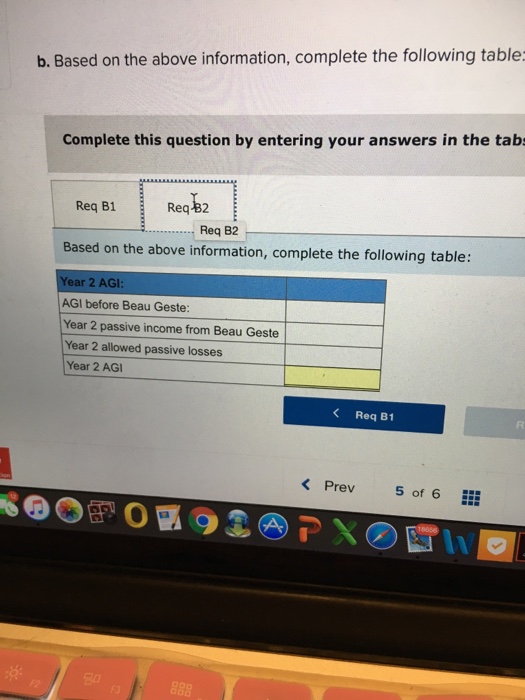

Return to question 5 Problem 7-62 (LO 7-4) Molly Grey (single) acquired a 30 percent limited partnership interest in Beau Geste LLP several years ago for $51,500. At the beginning of year 1, Molly has tax basis and an at-risk amount of $25,500. In year 1, Beau Geste incurs a loss of $192,000 and does not make any distributions to the partners In year 1, Molly's AGI (excluding any income or loss from Beau Geste) is $63,200. This includes $13,100 of passive income from other passive activities. In year 2, Beau Geste earns income of $36,200. In addition, Molly contributes an additional $27,440 to Beau Geste during year 2. Molly's AGl in year 2 is $66,800 (excluding any income or loss from Beau Geste). This amount includes $9,980 in income from her other passive investments. a. Based on the above information, complete the following table: 3 Answer is not complete. Complete this question by entering your answers in the tabs below

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts