Question: Return to question Datadog ( Ticker: DDOG ) underwent an initial public offering ( IPO ) in 2 0 1 9 by issuing 2 3

Return to question

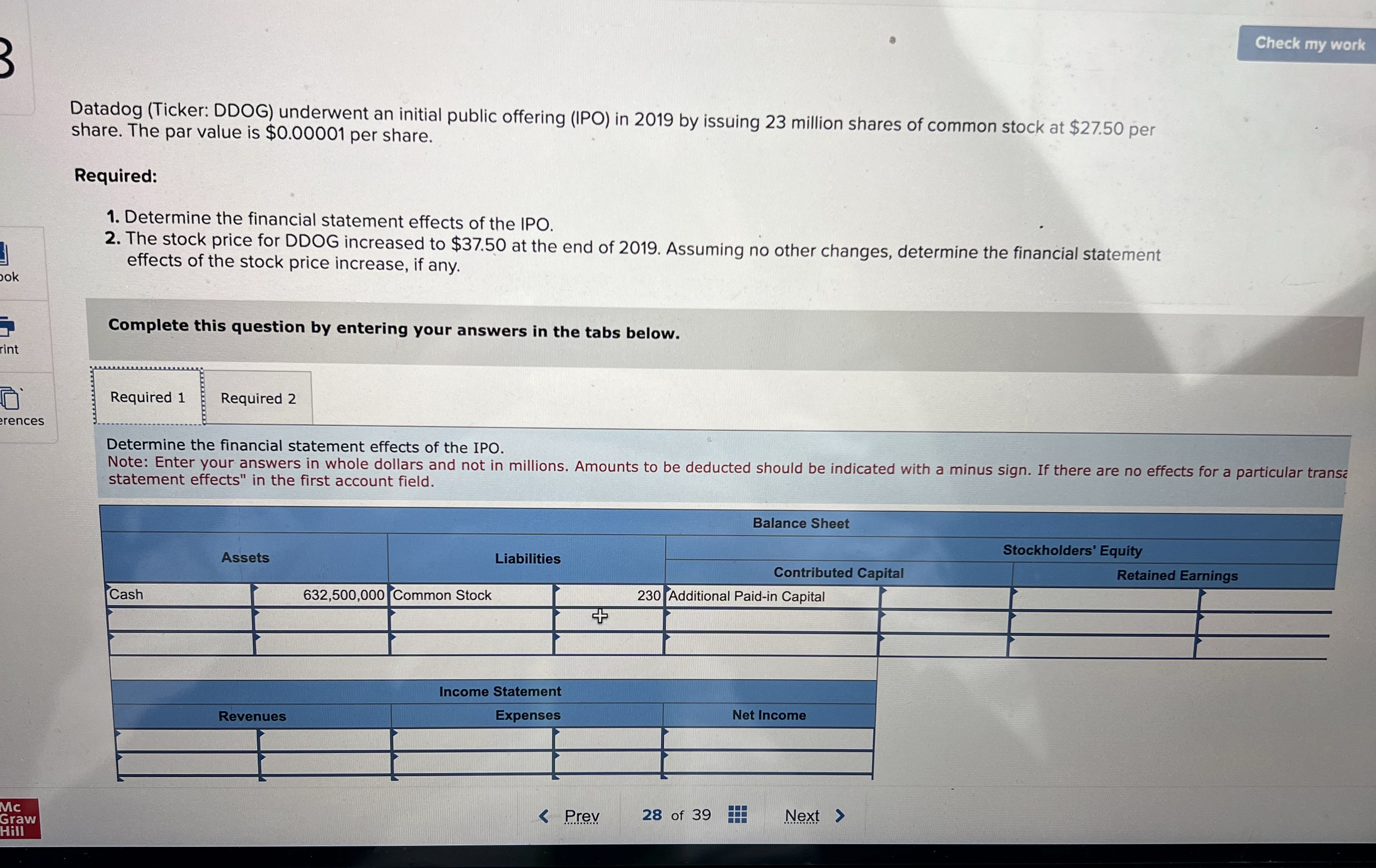

Datadog Ticker: DDOG underwent an initial public offering IPO in by issuing million shares of common stock at $ per share. The par value is $ per share.

Required:

Determine the financial statement effects of the IPO.

The stock price for DDOG increased to $ at the end of Assuming no other changes, determine the financial statement effects of the stock price increase, if any.

Answer is not complete.

Complete this question by entering your answers in the tabs below.

Determine the financial statement effects of the IPO.

Note: Enter your answers in whole dollars and not in millions. Amounts to be deducted should be indicated with a minus sign. If there are no effects for a particular transe statement effects" in the first account field.

Prev

of Datadog Ticker: DDOG underwent an initial public offering IPO in by issuing million shares of common stock at $ per share. The par value is $ per share.

Required:

Determine the financial statement effects of the IPO.

The stock price for DDOG increased to $ at the end of Assuming no other changes, determine the financial statement effects of the stock price increase, if any.

Complete this question by entering your answers in the tabs below.

Required

Required

Determine the financial statement effects of the IPO.

Note: Enter your answers in whole dollars and not in millions. Amounts to be deducted should be indicated with a minus sign. If there are no effects for a particular transe statement effects" in the first account field.

tableBalance SheetAssetsLiabilities,Stockholders' EquityContributed Capital,Retained EarningsCashCommon Stock,Additional Paidin Capital,,Income Statement,RevenuesExpenses,Net Income,,

Prev

of

Next

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock