Question: Return to question Gates Manufacturing reports based on an October 31 fiscal year. As a part of your interview for a cost analyst position,

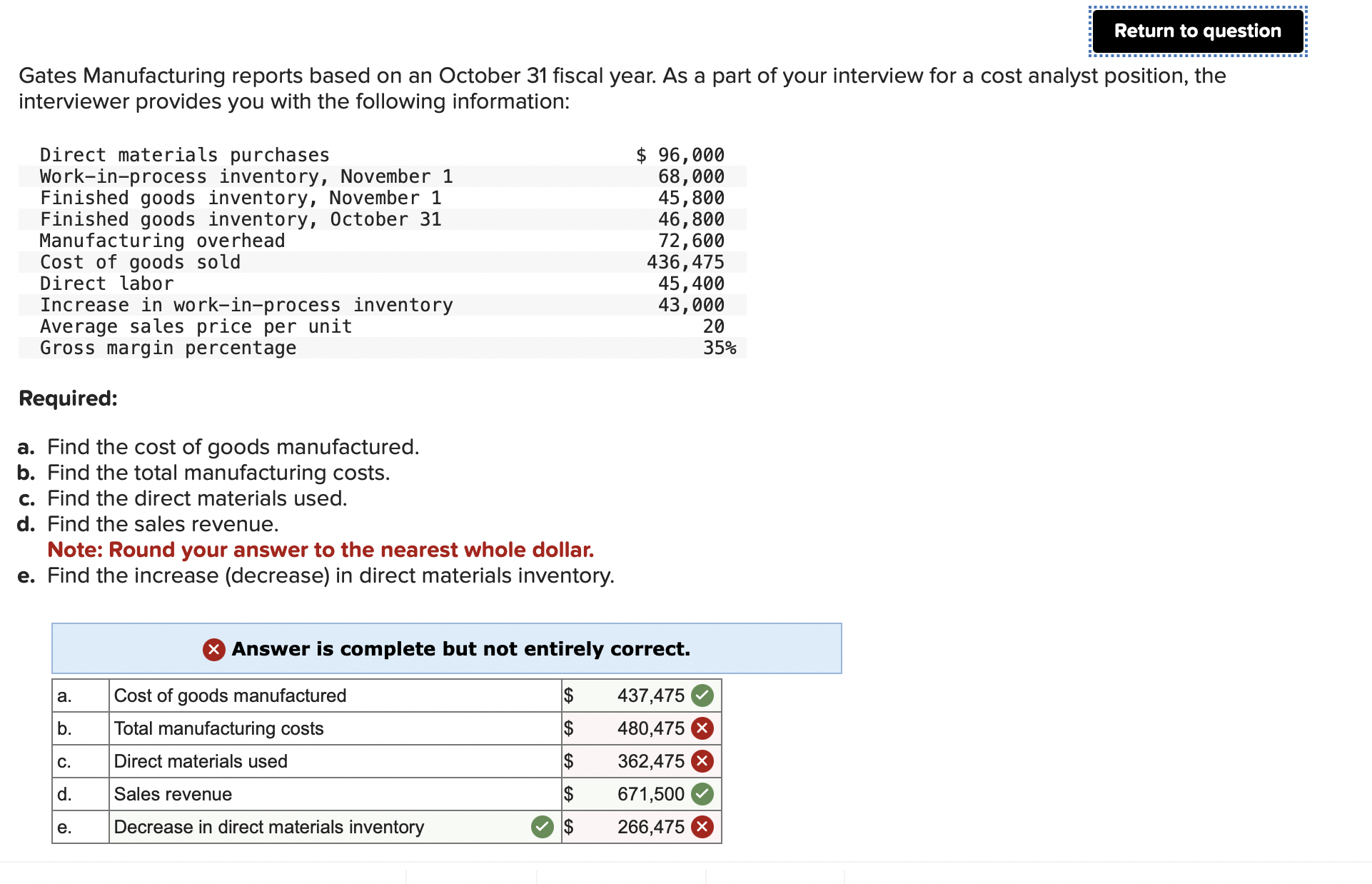

Return to question Gates Manufacturing reports based on an October 31 fiscal year. As a part of your interview for a cost analyst position, the interviewer provides you with the following information: Direct materials purchases Work-in-process inventory, November 1 Finished goods inventory, November 1 Finished goods inventory, October 31 Manufacturing overhead Cost of goods sold Direct labor Increase in work-in-process inventory Average sales price per unit Gross margin percentage Required: a. Find the cost of goods manufactured. b. Find the total manufacturing costs. c. Find the direct materials used. d. Find the sales revenue. Note: Round your answer to the nearest whole dollar. e. Find the increase (decrease) in direct materials inventory. a. b. C. d. e. Cost of goods manufactured Total manufacturing costs Direct materials used X Answer is complete but not entirely correct. $ 437,475 $ 480,475 X $ 362,475 671,500 266,475 Sales revenue Decrease in direct materials inventory $ 96,000 68,000 45,800 46,800 72,600 436, 475 45,400 43,000 $ 20 35%

Step by Step Solution

3.44 Rating (154 Votes )

There are 3 Steps involved in it

SOLUTION a Cost of goods manufactured To calculate the cost of goods manufactured we need to consider the following components Direct materials purchases 96000 Direct labor 45400 Manufacturing overhea... View full answer

Get step-by-step solutions from verified subject matter experts