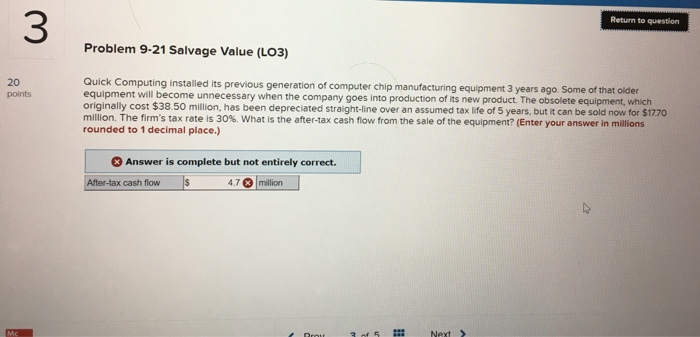

Question: Return to question Problem 9-21 Salvage Value (LO3) 20 points Quick Computing installed its previous generation of computer chip manufacturing equipment 3 years ago. Some

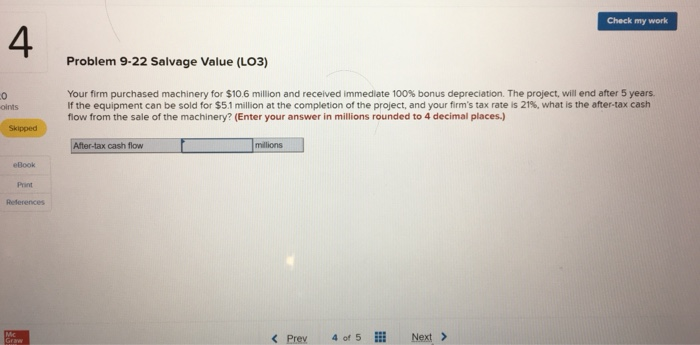

Return to question Problem 9-21 Salvage Value (LO3) 20 points Quick Computing installed its previous generation of computer chip manufacturing equipment 3 years ago. Some of that older equipment will become unnecessary when the company goes into production of its new product. The obsolete equipment, which originally cost $38.50 million, has been depreciated straight-line over an assumed tax life of 5 years, but it can be sold now for $1770 million. The firm's tax rate is 30% What is the after-tax cash flow from the sale of the equipment? (Enter your answer in millions rounded to 1 decimal place.) Answer is complete but not entirely correct. After-tax cash flow s 4.7 million Check my work Problem 9-22 Salvage Value (LO3) oints Your firm purchased machinery for $10.6 million and received immediate 100% bonus depreciation. The project, will end after 5 years If the equipment can be sold for $5.1 million at the completion of the project, and your firm's tax rate is 21%, what is the after-tax cash flow from the sale of the machinery? (Enter your answer in millions rounded to 4 decimal places.) Skipped After-tax cash flow millions Book References

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts