Question: Return to question ! Required information Exercise 9-11B Record bonds issued at a discount and related semiannual interest (LO9-6) [The following information applies to the

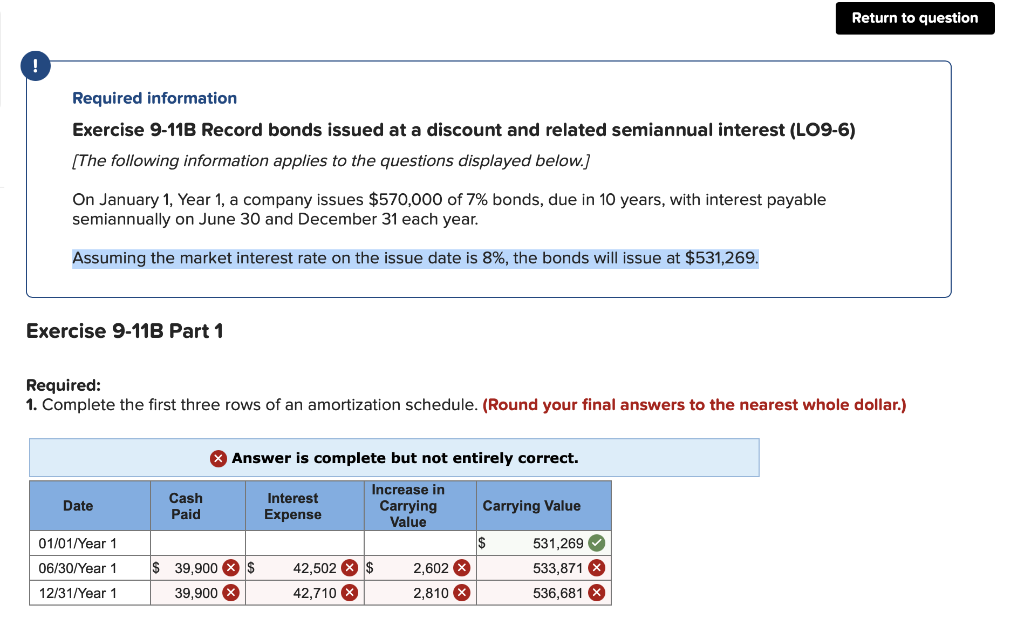

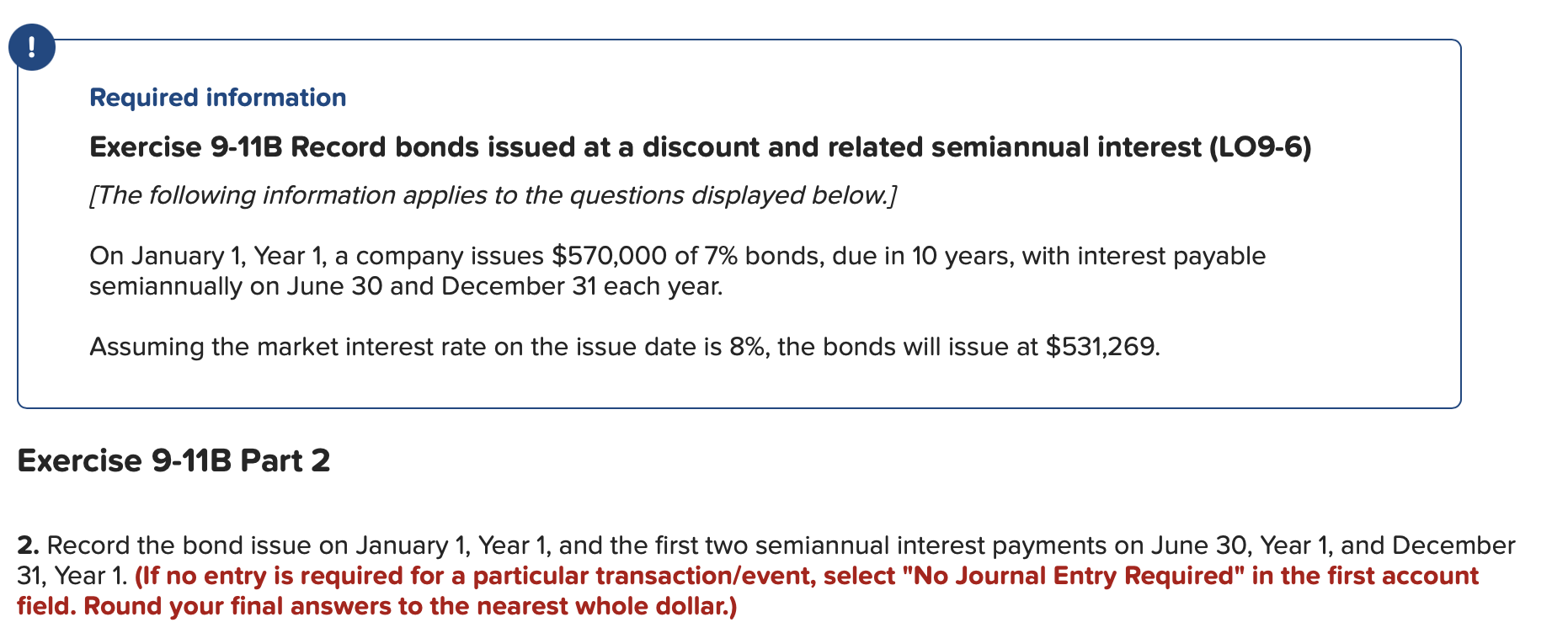

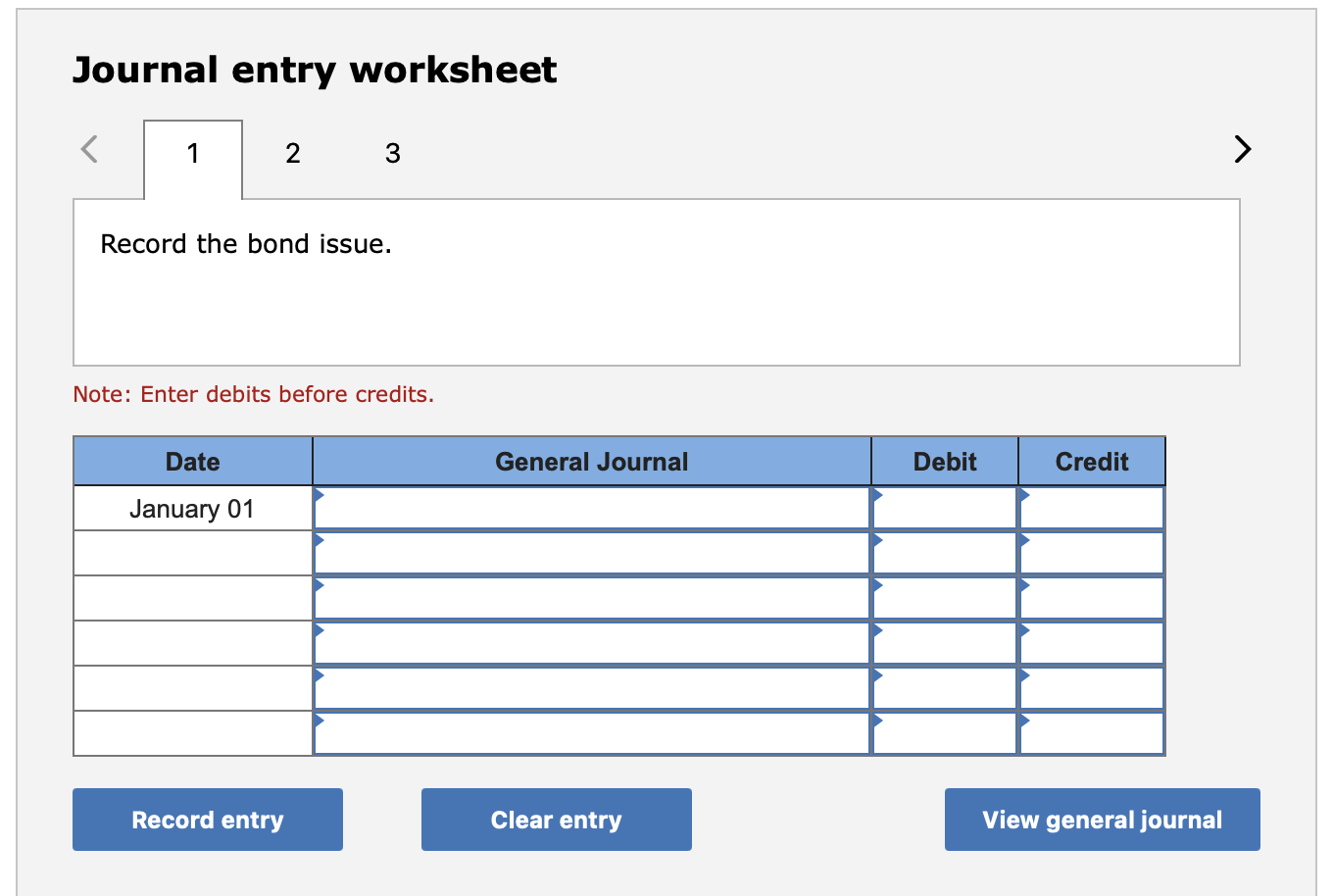

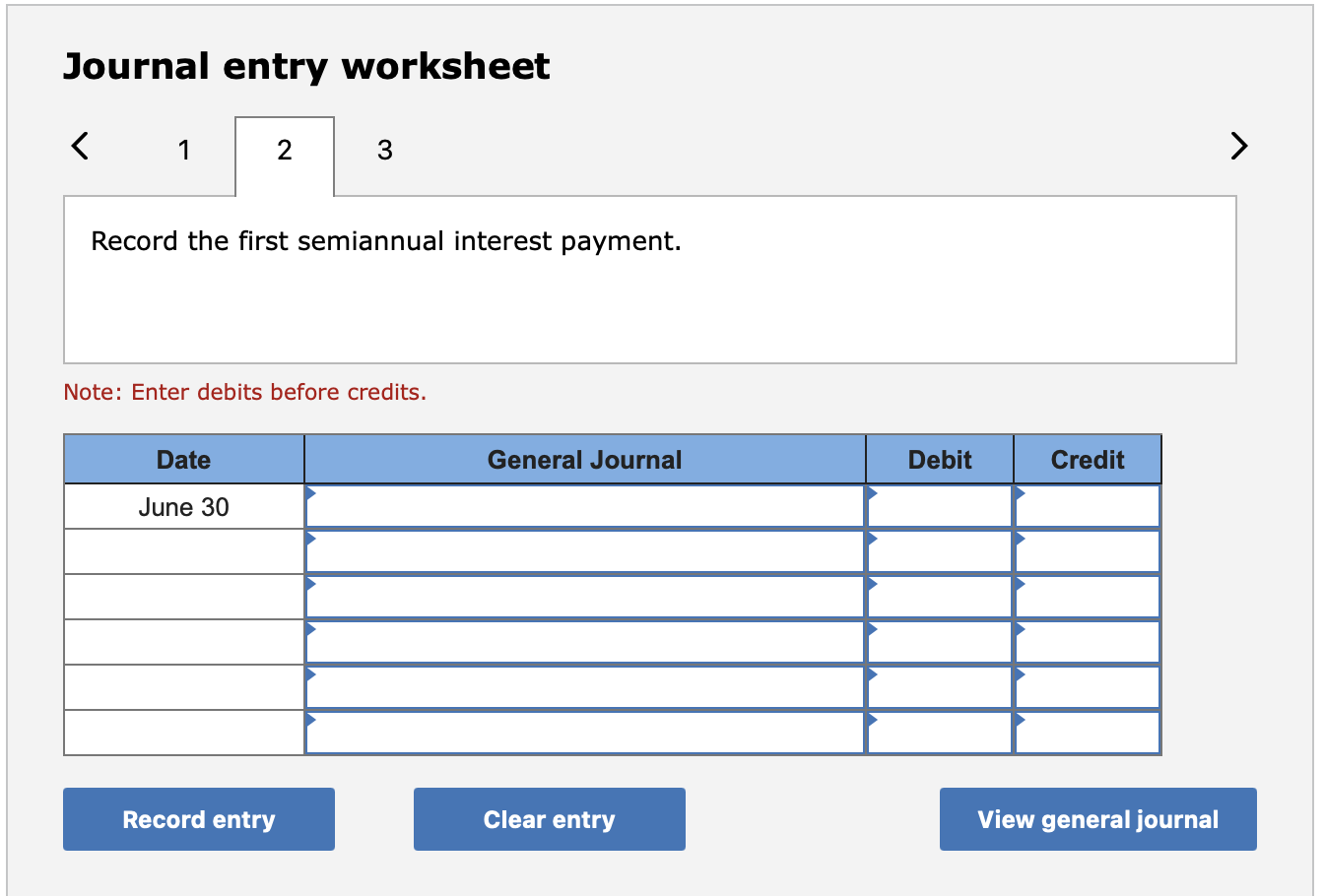

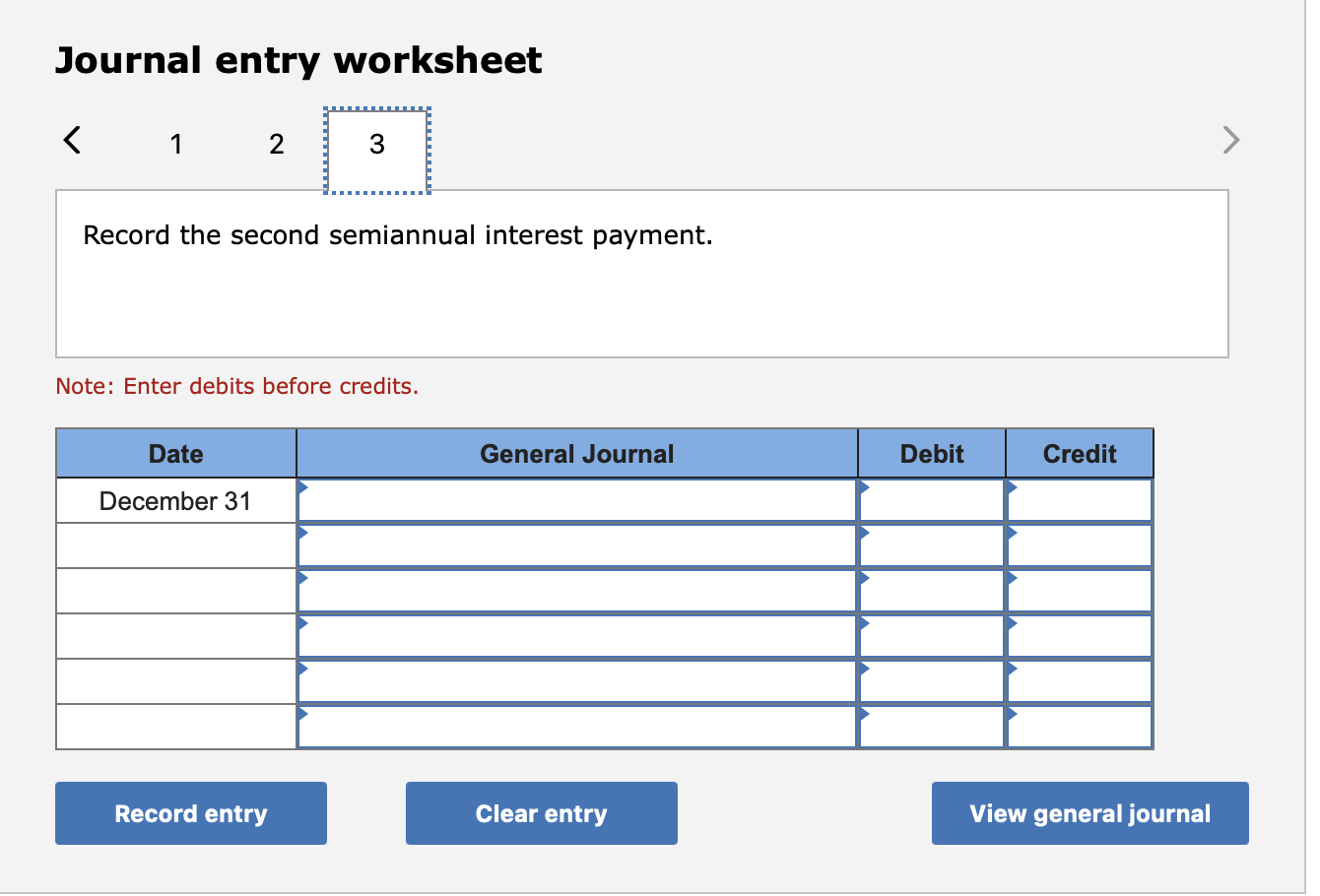

Return to question ! Required information Exercise 9-11B Record bonds issued at a discount and related semiannual interest (LO9-6) [The following information applies to the questions displayed below.) On January 1, Year 1, a company issues $570,000 of 7% bonds, due in 10 years, with interest payable semiannually on June 30 and December 31 each year. Assuming the market interest rate on the issue date is 8%, the bonds will issue at $531,269. Exercise 9-11B Part 1 Required: 1. Complete the first three rows of an amortization schedule. (Round your final answers to the nearest whole dollar.) Answer is complete but not entirely correct. Date Cash Paid 01/01/Year 1 06/30/Year 1 Increase in Interest Expense Carrying Carrying Value Value $ 531,269 42,502 X $ 2,602 X 533,871 42,710 X 2,810 536,681 $ 39,900 X $ 12/31/Year 1 39,900 X ! Required information Exercise 9-11B Record bonds issued at a discount and related semiannual interest (LO9-6) [The following information applies to the questions displayed below.) On January 1, Year 1, a company issues $570,000 of 7% bonds, due in 10 years, with interest payable semiannually on June 30 and December 31 each year. Assuming the market interest rate on the issue date is 8%, the bonds will issue at $531,269. Exercise 9-11B Part 2 2. Record the bond issue on January 1, Year 1, and the first two semiannual interest payments on June 30, Year 1, and December 31, Year 1. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field. Round your final answers to the nearest whole dollar.) Journal entry worksheet Record the first semiannual interest payment. Note: Enter debits before credits. Date General Journal Debit Credit June 30 Record entry Clear entry View general journal Journal entry worksheet Record the second semiannual interest payment. Note: Enter debits before credits. Date General Journal Debit Credit December 31 Record entry Clear entry View general journal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts