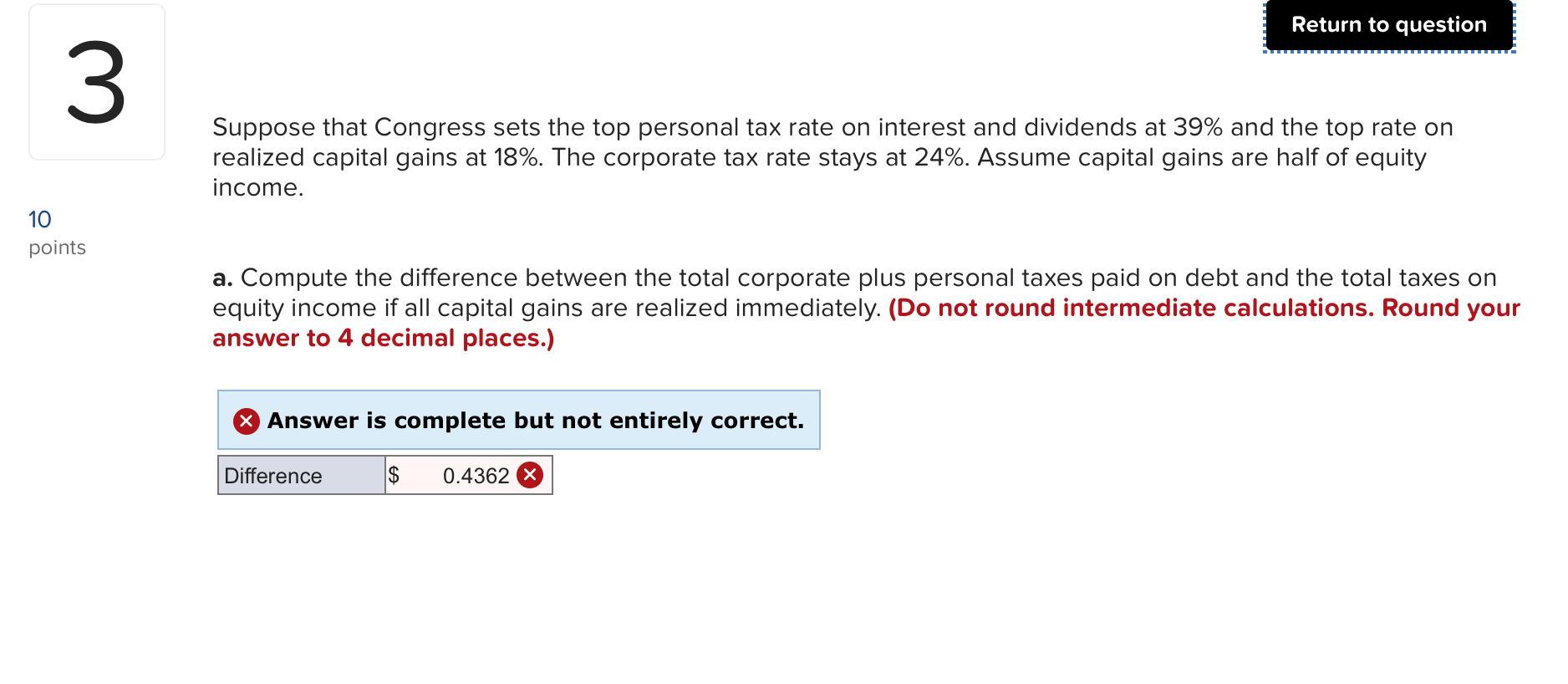

Question: Return to question Suppose that Congress sets the top personal tax rate on interest and dividends at 39% and the top rate on realized capital

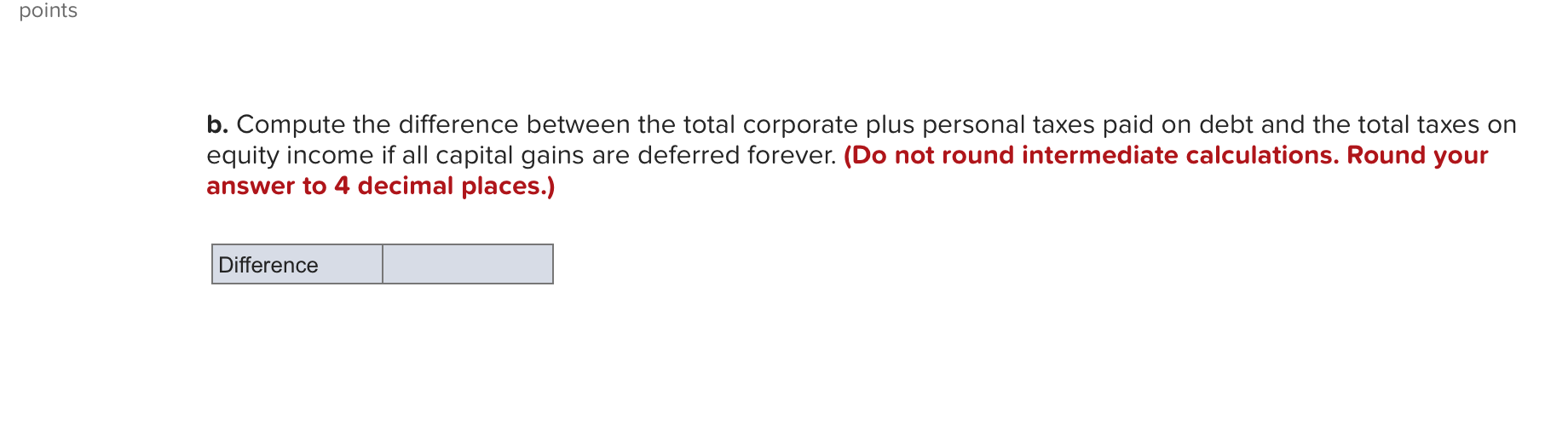

Return to question Suppose that Congress sets the top personal tax rate on interest and dividends at 39% and the top rate on realized capital gains at 18%. The corporate tax rate stays at 24%. Assume capital gains are half of equity income. 10 points a. Compute the difference between the total corporate plus personal taxes paid on debt and the total taxes on equity income if all capital gains are realized immediately. (Do not round intermediate calculations. Round your answer to 4 decimal places.) X Answer is complete but not entirely correct. Difference $ 0.4362 points b. Compute the difference between the total corporate plus personal taxes paid on debt and the total taxes on equity income if all capital gains are deferred forever. (Do not round intermediate calculations. Round your answer to 4 decimal places.) Difference Difference | Return to question Suppose that Congress sets the top personal tax rate on interest and dividends at 39% and the top rate on realized capital gains at 18%. The corporate tax rate stays at 24%. Assume capital gains are half of equity income. 10 points a. Compute the difference between the total corporate plus personal taxes paid on debt and the total taxes on equity income if all capital gains are realized immediately. (Do not round intermediate calculations. Round your answer to 4 decimal places.) X Answer is complete but not entirely correct. Difference $ 0.4362 points b. Compute the difference between the total corporate plus personal taxes paid on debt and the total taxes on equity income if all capital gains are deferred forever. (Do not round intermediate calculations. Round your answer to 4 decimal places.) Difference Difference |

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts