Question: Return to the Sport Hotel example in the class notes (pages T2-74), discussed in class (Monday November 6), and in Chapter 9 of the textbook

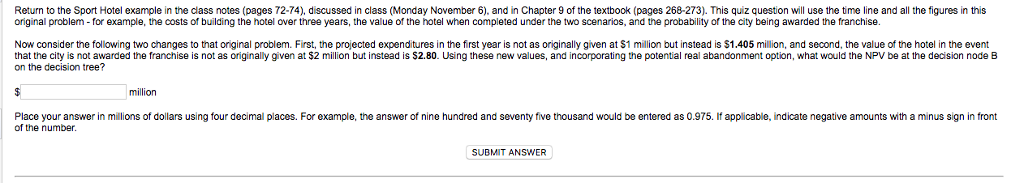

Return to the Sport Hotel example in the class notes (pages T2-74), discussed in class (Monday November 6), and in Chapter 9 of the textbook (pages 268-273). This quiz question will use the time line and all the figures in this original problem-for example, the costs of building the hotel over three years, the value of the hotel when completed under the two scenarios, and the probability of the city being awarded the franchise. Now consider the following two changes to that original problem. First, the projected expenditures in the first year is not as originally given at $1 million but instead is $1.405 million, and second, the value of the hotel in the event that the city is not awarded the franchise is not as originally given at $2 million but instead is $2.80. Using these new values, and incorporating the potential real abandonment option, what would the NPV be at the decision node B on the decision tree? million Place your answer in millions of dollars using four decimal places. For example, the answer of nine hundred and seventy five thousand would be entered as 0.975. If applicable, indicate negative amounts with a minus sign in front of the number SUBMIT ANSWER Return to the Sport Hotel example in the class notes (pages T2-74), discussed in class (Monday November 6), and in Chapter 9 of the textbook (pages 268-273). This quiz question will use the time line and all the figures in this original problem-for example, the costs of building the hotel over three years, the value of the hotel when completed under the two scenarios, and the probability of the city being awarded the franchise. Now consider the following two changes to that original problem. First, the projected expenditures in the first year is not as originally given at $1 million but instead is $1.405 million, and second, the value of the hotel in the event that the city is not awarded the franchise is not as originally given at $2 million but instead is $2.80. Using these new values, and incorporating the potential real abandonment option, what would the NPV be at the decision node B on the decision tree? million Place your answer in millions of dollars using four decimal places. For example, the answer of nine hundred and seventy five thousand would be entered as 0.975. If applicable, indicate negative amounts with a minus sign in front of the number SUBMIT

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts