Question: Return to the Sport Hotel example in the course notes, the lesson, and in Chapter 9. Suppose that everything stays the same as was presented

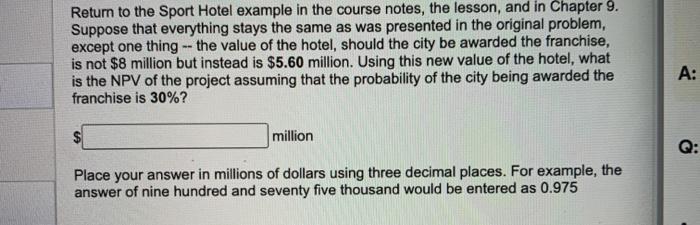

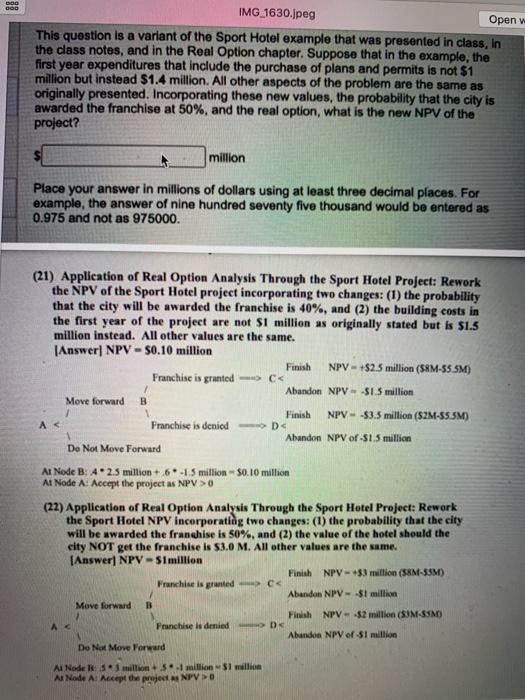

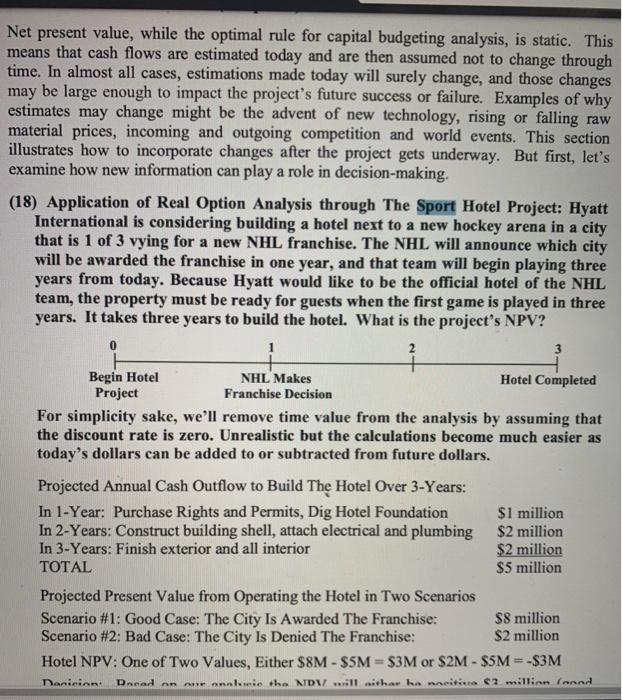

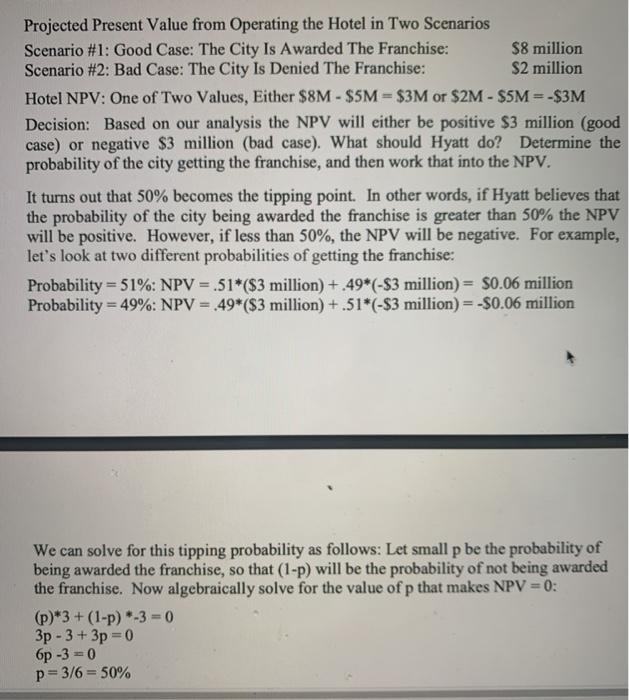

Return to the Sport Hotel example in the course notes, the lesson, and in Chapter 9. Suppose that everything stays the same as was presented in the original problem, except one thing -- the value of the hotel, should the city be awarded the franchise, is not $8 million but instead is $5.60 million. Using this new value of the hotel, what is the NPV of the project assuming that the probability of the city being awarded the franchise is 30%? A: million Place your answer in millions of dollars using three decimal places. For example, the answer of nine hundred and seventy five thousand would be entered as 0.975 bog DOD IMG_1630.jpeg Open This question is a variant of the Sport Hotel example that was presented in class, in the class notes, and in the Real Option chapter. Suppose that in the example, the first year expenditures that include the purchase of plans and permits is not $1 million but instead $1.4 million. All other aspects of the problem are the same as originally presented. Incorporating these new values, the probability that the city is awarded the franchise at 50%, and the real option, what is the new NPV of the project? million Place your answer in millions of dollars using at least three decimal places. For example, the answer of nine hundred seventy five thousand would be entered as 0.975 and not as 975000. (21) Application of Real Option Analysis Through the Sport Hotel Project: Rework the NPV of the Sport Hotel project incorporating two changes: (1) the probability that the city will be awarded the franchise is 40%, and (2) the building costs in the first year of the project are not $1 million as originally stated but is $1.5 million instead. All other values are the same. (Answer] NPV - 50.10 million Finish NPV - $2.5 million (58M-55 SM) Franchise is granted - C Abandon NPV-S1.5 million Move forward B Finish NPV - 53.5 million (S2M-S5.5M) D 0 (22) Application of Real Option Analysis Through the Sport Hotel Project: Rework the Sport Hotel NPV incorporating two changes: (1) the probability that the city will be awarded the franchise is 50%, and (2) the value of the hotel should the city NOT get the franchise is $3.0 M. All other values are the same. Answer| NPV - Simillion Finish NPV-53 million (58M-55M) Franchise is granted Abandon NPV - $1 million Move forward B Finish NPV - $2 million (SM-SIM Franchise is denied D Abandon NPV of si million Do Not Move Forward Al Node 3 million+ 5.1 million $1 million At Node A: Accept the project NPVO 0 Net present value, while the optimal rule for capital budgeting analysis, is static. This means that cash flows are estimated today and are then assumed not to change through time. In almost all cases, estimations made today will surely change, and those changes may be large enough to impact the project's future success or failure. Examples of why estimates may change might be the advent of new technology, rising or falling raw material prices, incoming and outgoing competition and world events. This section illustrates how to incorporate changes after the project gets underway. But first, let's examine how new information can play a role in decision-making. (18) Application of Real Option Analysis through The Sport Hotel Project: Hyatt International is considering building a hotel next to a new hockey arena in a city that is 1 of 3 vying for a new NHL franchise. The NHL will announce which city will be awarded the franchise in one year, and that team will begin playing three years from today. Because Hyatt would like to be the official hotel of the NHL team, the property must be ready for guests when the first game is played in three years. It takes three years to build the hotel. What is the project's NPV? 2 3 + Begin Hotel NHL Makes Hotel Completed Project Franchise Decision For simplicity sake, we'll remove time value from the analysis by assuming that the discount rate is zero. Unrealistic but the calculations become much easier as today's dollars can be added to or subtracted from future dollars. Projected Annual Cash Outflow to Build The Hotel Over 3-Years: In 1-Year: Purchase Rights and Permits, Dig Hotel Foundation $1 million In 2-Years: Construct building shell, attach electrical and plumbing $2 million In 3-Years: Finish exterior and all interior $2 million TOTAL $5 million Projected Present Value from Operating the Hotel in Two Scenarios Scenario #1: Good Case: The City Is Awarded The Franchise: $8 million Scenario #2: Bad Case: The City Is Denied The Franchise: $2 million Hotel NPV: One of Two Values, Either $8M - $5M = $3M or $2M - $5M = -$3M mannlin tha NID caill aitha ha naciteta 2 million and Tani in Darad an Projected Present Value from Operating the Hotel in Two Scenarios Scenario #1: Good Case: The City Is Awarded The Franchise: $8 million Scenario #2: Bad Case: The City Is Denied The Franchise: $2 million Hotel NPV: One of Two Values, Either $8M - $5M =$3M or $2M - $5M = -$3M Decision: Based on our analysis the NPV will either be positive $3 million (good case) or negative $3 million (bad case). What should Hyatt do? Determine the probability of the city getting the franchise, and then work that into the NPV. It turns out that 50% becomes the tipping point. In other words, if Hyatt believes that the probability of the city being awarded the franchise is greater than 50% the NPV will be positive. However, if less than 50%, the NPV will be negative. For example, let's look at two different probabilities of getting the franchise: Probability = 51%: NPV = 51*($3 million) +.49*(-$3 million) = $0.06 million Probability = 49%: NPV = .49*($3 million) + .51*(-$3 million) = -$0.06 million We can solve for this tipping probability as follows: Let small p be the probability of being awarded the franchise, so that (1-p) will be the probability of not being awarded the franchise. Now algebraically solve for the value of p that makes NPV = 0; (p)*3+ (1-P) -3=0 3p - 3 + 3p = 0 -3 = 0 p=3/6 = 50% Return to the Sport Hotel example in the course notes, the lesson, and in Chapter 9. Suppose that everything stays the same as was presented in the original problem, except one thing -- the value of the hotel, should the city be awarded the franchise, is not $8 million but instead is $5.60 million. Using this new value of the hotel, what is the NPV of the project assuming that the probability of the city being awarded the franchise is 30%? A: million Place your answer in millions of dollars using three decimal places. For example, the answer of nine hundred and seventy five thousand would be entered as 0.975 bog DOD IMG_1630.jpeg Open This question is a variant of the Sport Hotel example that was presented in class, in the class notes, and in the Real Option chapter. Suppose that in the example, the first year expenditures that include the purchase of plans and permits is not $1 million but instead $1.4 million. All other aspects of the problem are the same as originally presented. Incorporating these new values, the probability that the city is awarded the franchise at 50%, and the real option, what is the new NPV of the project? million Place your answer in millions of dollars using at least three decimal places. For example, the answer of nine hundred seventy five thousand would be entered as 0.975 and not as 975000. (21) Application of Real Option Analysis Through the Sport Hotel Project: Rework the NPV of the Sport Hotel project incorporating two changes: (1) the probability that the city will be awarded the franchise is 40%, and (2) the building costs in the first year of the project are not $1 million as originally stated but is $1.5 million instead. All other values are the same. (Answer] NPV - 50.10 million Finish NPV - $2.5 million (58M-55 SM) Franchise is granted - C Abandon NPV-S1.5 million Move forward B Finish NPV - 53.5 million (S2M-S5.5M) D 0 (22) Application of Real Option Analysis Through the Sport Hotel Project: Rework the Sport Hotel NPV incorporating two changes: (1) the probability that the city will be awarded the franchise is 50%, and (2) the value of the hotel should the city NOT get the franchise is $3.0 M. All other values are the same. Answer| NPV - Simillion Finish NPV-53 million (58M-55M) Franchise is granted Abandon NPV - $1 million Move forward B Finish NPV - $2 million (SM-SIM Franchise is denied D Abandon NPV of si million Do Not Move Forward Al Node 3 million+ 5.1 million $1 million At Node A: Accept the project NPVO 0 Net present value, while the optimal rule for capital budgeting analysis, is static. This means that cash flows are estimated today and are then assumed not to change through time. In almost all cases, estimations made today will surely change, and those changes may be large enough to impact the project's future success or failure. Examples of why estimates may change might be the advent of new technology, rising or falling raw material prices, incoming and outgoing competition and world events. This section illustrates how to incorporate changes after the project gets underway. But first, let's examine how new information can play a role in decision-making. (18) Application of Real Option Analysis through The Sport Hotel Project: Hyatt International is considering building a hotel next to a new hockey arena in a city that is 1 of 3 vying for a new NHL franchise. The NHL will announce which city will be awarded the franchise in one year, and that team will begin playing three years from today. Because Hyatt would like to be the official hotel of the NHL team, the property must be ready for guests when the first game is played in three years. It takes three years to build the hotel. What is the project's NPV? 2 3 + Begin Hotel NHL Makes Hotel Completed Project Franchise Decision For simplicity sake, we'll remove time value from the analysis by assuming that the discount rate is zero. Unrealistic but the calculations become much easier as today's dollars can be added to or subtracted from future dollars. Projected Annual Cash Outflow to Build The Hotel Over 3-Years: In 1-Year: Purchase Rights and Permits, Dig Hotel Foundation $1 million In 2-Years: Construct building shell, attach electrical and plumbing $2 million In 3-Years: Finish exterior and all interior $2 million TOTAL $5 million Projected Present Value from Operating the Hotel in Two Scenarios Scenario #1: Good Case: The City Is Awarded The Franchise: $8 million Scenario #2: Bad Case: The City Is Denied The Franchise: $2 million Hotel NPV: One of Two Values, Either $8M - $5M = $3M or $2M - $5M = -$3M mannlin tha NID caill aitha ha naciteta 2 million and Tani in Darad an Projected Present Value from Operating the Hotel in Two Scenarios Scenario #1: Good Case: The City Is Awarded The Franchise: $8 million Scenario #2: Bad Case: The City Is Denied The Franchise: $2 million Hotel NPV: One of Two Values, Either $8M - $5M =$3M or $2M - $5M = -$3M Decision: Based on our analysis the NPV will either be positive $3 million (good case) or negative $3 million (bad case). What should Hyatt do? Determine the probability of the city getting the franchise, and then work that into the NPV. It turns out that 50% becomes the tipping point. In other words, if Hyatt believes that the probability of the city being awarded the franchise is greater than 50% the NPV will be positive. However, if less than 50%, the NPV will be negative. For example, let's look at two different probabilities of getting the franchise: Probability = 51%: NPV = 51*($3 million) +.49*(-$3 million) = $0.06 million Probability = 49%: NPV = .49*($3 million) + .51*(-$3 million) = -$0.06 million We can solve for this tipping probability as follows: Let small p be the probability of being awarded the franchise, so that (1-p) will be the probability of not being awarded the franchise. Now algebraically solve for the value of p that makes NPV = 0; (p)*3+ (1-P) -3=0 3p - 3 + 3p = 0 -3 = 0 p=3/6 = 50%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts