Question: Revenue Recognition Project Please JUST SOLVE QUESTION 5 , the rest have been solved. In 2 0 2 4 , the Roadrunner Construction Company entered

Revenue Recognition Project

Please JUST SOLVE QUESTION the rest have been solved.

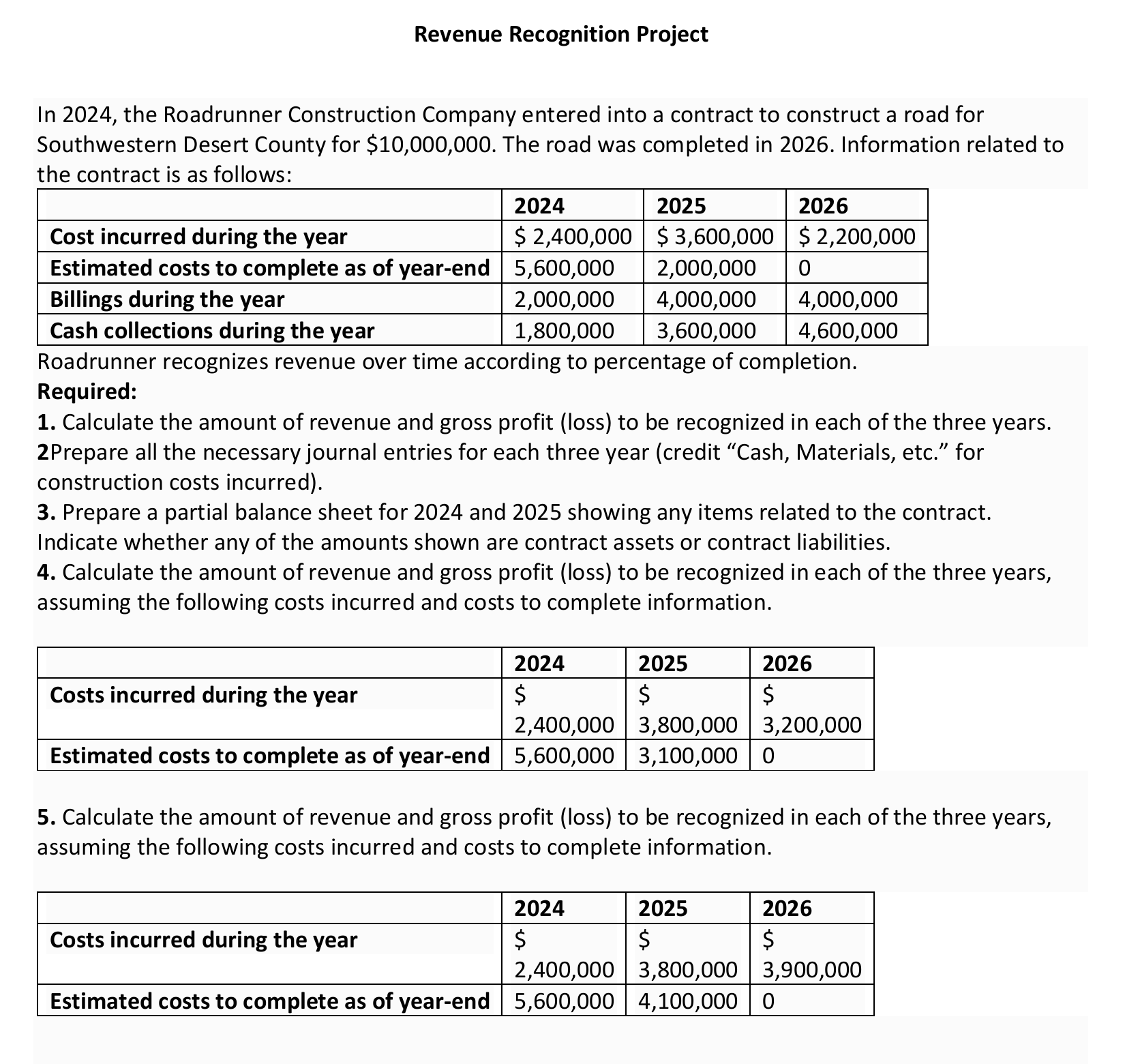

In the Roadrunner Construction Company entered into a contract to construct a road for

Southwestern Desert County for $ The road was completed in Information related to

the contract is as follows:

Roadrunner recognizes revenue over time according to percentage of completion.

Required:

Calculate the amount of revenue and gross profit loss to be recognized in each of the three years.

Prepare all the necessary journal entries for each three year credit "Cash, Materials, etc." for

construction costs incurred

Prepare a partial balance sheet for and showing any items related to the contract.

Indicate whether any of the amounts shown are contract assets or contract liabilities.

Calculate the amount of revenue and gross profit loss to be recognized in each of the three years,

assuming the following costs incurred and costs to complete information.

Calculate the amount of revenue and gross profit loss to be recognized in each of the three years,

assuming the following costs incurred and costs to complete information.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock