Question: Reverse Engineering with the PB Ratio Assume the following table provides summary data for Family Dollar, Inc. (in millions). Analysts will often use the observed

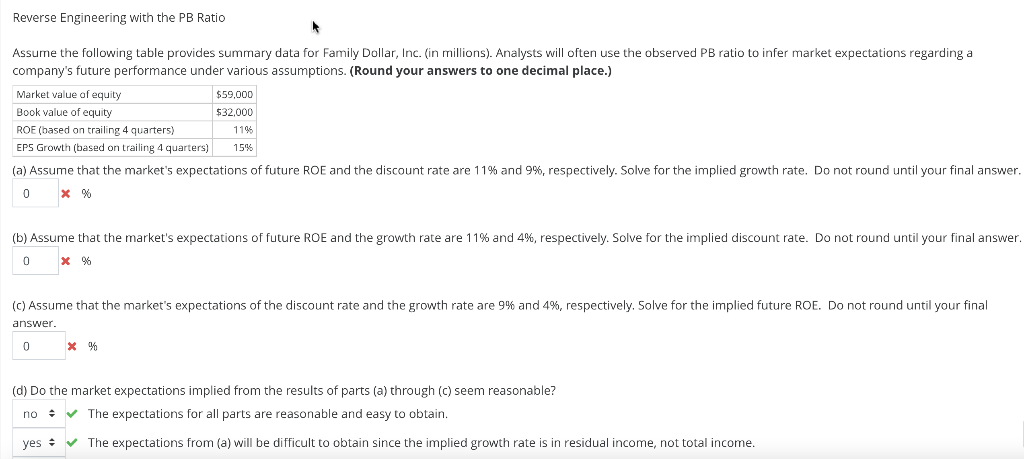

Reverse Engineering with the PB Ratio Assume the following table provides summary data for Family Dollar, Inc. (in millions). Analysts will often use the observed PB ratio to infer market expectations regarding a company's future performance under various assumptions. (Round your answers to one decimal place.) Market value of equity $59,000 Book value of equity $32,000 ROE (based on trailing 4 quarters) 11% EPS Growth (based on trailing 4 quarters) 15% (a) Assume that the market's expectations of future ROE and the discount rate are 11% and 9%, respectively. Solve for the implied growth rate. Do not round until your final answer. 0 (b) Assume that the market's expectations of future ROE and the growth rate are 11% and 4%, respectively. Solve for the implied discount rate. Do not round until your final answer. 0 X % (C) Assume that the market's expectations of the discount rate and the growth rate are 9% and 4%, respectively, Solve for the implied future ROE. Do not round until your final answer. 0 X % (d) Do the market expectations implied from the results of parts (a) through (C) seem reasonable? no The expectations for all parts are reasonable and easy to obtain. yes - The expectations from (a) will be difficult to obtain since the implied growth rate is in residual income, not total income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts