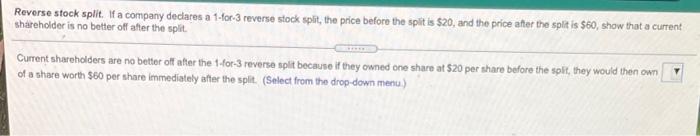

Question: Reverse stock split. If a company declares a 1-for-3 reverse stock split, the price before the split is $20, and the price after the split

Reverse stock split. If a company declares a 1-for-3 reverse stock split, the price before the split is $20, and the price after the split is $50, show that a current shareholder is no better off after the split. Current shareholders are no better off after the t-for-3 reverse split because if they cwned one share at $20 per share before the spilt, they would then own of a share worth $80 per share immediately after the split. (Select from the drop-down menu)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts