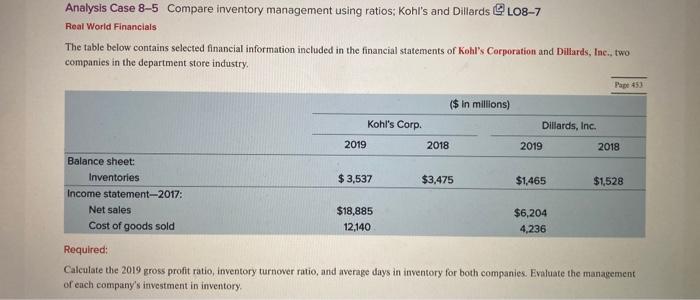

Question: Analysis Case 8-5 Compare inventory management using ratios; Kohl's and Dillards LO8-7 Real World Financials The table below contains selected financial information included in

Analysis Case 8-5 Compare inventory management using ratios; Kohl's and Dillards LO8-7 Real World Financials The table below contains selected financial information included in the financial statements of Kohl's Corporation and Dillards, Inc., two companies in the department store industry. Balance sheet: Inventories Income statement-2017: Net sales Cost of goods sold Required: ($ in millions) Kohl's Corp. 2019 2018 Page 453 Dillards, Inc. 2019 2018 $3,537 $3,475 $1,465 $1,528 $18,885 12,140 $6,204 4,236 Calculate the 2019 gross profit ratio, inventory turnover ratio, and average days in inventory for both companies. Evaluate the management i of each company's investment in inventory.

Step by Step Solution

There are 3 Steps involved in it

To analyze inventory management for Kohls well calculate the gross profit ratio inventory turnover ratio and average days in inventory for 2019 using ... View full answer

Get step-by-step solutions from verified subject matter experts