Question: Review Homework: Homework 9 (Chapter 10) Question 5, P 10-5 (similar to) HW Score: 75%, 15 of 20 points O Points: 0 of 1 Close

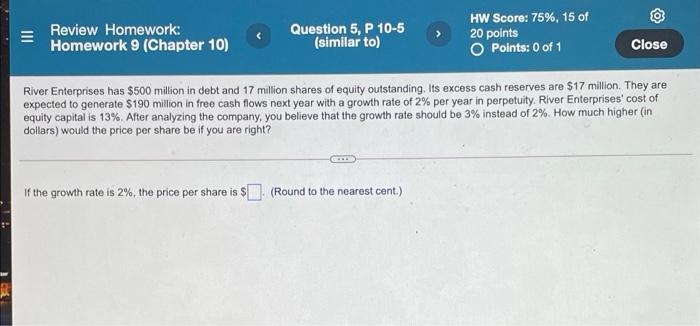

Review Homework: Homework 9 (Chapter 10) Question 5, P 10-5 (similar to) HW Score: 75%, 15 of 20 points O Points: 0 of 1 Close River Enterprises has 500 million in debt and 17 million shares of equity outstanding. Its excess cash reserves are $17 million. They are expected to generate $190 million in free cash flows next year with a growth rate of 2% per year in perpetuity, River Enterprises' cost of equity capital is 13%. After analyzing the company, you believe that the growth rate should be 3% instead of 2%. How much higher (in dollars) would the price per share be if you are right? if the growth rate is 2%, the price per share is $ (Round to the nearest cent.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts