Question: REVIEW QUESTION: [NBAA - B1, Question 7: intermediate level, May 2015] Rafiq Company, a medium - sized company specializing in the manufacture and distribution of

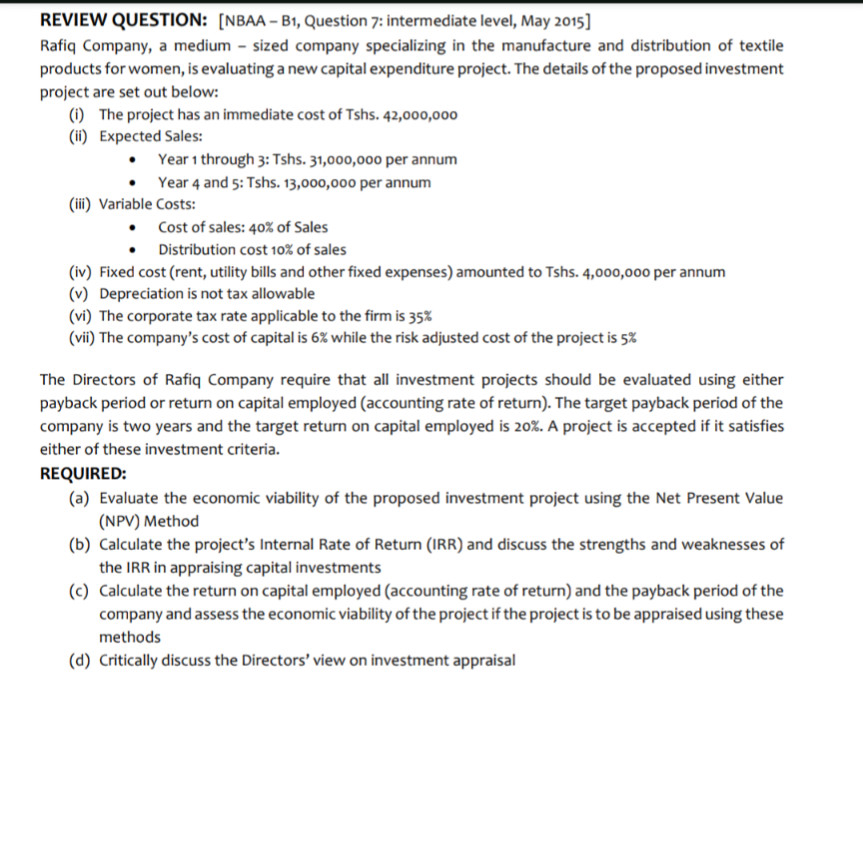

REVIEW QUESTION: [NBAA - B1, Question 7: intermediate level, May 2015] Rafiq Company, a medium - sized company specializing in the manufacture and distribution of textile products for women, is evaluating a new capital expenditure project. The details of the proposed investment project are set out below: (i) The project has an immediate cost of Tshs. 42,000,000 (ii) Expected Sales: ? Year 1 through 3: Tshs. 31,000,000 per annum ? Year 4 and 5: Tshs. 13,000,000 per annum (iii) Variable Costs: ? Cost of sales: 40% of Sales ? Distribution cost 10% of sales (iv) Fixed cost (rent, utility bills and other fixed expenses) amounted to Tshs. 4,000,000 per annum (v) Depreciation is not tax allowable (vi) The corporate tax rate applicable to the firm is 35% (vii) The company's cost of capital is 6% while the risk adjusted cost of the project is 5% The Directors of Rafiq Company require that all investment projects should be evaluated using either payback period or return on capital employed (accounting rate of return). The target payback period of the company is two years and the target return on capital employed is 20%. A project is accepted if it satisfies either of these investment criteria. REQUIRED: (a) Evaluate the economic viability of the proposed investment project using the Net Present Value (NPV) Method (b) Calculate the project's Internal Rate of Return (IRR) and discuss the strengths and weaknesses of the IRR in appraising capital investments (c) Calculate the return on capital employed (accounting rate of return) and the payback period of the company and assess the economic viability of the project if the project is to be appraised using these methods (d) Critically discuss the Directors' view on investment appraisal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts