Question: Review the assignment information provided below. Copy/paste your analysis in the textbox. If you have performed calculations in excel, paste your tables/results into the textbox

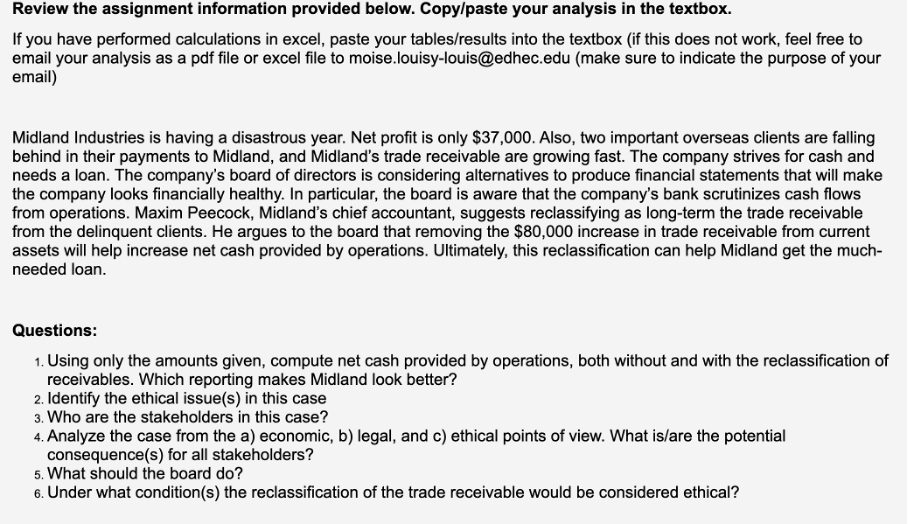

Review the assignment information provided below. Copy/paste your analysis in the textbox. If you have performed calculations in excel, paste your tables/results into the textbox (if this does not work, feel free to email your analysis as a pdf file or excel file to moise.louisy-louis@edhec.edu (make sure to indicate the purpose of your email) Midland Industries is having a disastrous year. Net profit is only $37,000. Also, two important overseas clients are falling behind in their payments to Midland, and Midland's trade receivable are growing fast. The company strives for cash and needs a loan. The company's board of directors is considering alternatives to produce financial statements that will make the company looks financially healthy. In particular, the board is aware that the company's bank scrutinizes cash flows from operations. Maxim Peecock, Midland's chief accountant, suggests reclassifying as long-term the trade receivable from the delinquent clients. He argues to the board that removing the $80,000 increase in trade receivable from current assets will help increase net cash provided by operations. Ultimately, this reclassification can help Midland get the muchneeded loan. Questions: 1. Using only the amounts given, compute net cash provided by operations, both without and with the reclassification of receivables. Which reporting makes Midland look better? 2. Identify the ethical issue(s) in this case 3. Who are the stakeholders in this case? 4. Analyze the case from the a) economic, b) legal, and c) ethical points of view. What is/are the potential consequence(s) for all stakeholders? 5. What should the board do? 6. Under what condition(s) the reclassification of the trade receivable would be considered ethical? Review the assignment information provided below. Copy/paste your analysis in the textbox. If you have performed calculations in excel, paste your tables/results into the textbox (if this does not work, feel free to email your analysis as a pdf file or excel file to moise.louisy-louis@edhec.edu (make sure to indicate the purpose of your email) Midland Industries is having a disastrous year. Net profit is only $37,000. Also, two important overseas clients are falling behind in their payments to Midland, and Midland's trade receivable are growing fast. The company strives for cash and needs a loan. The company's board of directors is considering alternatives to produce financial statements that will make the company looks financially healthy. In particular, the board is aware that the company's bank scrutinizes cash flows from operations. Maxim Peecock, Midland's chief accountant, suggests reclassifying as long-term the trade receivable from the delinquent clients. He argues to the board that removing the $80,000 increase in trade receivable from current assets will help increase net cash provided by operations. Ultimately, this reclassification can help Midland get the muchneeded loan. Questions: 1. Using only the amounts given, compute net cash provided by operations, both without and with the reclassification of receivables. Which reporting makes Midland look better? 2. Identify the ethical issue(s) in this case 3. Who are the stakeholders in this case? 4. Analyze the case from the a) economic, b) legal, and c) ethical points of view. What is/are the potential consequence(s) for all stakeholders? 5. What should the board do? 6. Under what condition(s) the reclassification of the trade receivable would be considered ethical

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts