Question: Review the cash flow statement, and comment on the basic sources and uses of cash for the year. Please clearly at any sources and changes.

Review the cash flow statement, and comment on the basic sources and uses of cash for the year. Please clearly at any sources and changes.

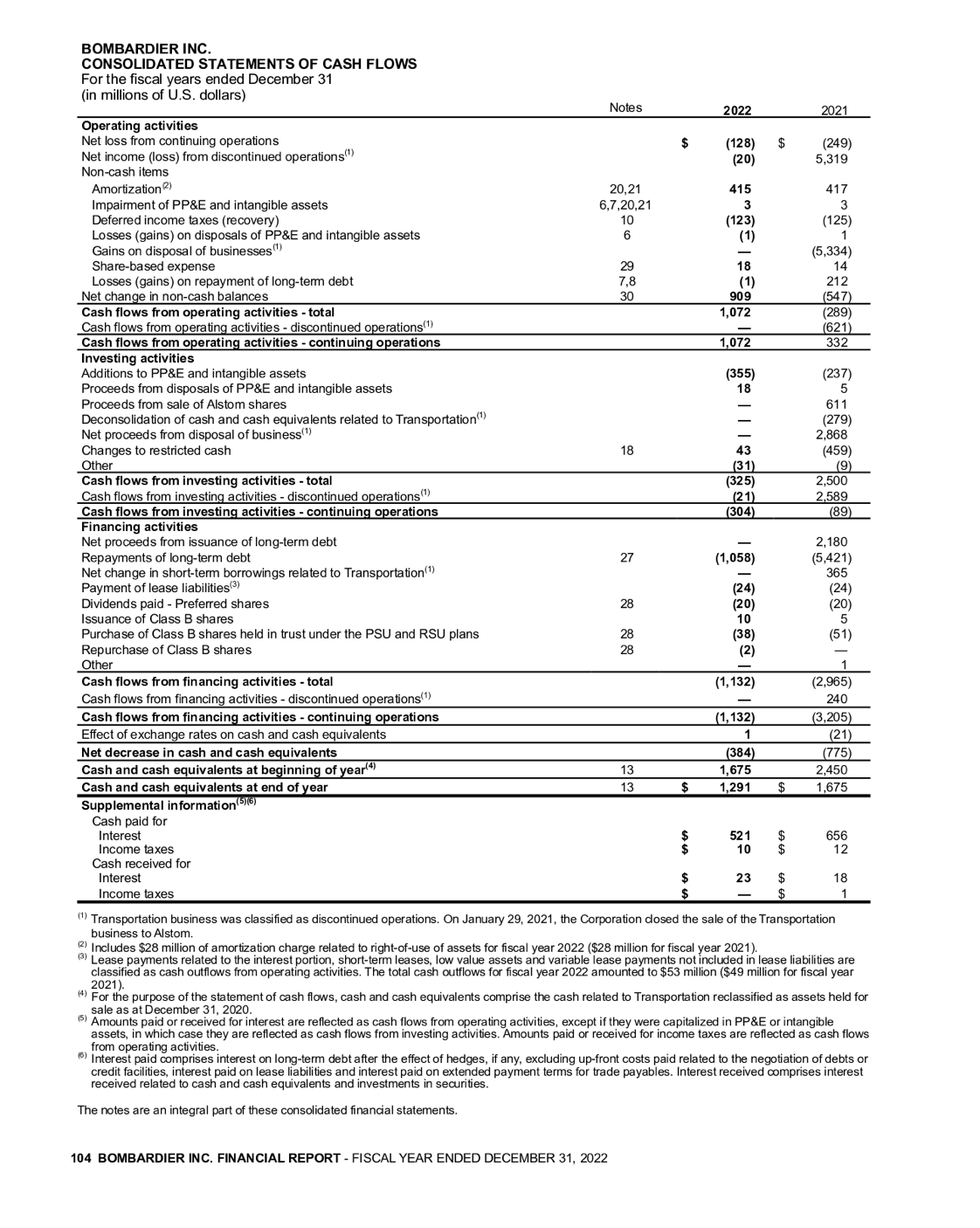

BOMBARDIER INC. CONSOLIDATED STATEMENTS OF CASH FLOWS For the fiscal years ended December 31 (in millions of U.S. dollars) Notes 2022 2021 \begin{tabular}{|c|c|c|c|c|c|} \hline \multicolumn{6}{|l|}{ Operating activities } \\ \hline Net loss from continuing operations & & $ & (128) & $ & (249) \\ \hline Net income (loss) from discontinued operations (1) & & & (20) & & 5,319 \\ \hline \multicolumn{6}{|l|}{ Non-cash items } \\ \hline Amortization (2) & 20,21 & & 415 & & 417 \\ \hline Impairment of PP\&E and intangible assets & 6,7,20,21 & & 3 & & 3 \\ \hline Deferred income taxes (recovery) & 10 & & (123) & & (125) \\ \hline Losses (gains) on disposals of PP\&E and intangible assets & 6 & & (1) & & 1 \\ \hline Gains on disposal of businesses (1) & & & - & & (5,334) \\ \hline Share-based expense & 29 & & 18 & & 14 \\ \hline Losses (gains) on repayment of long-term debt & 7,8 & & (1) & & 212 \\ \hline Net change in non-cash balances & 30 & & 909 & & (547) \\ \hline Cash flows from operating activities - total & & & 1,072 & & (289) \\ \hline Cash flows from operating activities - discontinued operations (1) & & & - & & (621) \\ \hline Cash flows from operating activities - continuing operations & & & 1,072 & & 332 \\ \hline \multicolumn{6}{|l|}{ Investing activities } \\ \hline Additions to PP\&E and intangible assets & & & (355) & & (237) \\ \hline Proceeds from disposals of PP\&E and intangible assets & & & 18 & & 5 \\ \hline Proceeds from sale of Alstom shares & & & - & & 611 \\ \hline Deconsolidation of cash and cash equivalents related to Transportation (1) & & & - & & (279) \\ \hline Net proceeds from disposal of business (1) & & & - & & 2,868 \\ \hline Changes to restricted cash & 18 & & 43 & & (459) \\ \hline Other & & & (31) & & (9) \\ \hline Cash flows from investing activities - total & & & (325) & & 2,500 \\ \hline Cash flows from investing activities - discontinued operations (1) & & & (21) & & 2,589 \\ \hline Cash flows from investing activities - continuing operations & & & (304) & & (89) \\ \hline \multicolumn{6}{|l|}{ Financing activities } \\ \hline Net proceeds from issuance of long-term debt & & & - & & 2,180 \\ \hline Repayments of long-term debt & 27 & & (1,058) & & (5,421) \\ \hline Net change in short-term borrowings related to Transportation (1) & & & - & & 365 \\ \hline Payment of lease liabilities (3) & & & (24) & & (24) \\ \hline Dividends paid - Preferred shares & 28 & & (20) & & (20) \\ \hline Issuance of Class B shares & & & 10 & & 5 \\ \hline Purchase of Class B shares held in trust under the PSU and RSU plans & 28 & & (38) & & (51) \\ \hline Repurchase of Class B shares & 28 & & (2) & & - \\ \hline Other & & & & & 1 \\ \hline Cash flows from financing activities - total & & & (1,132) & & (2,965) \\ \hline Cash flows from financing activities - discontinued operations (1) & & & - & & 240 \\ \hline Cash flows from financing activities - continuing operations & & & (1,132) & & (3,205) \\ \hline Effect of exchange rates on cash and cash equivalents & & & 1 & & (21) \\ \hline Net decrease in cash and cash equivalents & & & (384) & & (775) \\ \hline Cash and cash equivalents at beginning of year (4) & 13 & & 1,675 & & 2,450 \\ \hline Cash and cash equivalents at end of year & 13 & $ & 1,291 & $ & 1,675 \\ \hline \multicolumn{6}{|l|}{ Supplemental in formation (5)(6)} \\ \hline \multicolumn{6}{|l|}{ Cash paid for } \\ \hline Interest & & $ & 521 & $ & 656 \\ \hline Income taxes & & $ & 10 & $ & 12 \\ \hline \multicolumn{6}{|l|}{ Cash received for } \\ \hline Interest & & $ & 23 & $ & 18 \\ \hline Income taxes & & $ & - & $ & 1 \\ \hline \end{tabular} (1) Transportation business was classified as discontinued operations. On January 29, 2021, the Corporation closed the sale of the Transportation business to Alstom. (2) Includes $28 million of amortization charge related to right-of-use of assets for fiscal year 2022 (\$28 million for fiscal year 2021). (3) Lease payments related to the interest portion, short-term leases, low value assets and variable lease payments not included in lease liabilities are classified as cash outflows from operating activities. The total cash outflows for fiscal year 2022 amounted to $53 million ( $49 million for fiscal year 2021). (4) For the purpose of the statement of cash flows, cash and cash equivalents comprise the cash related to Transportation reclassified as assets held for sale as at December 31, 2020. (5) Amounts paid or received for interest are reflected as cash flows from operating activities, except if they were capitalized in PP\&E or intangible assets, in which case they are reflected as cash flows from investing activities. Amounts paid or received for income taxes are reflected as cash flows from operating activities. (6) Interest paid comprises interest on long-term debt after the effect of hedges, if any, excluding up-front costs paid related to the negotiation of debts or credit facilities, interest paid on lease liabilities and interest paid on extended payment terms for trade payables. Interest received mprises interest received related to cash and cash equivalents and investments in securities. The notes are an integral part of these consolidated financial statements. 104 BOMBARDIER INC. FINANCIAL REPORT - FISCAL YEAR ENDED DECEMBER 31, 2022

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts