Question: Review the example about Umbrella Inc and Sunscreen Inc. Both companies have 10% return & 45% volatility and are perfectly negatively correlated. a.) Assume

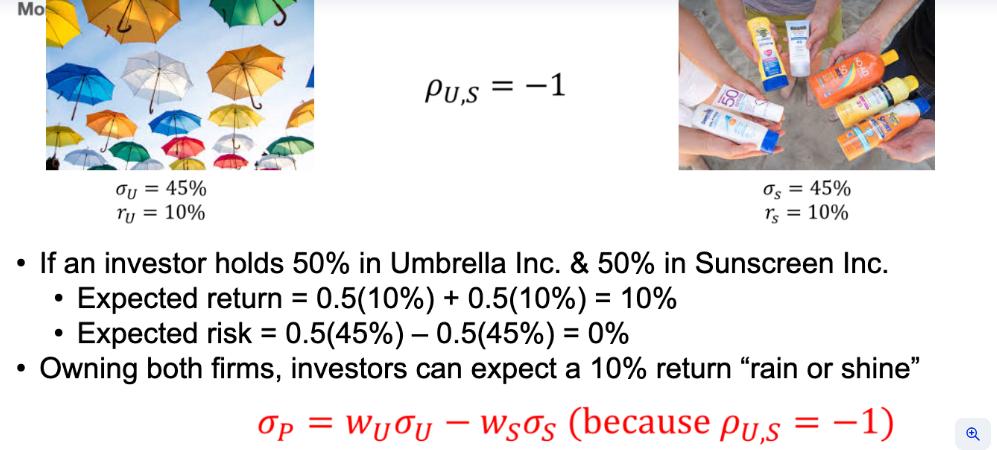

Review the example about Umbrella Inc and Sunscreen Inc. Both companies have 10% return & 45% volatility and are perfectly negatively correlated.

a.) Assume you sell 25% of Umbrella Inc and buy Sunscreen Inc. such that you hold 75% Umbrella and 25% Sunscreen. What is the return and risk of that portfolio?

b.) Assume you sell 50% of Umbrella and buy Sunscreen such that you now hold 50% of each stock. What is the return and risk of that portfolio?

c.)The risk of each stock (Sunscreen or Umbrella) by ITSELF is the its standard deviation, which is this example is 45%. What is the measure of each stock's contribution to risk when held together in a portfolio? (Hint: the risk of a portfolio comprising equal proportions of Sunscreen & Umbrella is zero. Yet the risk of each stock by itself is 45%).

Mo ou = 45% Tu = 10% If an investor holds 50% in Umbrella Inc. & 50% in Sunscreen Inc. Expected return = 0.5(10%) + 0.5(10%) = 10% Expected risk = 0.5(45%) - 0.5(45%) = 0% Owning both firms, investors can expect a 10% return "rain or shine" Op = Wuou - Wsos (because pus = 1) PU,S = -1 Os = 45% rs = 10% Q

Step by Step Solution

3.36 Rating (162 Votes )

There are 3 Steps involved in it

Portfolio Return It refers to the losses or gains realized by a portfolio of investments containing several types of investments The portfolio return ... View full answer

Get step-by-step solutions from verified subject matter experts