Question: review the problem and discuss the differences caused by using IFRS as compared to U.S. GAAP. Explain which presentation you think is more informative to

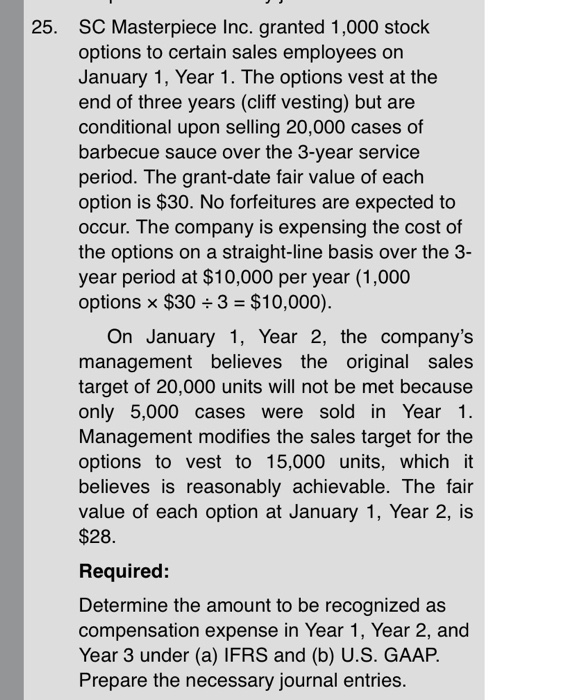

25. SC Masterpiece Inc. granted 1,000 stock options to certain sales employees on January 1, Year 1. The options vest at the end of three years (cliff vesting) but are conditional upon selling 20,000 cases of barbecue sauce over the 3-year service period. The grant-date fair value of each option is $30. No forfeitures are expected to occur. The company is expensing the cost of the options on a straight-line basis over the 3- year period at $10,000 per year (1,000 options x $30 = 3 = $10,000). On January 1, Year 2, the company's management believes the original sales target of 20,000 units will not be met because only 5,000 cases were sold in Year 1. Management modifies the sales target for the options to vest to 15,000 units, which it believes is reasonably achievable. The fair value of each option at January 1, Year 2, is $28. Required: Determine the amount to be recognized as compensation expense in Year 1, Year 2, and Year 3 under (a) IFRS and (b) U.S. GAAP. Prepare the necessary journal entries

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts