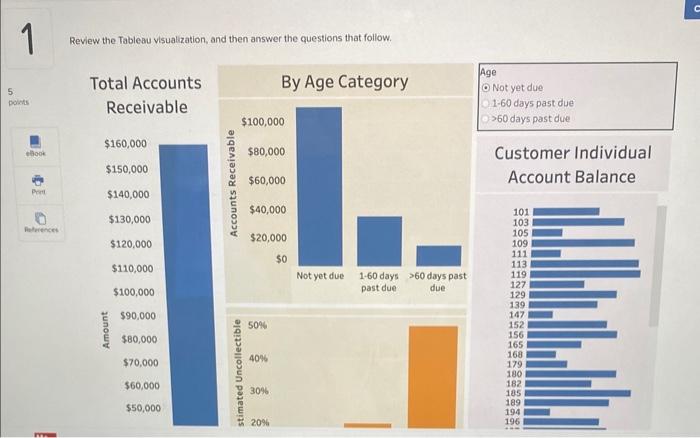

Question: Review the Tableau visualization, and then answer the questions that follow. je Not yet due 1.60 days past due >60 days past due Customer Individual

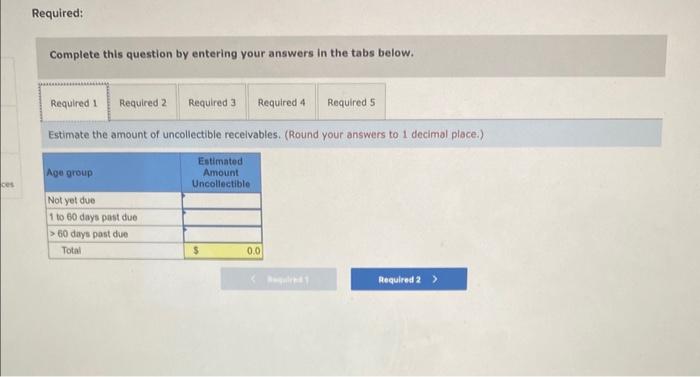

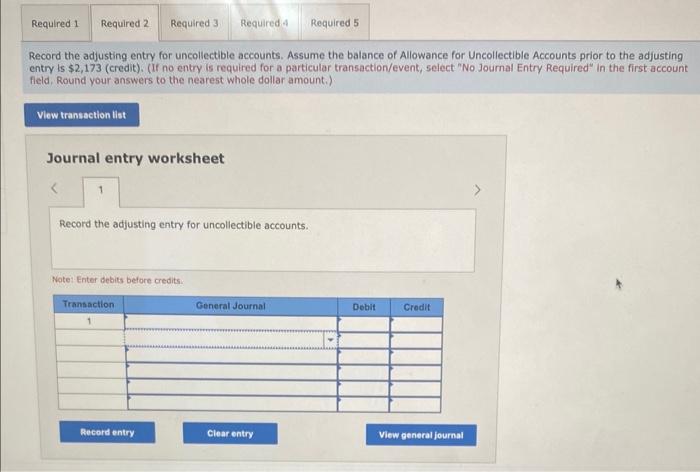

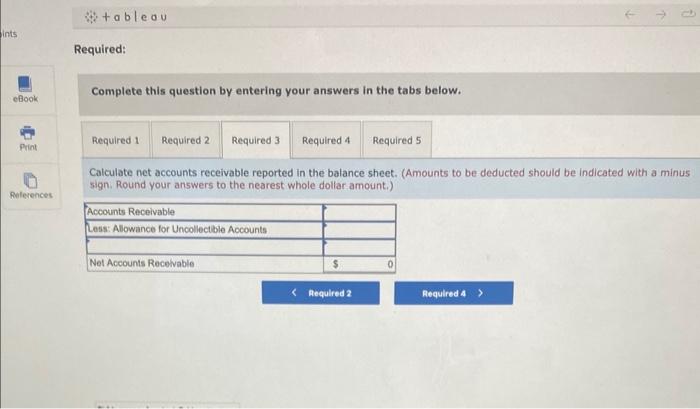

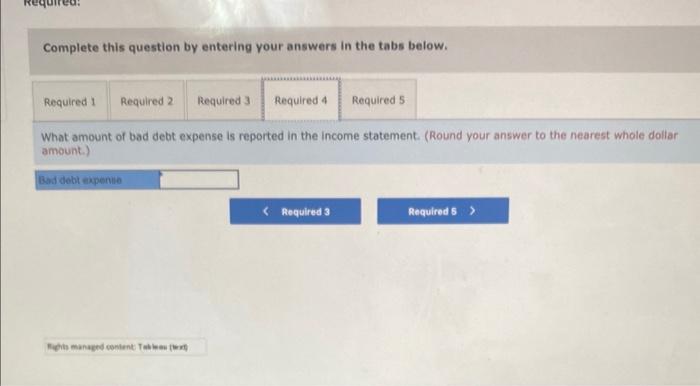

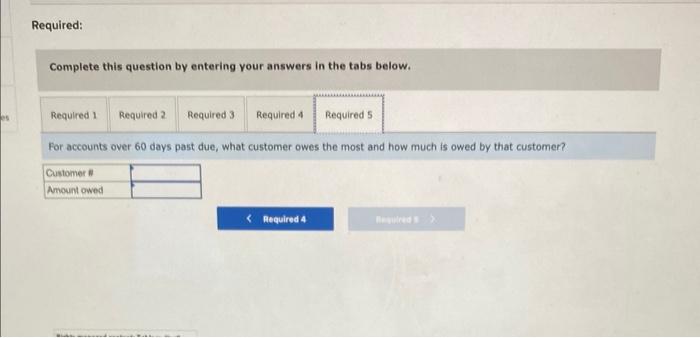

Review the Tableau visualization, and then answer the questions that follow. je Not yet due 1.60 days past due >60 days past due Customer Individual Account Balance Required: Complete this question by entering your answers in the tabs below. Required: Complete this question by entering your answers in the tabs below. Estimate the amount of uncollectible recelvables. (Round your answers to 1 decimal place.) Record the adjusting entry for uncollectible accounts. Assume the balance of Allowance for Uncollectible Accounts prior to the adjusting entry is $2,173 (credit). (If no entry is required for a particular transaction/event, select "No. Joumal Entry Required" in the first account field. Round your answers to the nearest whole dollar amount.) Journal entry worksheet Record the adjusting entry for uncollectible accounts. Notei Enter debits before credits: Required: Complete this question by entering your answers in the tabs below. Calculate net accounts receivable reported in the balance sheet. (Amounts to be deducted should be indicated with a minus sign. Round your answers to the nearest whole dollar amount.) Complete this question by entering your answers in the tabs below. What amount of bad debt expense is reported in the income statement. (Round your answer to the nearest whole dollar amount.) Required: Complete this question by entering your answers in the tabs below. For accounts over 60 days past due, what customer owes the most and how much is owed by that customer? Review the Tableau visualization, and then answer the questions that follow. je Not yet due 1.60 days past due >60 days past due Customer Individual Account Balance Required: Complete this question by entering your answers in the tabs below. Required: Complete this question by entering your answers in the tabs below. Estimate the amount of uncollectible recelvables. (Round your answers to 1 decimal place.) Record the adjusting entry for uncollectible accounts. Assume the balance of Allowance for Uncollectible Accounts prior to the adjusting entry is $2,173 (credit). (If no entry is required for a particular transaction/event, select "No. Joumal Entry Required" in the first account field. Round your answers to the nearest whole dollar amount.) Journal entry worksheet Record the adjusting entry for uncollectible accounts. Notei Enter debits before credits: Required: Complete this question by entering your answers in the tabs below. Calculate net accounts receivable reported in the balance sheet. (Amounts to be deducted should be indicated with a minus sign. Round your answers to the nearest whole dollar amount.) Complete this question by entering your answers in the tabs below. What amount of bad debt expense is reported in the income statement. (Round your answer to the nearest whole dollar amount.) Required: Complete this question by entering your answers in the tabs below. For accounts over 60 days past due, what customer owes the most and how much is owed by that customer

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts