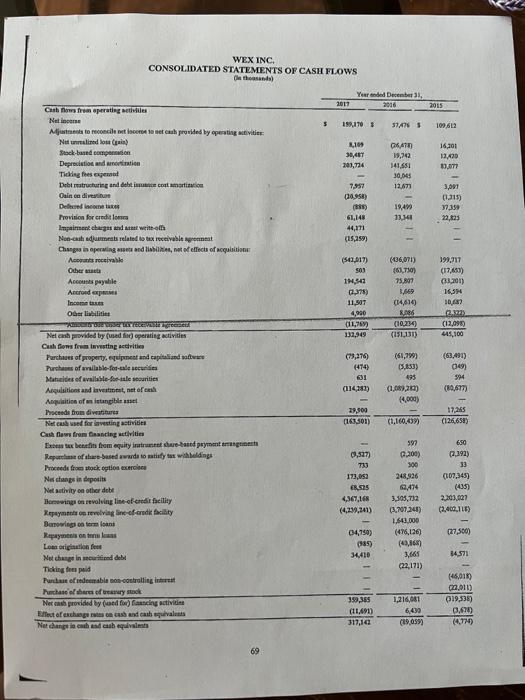

Question: review these three statements. make four observations about each one WEX INC. CONSOLIDATED STATEMENTS OF CASH FLOWS lehed) Yer December, 2016 2017 2015 5 199,170

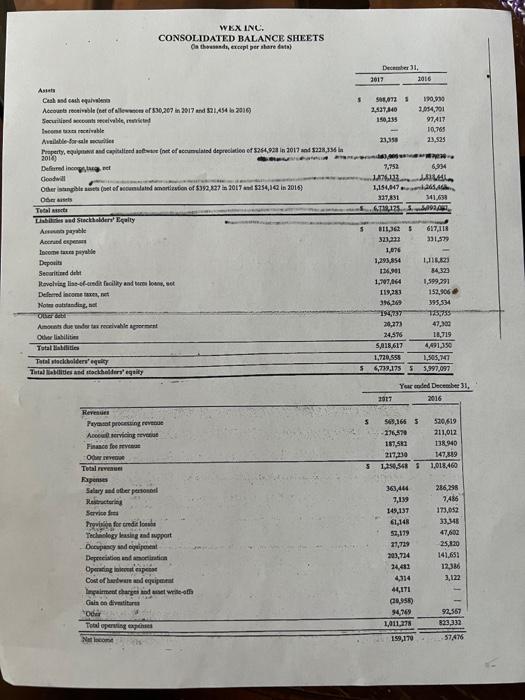

WEX INC. CONSOLIDATED STATEMENTS OF CASH FLOWS lehed) Yer December, 2016 2017 2015 5 199,170 57/765 109.612 2,10 30,487 201,724 16,301 13.400 647) 19,742 141,651 30,045 12,872 7557 (1095) s) 61,145 4,171 (15,459) 3,091 (121) 37.359 22,23 19,499 13,141 199,17 (17,453) (541,017) 500 11.50 012378) 11.07 (06.071) 26,701 75.807 3,649 (14,630 186 (10,2340 (151,131) 4,900 (11,789) 132.949 16,594 30. 212) (12,998) 445.100 Cuth from proting while Nation Adjustments to reconcile troch provided by operating svities: Not untilon) Stock-based companion Depreciation and in Tidig fees peat Debt rutructuring and debt contamination Gain di De Provision for credito Impain charges and it with No-cash adjuments related to tax receivable prenat Change in operating and Hibe, netfelfech of acquisition Accrocia Other Accounts payabile Acrop Income Olibilities Nel cast provided by used for operating activities Cash flows from westing activities Purchases of property, equipment and capitalienda Purchases of wilable for a secure Mads of ble fuele wurities Arquitions and latest, of Aqui ofan stangible Thoceeds from divers Net wed for lavesting activities Cash flow from an activities Ex axbet from equity in weed payment Repurchase of abused award to satisfy wildings Proceeds from stock optios exercice Nescansin deposits Net activity on other debe Hongos revolving line oferit facility Zephorevingne fordi facility Samoorings to form loans Keytist Logistiefel Natch in mod debel Ticking fees paid Punime of redemable non controlling Phase there any stock Netcash provided by and forcing activiti Effect of exchangers and cash values Net dangtia cathed ca equivalsts (79,276) (474) O (114281) (61,799) 05.053) 193 0.00926 4.000) (63,491) (349) 594 (89,677) 29,900 (163.301) 17.265 (126,651) (1,160.09 0.527) 733 173,052 ER SES 4,367,168 (4,249,141) 597 0.200) 300 24,926 GAN 3,305,732 (3.707,241) 1.543,000 (476,126) (49,80 3,661 (22,171) 650 0.192) 33 (107,345) (435) 2203.027 (2,400.115) 27,500) 014,750) (185) 34,410 84571 359,365 (11.491 317,10 1,216,061 6430 (19.0991 (46,011) 22.0112 19,538) 0.870) (4.720) WEX INC. CONSOLIDATED BALANCE SHEETS Ca thousand, excepl per shared December 11, 2017 2016 5 in 1 2,437,840 150,135 190.000 1,054,701 97A17 10.765 23.525 20.358 6994 MO 7,753 147613... 1,154,047. 327,831 AT1175 141633 5 Asics Cash and the Accounts receivable feet of allows 590,207 en 2017 and 521.4546.2010 Serwilised me conhecelulle, Income cable Aversale cu Peperty, gent and capitalled as a free of cranulated depreciation of 264.93 in 2017 and 322,394 2018) Defending Cew Other style of dated martiation of $52.327 in 2017 254,1 in 2016 Oder is TE Lisad Stecher Equity Are yake Aspen Encome tax payable Deposit Second detet Revching line-of- adi fucilly and so Defined conexe, Not standing, DO As due to tapetable agreement Otvoriti Total Total desequity Tutal Antecedensity 617,118 331,379 811,3625 323222 1,076 1,295,854 114,901 1,707,464 119,283 34,149 194737 28,273 24,576 5,818,617 1,720.555 4,739,175 5 11133 84 323 1,599,291 152,906 395,534 735735 47.100 14,719 4,491,350 1,505,747 5,997.097 Yearded December 31, 2016 2017 548,165 -216520 181,521 217,230 1.250,5483 530,619 211,012 138 940 147,819 1,018,460 5 Rere Peyaset processing revue Arvioing Finance for OVER TOP perise Salary and alter personal Reuters Services Pogle for credidlo Technology lasing and support Ocupancy Deprecated into Operating biri espect Cost of hard equip Impairment charged with Galon dintre oder Totalpring the 363,444 7,139 145,137 1,148 52,119 11,719 203,734 24,411 286,298 9:46 173,052 33,241 47,600 25.120 141,651 12,36 2,122 44,171 (0,958) $4,709 1,011.278 92,567 823,332 199,170 57475

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts