Question: Review View Help E3 214 E DEI AaBbCcL AaBBC AaBbCI AaBbCd AaBbCcD Emphasis 1 Heading 1 1 Normal Strong Subtitle Paragraph Styles Inputs for WACC

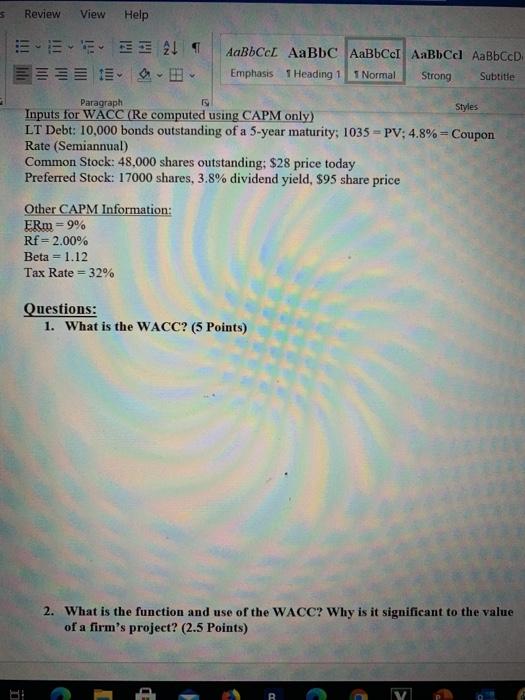

Review View Help E3 214 E DEI AaBbCcL AaBBC AaBbCI AaBbCd AaBbCcD Emphasis 1 Heading 1 1 Normal Strong Subtitle Paragraph Styles Inputs for WACC (Re computed using CAPM only) LT Debt: 10,000 bonds outstanding of a 5-year maturity: 1035 = PV: 4.8% = Coupon Rate (Semiannual) Common Stock: 48,000 shares outstanding: $28 price today Preferred Stock: 17000 shares, 3.8% dividend yield, $95 share price Other CAPM Information: ERm = 9% Rf=2.00% Beta = 1.12 Tax Rate = 32% Questions: 1. What is the WACC? (5 Points) 2. What is the function and use of the WACC? Why is it significant to the value of a firm's project? (2.5 Points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts