Question: ReviewView AaBbCcl AaBbCcl AaBbCel AaBbCel AaBbCel AaBbCel AaBbC ??? | : . |??. | | Emphasis 'Heading 1 1 Heading 211Normal! Strong Subtitle ritle Paragrapth

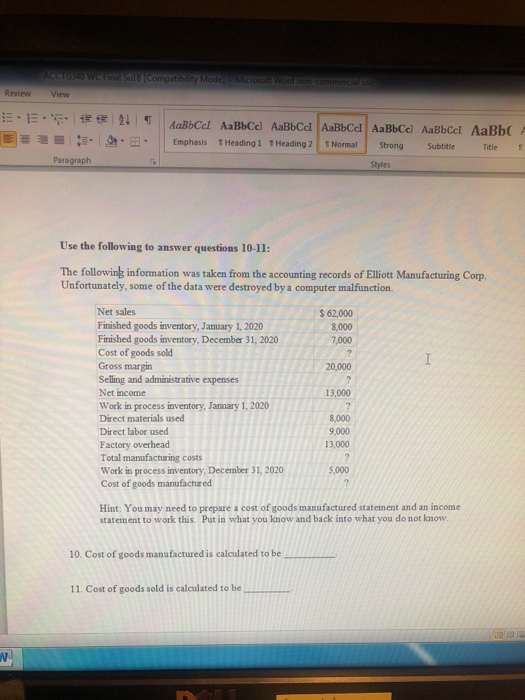

ReviewView AaBbCcl AaBbCcl AaBbCel AaBbCel AaBbCel AaBbCel AaBbC ??? | : . |??. | | Emphasis 'Heading 1 1 Heading 211Normal! Strong Subtitle ritle Paragrapth Styles Use the following to answer questions 10-11 The following information was taken from the accounting records of Elliott Manufacturing Corp Unfortunately, some of the data were destroyed by a computer malfunction. Net sales Finished goods inventory, Jamuary 1, 2020 Finished goods inventory, December 31, 2020 Cost of goods sold Gross margin Selling and administrative expenses Net income Work in process inventory, January 1, 2020 Direct materials used Direct labor used Factory overhead Total manufacturing costs Work in process inventory, December 31, 2020 Cost of goods manufactured $ 62,000 8,000 7,000 20,000 13,000 8,000 9,000 13,000 5,000 Hint: You may need to prepare a cost of goods manufactured statement and an income statement to work this. Put in what you know and back into what you do not know 10. Cost of goods manufactured is calculated to be 11. Cost of goods sold is calculated to be

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts