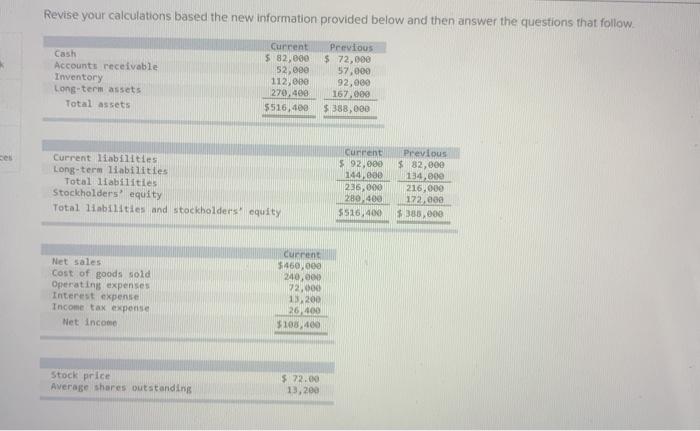

Question: Revise your calculations based the new information provided below and then answer the questions that follow Cash Accounts receivable Inventory Long term assets Total assets

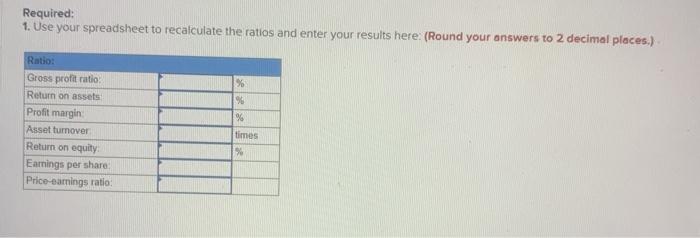

Revise your calculations based the new information provided below and then answer the questions that follow Cash Accounts receivable Inventory Long term assets Total assets Current 5 82,000 52,00 112,000 270,400 5516,400 Previous $ 72,000 57.000 92,000 167.000 $388,000 Current liabilities Long-term liabilities Total liabilities Stockholders' equity Total liabilities and stockholders equity current $ 92,000 144,000 236.000 280 400 $516,400 Previous $ 82,000 134,000 216.000 172,000 $ 380,000 Net sales Cost of goods sold Operating expenses Interest expense Income tax expense Net Income current $450,000 240,000 12,000 13.200 26,400 5108) 400 Stock price Average shares outstanding $ 72.00 13,200 Required: 1. Use your spreadsheet to recalculate the ratios and enter your results here: (Round your answers to 2 decimal places.) % 96 96 Ratio: Gross profit ratio Return on assets Profit margin Asset turnover Return on equity Earnings per share Price-samnings ratio: times 3. Asset turnover measures sales volume in relation to the investment in assets and is a good Indication of how well a company is utilizing its 3 The gross prolit ratio measure how much of each sales dollar a company ears as profit after paying for its cost of sales, and will tend to as competition and other market forces impact a company's performance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts