Question: Revise your calculations based the new information provided below and then answer the questions that follow. A company lends $420,000 to an owner and accepts

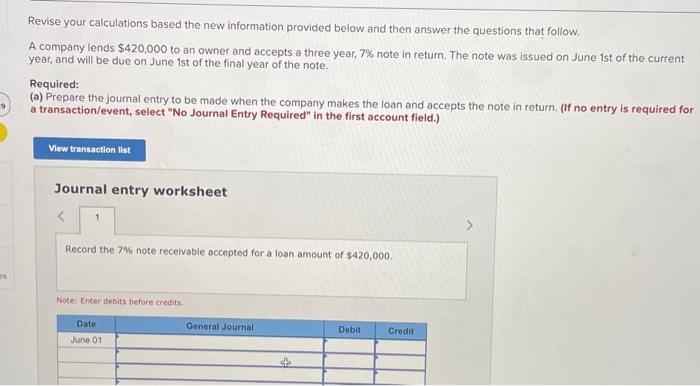

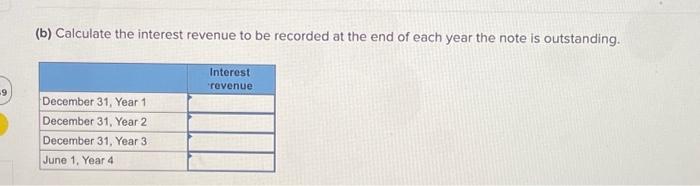

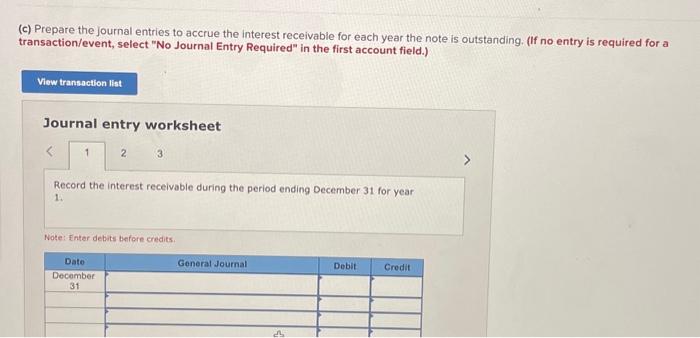

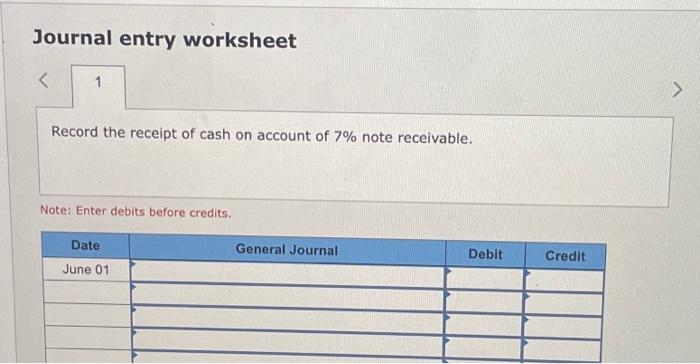

Revise your calculations based the new information provided below and then answer the questions that follow. A company lends $420,000 to an owner and accepts a three year, 7% note in return. The note was issued on June ist of the current year, and will be due on June ist of the final year of the note. Required: (a) Prepare the journal entry to be made when the company makes the loan and accepts the note in return. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Record the 7% note receivable occepted for a loan amount of $420,000. Notei Enter debits before credits: (b) Calculate the interest revenue to be recorded at the end of each year the note is outstanding. (c) Prepare the journal entries to accrue the interest receivable for each year the note is outstanding. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Record the interest receivable during the period ending December 31 for year 1. Note: Enter debits thefore credits. Journal entry worksheet Record the receipt of cash on account of 7% note receivable. Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts