Question: Question 1 White Pink Limited, a manufacturing company, is considering producing a new product, which will require an investment of RM600,000 in new manufacturing

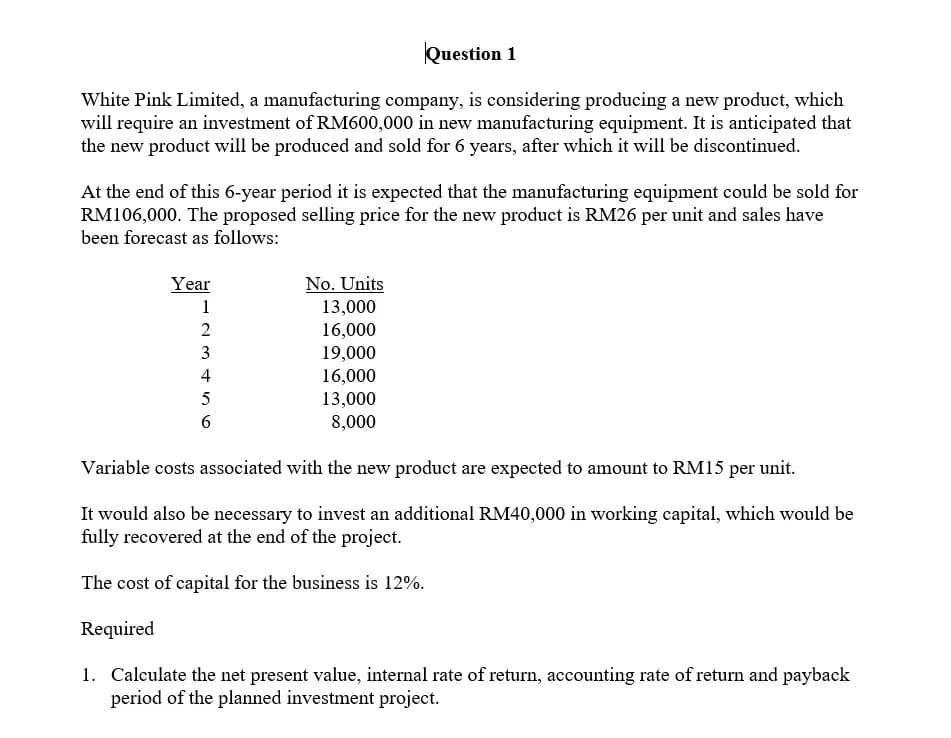

Question 1 White Pink Limited, a manufacturing company, is considering producing a new product, which will require an investment of RM600,000 in new manufacturing equipment. It is anticipated that the new product will be produced and sold for 6 years, after which it will be discontinued. At the end of this 6-year period it is expected that the manufacturing equipment could be sold for RM106,000. The proposed selling price for the new product is RM26 per unit and sales have been forecast as follows: Year 1 2 3 4 456 6 No. Units 13,000 16,000 19,000 16,000 13,000 8,000 Variable costs associated with the new product are expected to amount to RM15 per unit. It would also be necessary to invest an additional RM40,000 in working capital, which would be fully recovered at the end of the project. The cost of capital for the business is 12%. Required 1. Calculate the net present value, internal rate of return, accounting rate of return and payback period of the planned investment project.

Step by Step Solution

3.44 Rating (151 Votes )

There are 3 Steps involved in it

NET PRESENT VALUE Cost of capital 12 NPV PV of Cash inflow PV of cash outflow Cash outflow of y... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (2 attachments)

635d8bff11dbd_176626.pdf

180 KBs PDF File

635d8bff11dbd_176626.docx

120 KBs Word File