Question: Revision question. please answer a) b) c) A private company, FreshBeans Inc, specializes in the processing (hulling and polishing) of coffee beans. The company would

Revision question. please answer a) b) c)

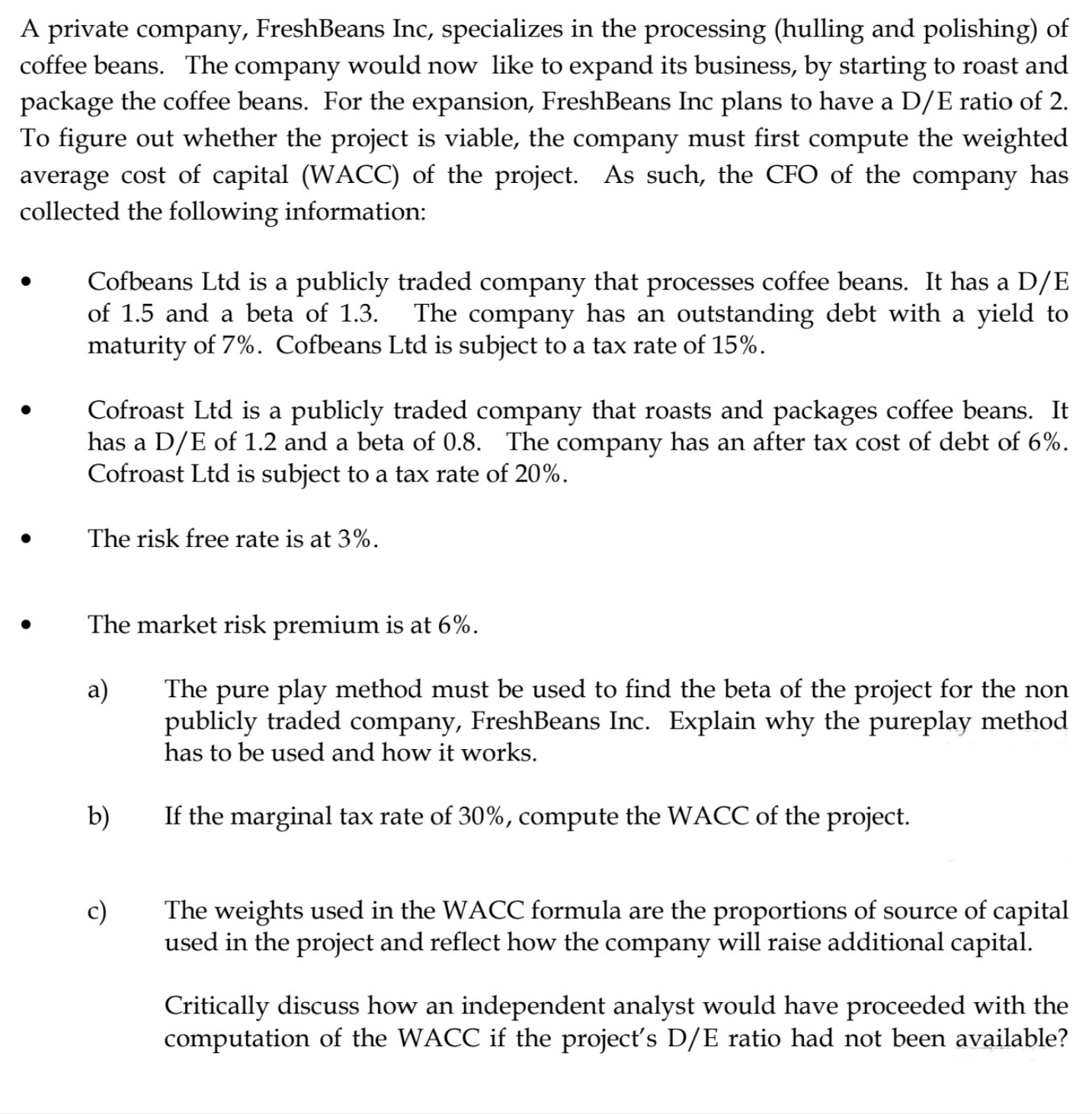

A private company, FreshBeans Inc, specializes in the processing (hulling and polishing) of coffee beans. The company would now like to expand its business, by starting to roast and package the coffee beans. For the expansion, FreshBeans Inc plans to have a D / E ratio of 2. To gure out whether the project is Viable, the company must rst compute the weighted average cost of capital (WACC) of the project. As such, the CFO of the company has collected the following information: I Cofbeans Ltd is a publicly traded company that processes coffee beans. It has a D / E of 1.5 and a beta of 1.3. The company has an outstanding debt with a yield to maturity of 7%. Cofbeans Ltd is subject to a tax rate of 15%. 0 Cofroast Ltd is a publicly traded company that roasts and packages coffee beans. It has a D/E of 1.2 and a beta of 0.8. The company has an after tax cost of debt of 6%. Cofroast Ltd is subject to a tax rate of 20%. 0 The risk free rate is at 3%. 0 The market risk premium is at 6%. a) The pure play method must be used to nd the beta of the project for the non publicly traded company, FreshBeans Inc. Explain why the pureplay method has to be used and how it works. b) If the marginal tax rate of 30%, compute the WACC of the project. c) The weights used in the WACC formula are the proportions of source of capital used in the project and reect how the company will raise additional capital. Critically discuss how an independent analyst would have proceeded with the computation of the WACC if the project's D/E ratio had not been available

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts