Question: REWORD THE ANSWER TO QUESTION 5. ( Ignore the red ink ) 5. Determine the systematic risk (beta) of Stock A and of Stock B.

REWORD THE ANSWER TO QUESTION 5. ( Ignore the red ink )

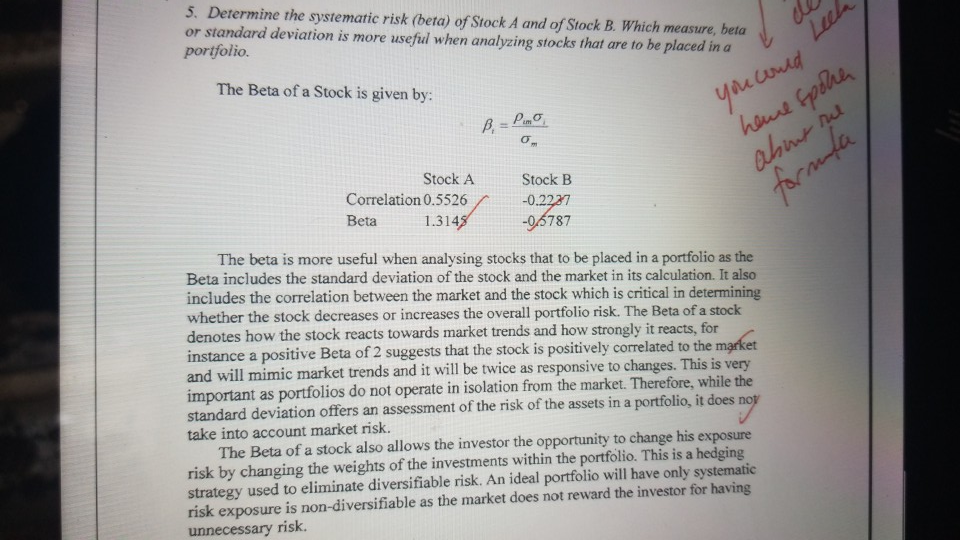

5. Determine the systematic risk (beta) of Stock A and of Stock B. Which measure, beta or standard deviation is more useful when analyzing stocks that are to be placed in a portfolio The Beta of a Stock is given by: B = Pino you could heme spoke o about rul forma Stock A Stock B Correlation 0.5526 -0.2227 Beta 1.3145 -96787 The beta is more useful when analysing stocks that to be placed in a portfolio as the Beta includes the standard deviation of the stock and the market in its calculation. It also includes the correlation between the market and the stock which is critical in determining whether the stock decreases or increases the overall portfolio risk. The Beta of a stock denotes how the stock reacts towards market trends and how strongly it reacts, for instance a positive Beta of 2 suggests that the stock is positively correlated to the market and will mimic market trends and it will be twice as responsive to changes. This is very important as portfolios do not operate in isolation from the market. Therefore, while the standard deviation offers an assessment of the risk of the assets in a portfolio, it does not take into account market risk. The Beta of a stock also allows the investor the opportunity to change his exposure risk by changing the weights of the investments within the portfolio. This is a hedging strategy used to eliminate diversifiable risk. An ideal portfolio will have only systematic risk exposure is non-diversifiable as the market does not reward the investor for having unnecessary risk

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts